Summary

-

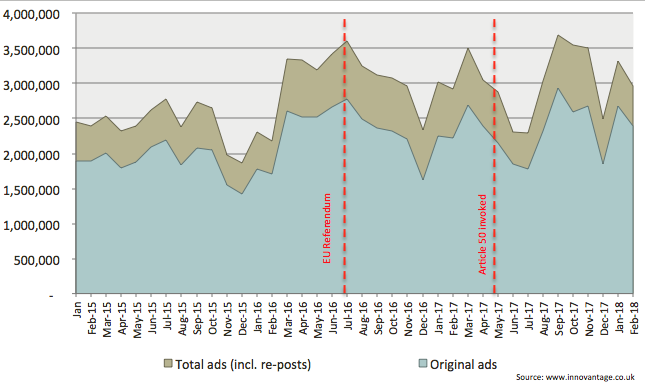

In February 2018, Innovantage captured a total of c. 2.96m online job ads (including re-posts). This number was:

- Just 2% higher than a year earlier but a noteworthy 35% higher than in February 2016.

- Reposts (0.56m) equated to 23% of all original on-line job ads in February 2018

-

The number of original job ads captured in the month was c.2.40m. This was:

- 8% higher than a year earlier and 40% higher than in February 2016.

-

The official ONS vacancy figure across Dec 17 – Feb 18 was 816k. This number was:

- 7% higher than the prior year and by 8% higher than two years earlier.

The number of original job ads, and the total (including reposts), Jan 15-Feb 18

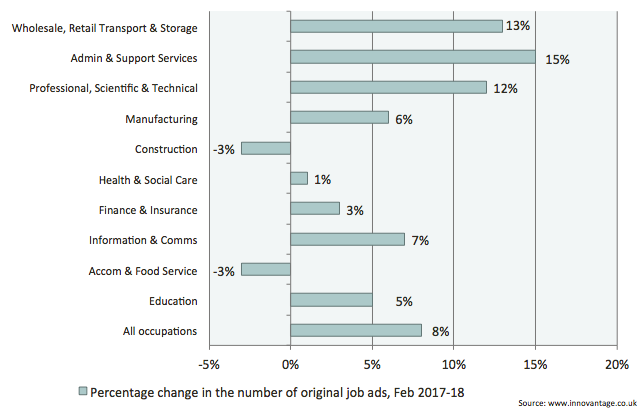

By industry, the year-on-year (YoY) changes in the volume of original job ads varied significantly, ranging from a 3% decline in both Construction and Accommodation & Food Service to a 15% increase in Admin & Support Services.

Percentage change in the number of original jobs ads, by occupation, Feb 2017-18

-

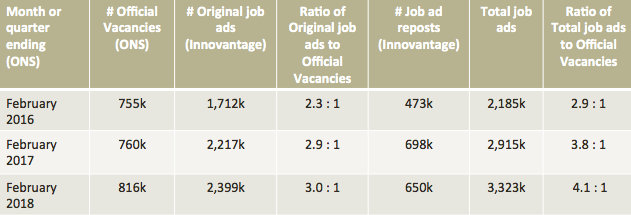

When considering how this increasing volume of job ads relates to the official volume of UK vacancies, the ratio of original ads to official vacancies was 3.0 to 1 in Feb 2018.

- This was up from a ratio of 2.9 original ads for each official vacancy in Feb 2017.

- When considering the total number of ads, including reposts (where hires could not be made through the original posting), the ratio was 4.1 ads for each official vacancy in Feb 18 – up from 3.8 ads per vacancy in Feb 2017).

-

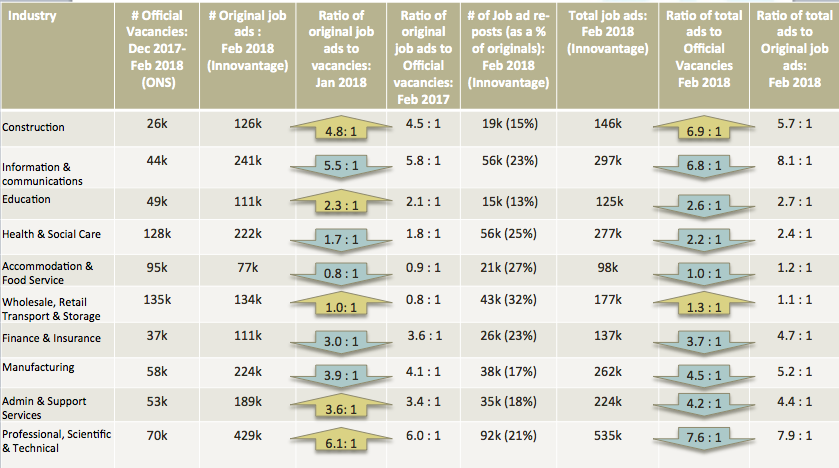

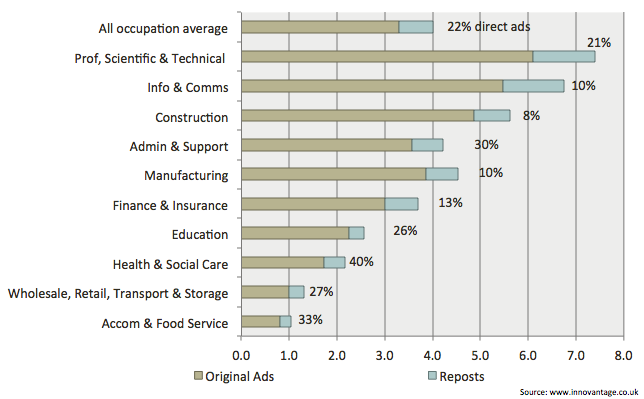

The job ad to official vacancy ratio ranges significantly by industry, however, which serves as a useful indicator of how hard each sector is having to work to fill vacancies and how the effort being expended (by employers and their intermediary supply chain partners) is changing over time.

