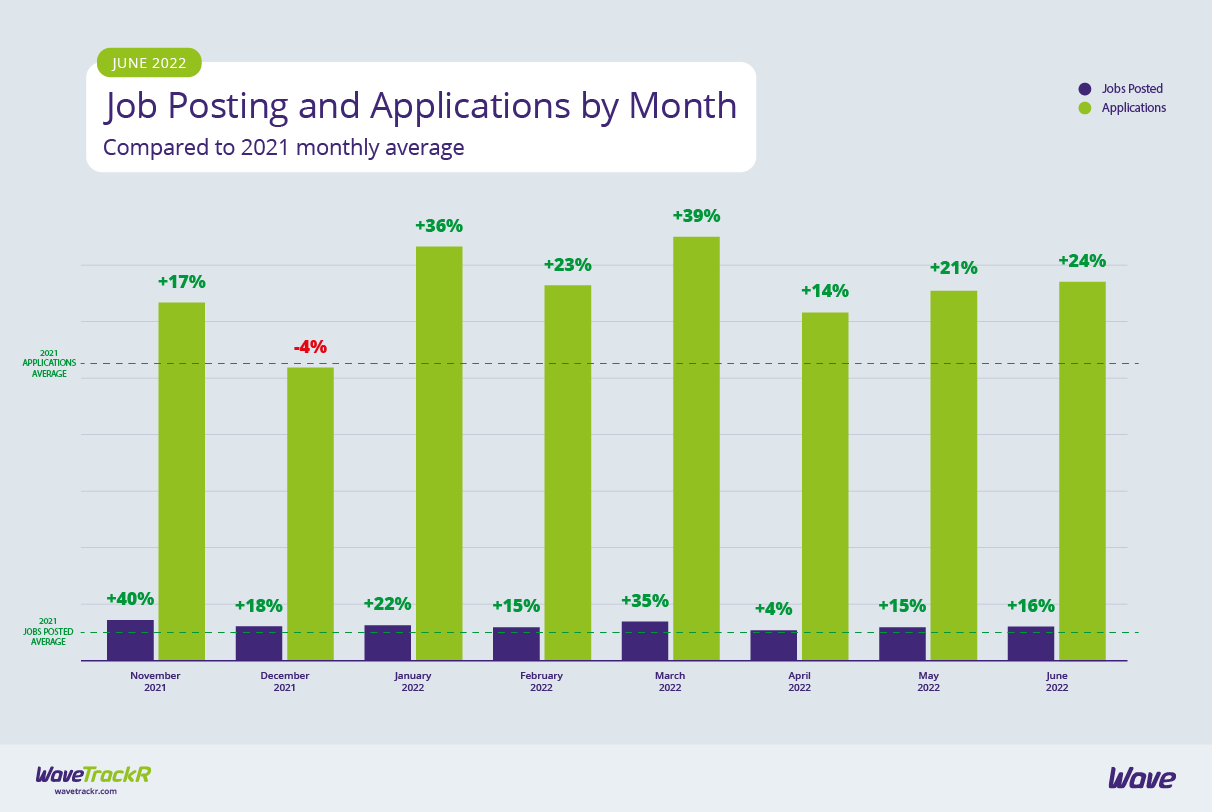

With jobs and applications increasing by just 2% each from May to June, the WaveTrackR June 2022 Recruitment Trends Report has essentially revealed a plateauing of job activity. This is likely due to cooling demand brought about by rapidly rising prices affecting both business costs and the cost of living. We may now be seeing the start of a shift as we enter the slower summer holiday season and then transition into an autumn during which The Bank of England is forecasting inflation to peak at at 11%.

This period of slowed growth isn’t entirely unexpected. Reduced activity as the summer holiday months hit is a trend that WaveTrackR data picks up year on year, other than over the pandemic years when everything was off-kilter. Economists and industry bodies have also been predicting a recession as economic recovery begins to stall thanks to ongoing surging prices. Given the news from the Office for National Statistics that the UK economy shrank in April for the second month running, it is particularly encouraging that applications are not falling. The increase may be small but any growth in terms of candidate applications is positive given the shortage of candidates we have been seeing over the past year. Indeed, the average number of applications per job remains the same as May, at 11.

Of course, as always, there are certain industries that buck the trend in either direction. IT & Internet continues to post high numbers of jobs and receive correspondingly high numbers of applications. It is, yet again, the most active industry, posting 19% of jobs and receiving the lion’s share of applications. In fact, the industry has increased its dominance of applications, from receiving 16% of all applications in May to 19% in June. Engineering, the industry to receive the next highest percentage of applications, took a share of 13%.

Other than the increase in IT & Internet’s share of applications, the industries posting the most jobs and receiving the most applications are unchanged from May. The Education sector is still recording similarly high numbers of jobs as applications, as is Secretarial, PAs & Admin. Meanwhile, Health & Nursing and Public Sector are posting high percentages of jobs but without the applications to help fill those vacancies.

On the flip side, both Manufacturing and Engineering recorded high numbers of applications without a correspondingly high number of job postings to cater to the higher candidate numbers in those industries. It is perhaps unsurprising, therefore, that Manufacturing and Engineering received amongst the highest average numbers of applications per job across all sectors. The soaring costs of raw materials and energy are having a direct effect on the output of both industries, which in turn is affecting jobs. It is Management Consultancy, however, that remains at the top of the board, receiving an average of 24 applications per job. Finance and Accountancy are also both up there, at an average of 19 and 17 applications per job, respectively.

Travel, Leisure & Tourism and Health & Nursing received an average of just 3 applications per job each. We can certainly see the former’s numbers reflected in the seemingly constant news regarding chaos at airports due largely to a shortage of staff within the airports themselves and across the airlines. Flight cancellations and delays, plus lengthy queues at check-in, security and baggage reclaim are likely to remain a feature of summer 2022. Many Travel, Leisure & Tourism employees who were made redundant over the pandemic have now permanently left the industry and it has become a real struggle to recruit and train enough staff in time for the busy summer season. Health & Nursing suffers from historic skills shortages, as does Public Sector which received an average of 5 applications per job. Human Resources and Not for Profit & Charities also received low average numbers of applications per job.

It is the job boards that cater to those industries with high jobs and candidate numbers that provided recruiters with the highest average number of applications per job in June, namely JobServe, Caterer and Secs in the City. They were also the only job boards to outdo the average number across all industries, receiving an average of 12 applications per job each as opposed to the general average of 11. The three generalist job boards to receive the highest average number of applications per job remain the same as May - Jobsite + Totaljobs, CV-Library and Reed - although Jobsite + TotalJobs received double the number of the other two, at 11 to their 5.

The June report also found that the most active day of the week in terms of jobs and applications has changed, from Tuesday in May to Wednesday in June. What is important is that they correlate, meaning that the majority of recruiters are posting their jobs when candidates are actively looking. At a time when candidate numbers are still relatively low, this is incredibly important.

We may be in for a rocky road over the next six months but the fact that neither job nor application numbers are falling yet is a positive sign. There is bound to be a cooling period while uncertainty and rising prices are a feature of the market. We can probably expect figures to start to drop again as hiring plans slow down and employees stick to safe jobs but the hope is we won’t see dramatic falls.