- There were around 172,000 new job postings in the last week of March – 25% lower than the previous week and the lowest since mid-January

- But there were still 1.83 million active job adverts in the UK last week

- High demand for hairdressers and barbers, security occupations, bar staff

- Notable increases in adverts for other skilled occupations like veterinarians and crane drivers

- Five out of the UK’s top ten hiring hotspots were in Scotland last week, three in Northern Ireland

- Local areas with the biggest decreases in job adverts were Hounslow and Richmond upon Thames, Nottingham, and Cambridgeshire

Growth in the number of job adverts across the UK has stabilised in recent weeks, according to the Recruitment & Employment Confederation (REC)’s latest Labour Market Tracker. There were around 1.83 million active job adverts in the UK in the week of 21-27 March. This total has remained relatively stable since early March.

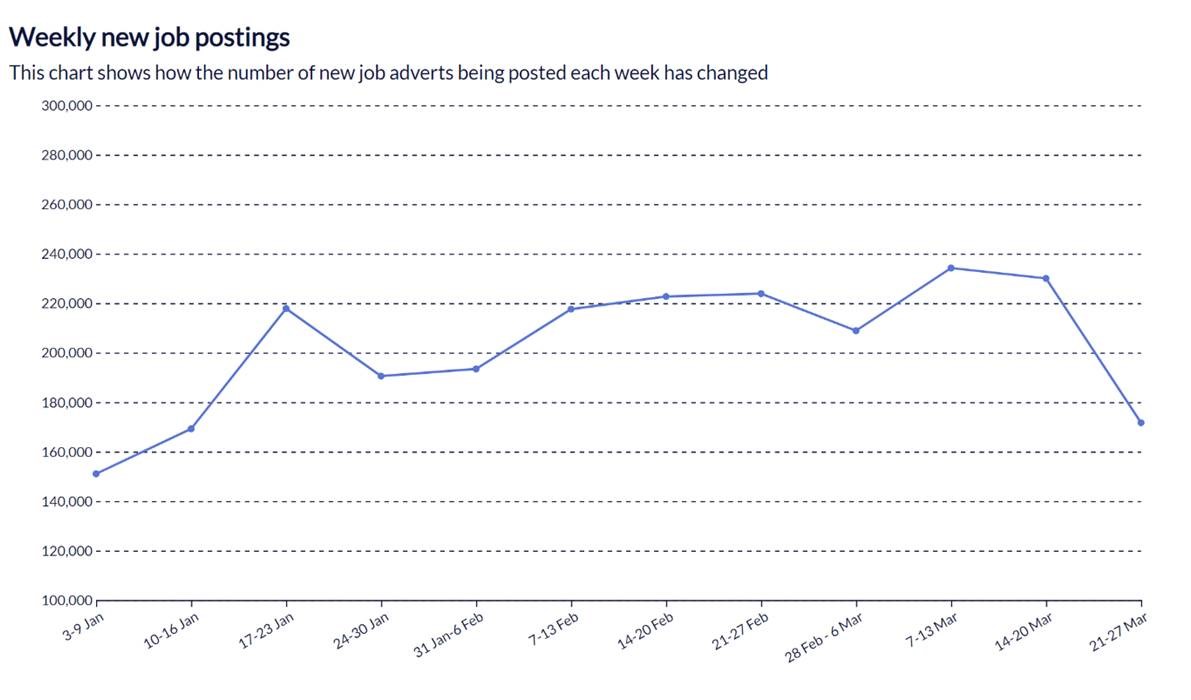

However, last week there was a significant drop in the number of new job adverts, with roughly 172,000 new postings in the UK. This was 25% lower than the previous week and the lowest of any week since mid-January.

Neil Carberry, Chief Executive of the REC, said:

“The jobs market has been super-heated in the first few months of this year, and was always likely to stabilise in the spring. We may be seeing the first signs of that now. Over the next few weeks, we will see whether this is the cooling we expected, or a slower market developing as employers factor rising inflation into their plans. It is good to see vacancy numbers continuing to recover in Scotland and Northern Ireland after later ending of restrictions, and likewise in the leisure and hospitality industries that were so restricted by COVID.

“Businesses are having to work harder than ever to hire the staff they need, but it is possible to hire if you get your offer right. Consulting with recruitment experts about your approach, including broadening your search, making job ads more attractive and offering enhanced flexibility and benefits can all help, without breaking the bank.”

There was a significant increase in adverts for hairdressers and barbers (+9.4%), elementary security occupations (+9.0%), and bar staff (+8.4%) last week. Other hospitality, leisure and service sector roles such as waiters and waitresses (+6.6%) also saw notable increases, as well as specialist skilled occupations such as vets (+8.3%) and photographers (+7.2%).

On the other hand, driving instructors (-9.7%), postal workers and couriers (-6.3%), and roofers (-4.7%) were the occupations that saw the biggest weekly declines in active job adverts.

The devolved nations saw notable growth in job postings last week, with five of the top ten hiring hotspots in Scotland and three in Northern Ireland. However, the local area with the highest increase in job adverts last week was Westminster (+17.7%), followed by West Dunbartonshire (+13.2%) and Highland (+10.7%).

At the other end of the scale, the area with the largest decrease in job adverts was Hounslow and Richmond upon Thames (-11.0%). In addition, a number of major cities in also saw small decreases in job adverts last week, including Liverpool (-3.5%), Leeds (-2.5%) and Birmingham (-2.1%).

John Gray, Vice President, UK Operations at Emsi Burning Glass, said:

“Employer demand has been at record highs since the second half of 2021, and it was inevitable that we would see a levelling off at some point. However, whilst we’ve seen this levelling off occurring since the start of March, in the last week there has been a significant drop, from over 235,000 new job postings in the week beginning 14th March, to around 172,000 in the following week.

“Tracking job postings continues to be the best way to understand current employer demand, and the next few weeks of tracking this should give us a clearer picture of whether the latest decrease in postings is a short-term blip, or whether it indicates the start of a new phase in employer uncertainty, caused by numerous factors such as rising inflation and energy costs.”