- Employers posted just 22% of original job ads directly in Feb 2018.

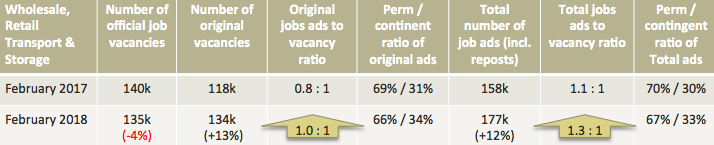

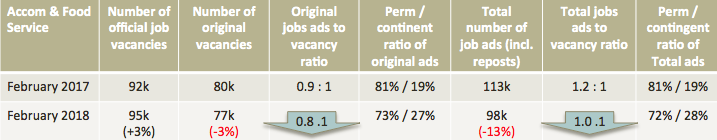

Summary of online job ads and official vacancy numbers, by industry, Feb 2017 & Feb 2018

Innovantage Demand Barometer – Full report, March 2018

Original online job ads in Feb 2018 were up 8% year-on-year (YoY), and were 40% higher than in Feb 2016…

-

…but there was a YoY decline in Construction and Accommodation & Food Service original job ad numbers

In February 2018, Innovantage captured a total of c. 2.96m online job ads. This number was just 2% higher than a year earlier but a noteworthy 35% higher than in February 2016.

Of the c.2.96m total online ads:

- 2.40m (81%) were original adverts

- 0.56m (19%) were reposts of previous adverts – suggesting that the role was unfilled via the original post and/or it was role that an employer continually advertised.

At c.2.40m in February 2018, the number of original job ads was 8% higher than a year earlier and 40% higher than in February 2016.

Set into context of the most recent total number of UK workforce jobs (35.1m in December 2017), the workforce jobs total was 1.2% (407k) higher than a year earlier and 2.8% (963k) higher than in December 2015.

And set in context of the official ONS vacancy number for the quarter ending February 2018 (816k), UK vacancy numbers were 7% higher than the figure one year earlier and 8% higher than in December 2015-February 2016.

As such – and as evidenced by the following summary ratios - it appears that employers had to work harder in advertising open roles in February 2018 than they did in either of the two preceding years.

-

The ratio of original postings to official vacancies was 3.0 to 1.

- This was up from 2.9 to 1 a year earlier and 2.3 to 1 in February 2016.

-

The ratio of total ads (including reposts) to official vacancies was 4.1 to 1.

- This was up from 3.8 to 1 in February 2017 and 2.9 to 1 in February 2016.

Regional profile

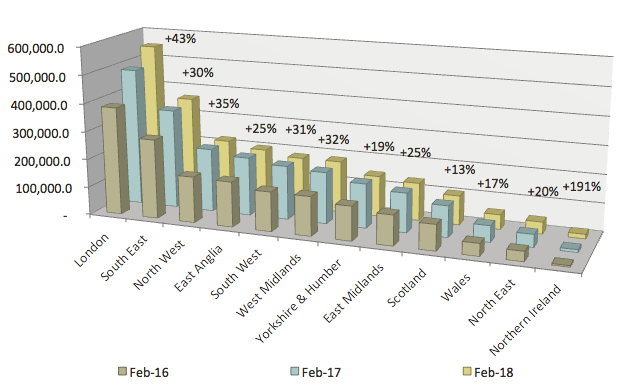

From a regional perspective, all areas have witnessed increases in the total number of original job ads, but to varying degrees. Regions with notable above-average two-year increases in the number of original ads (+40%) in February 2018 included:

- London: +43%

- Northern Ireland: +191%

Number of original job ads, by region, in February 2016, 2017 and 2018 (and the 2-year percentage increase)

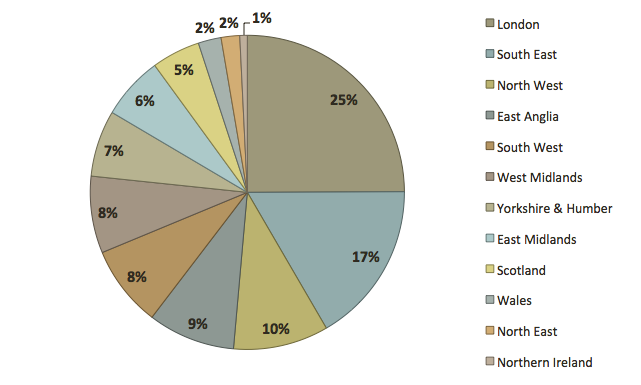

In terms of which regions appear the most challenged, as a result of their job posting activity, more than half (52%) of all original job ads in the UK (where the post location was known) were for just three regions in February 2018: London (25%), the South-East (17%) and the North-West (10%). In the most recently available regional employment data (December 2017), the workforce jobs total of these three regions represented 41% of the UK total: London (17%), South East (14%) and the North West (10%). As such, the data suggests that employers (and their intermediaries) in London and the Southeast have to advertise harder than other regions to fill posts.

The percentage of all original job ads, by region (where location specified): February 2018

Occupational profile

Combined ratio of original job ads & reposts to ONS vacancy numbers + the percentage of all jobs advertised directly by employers (February 2018)

Professional, scientific & technical

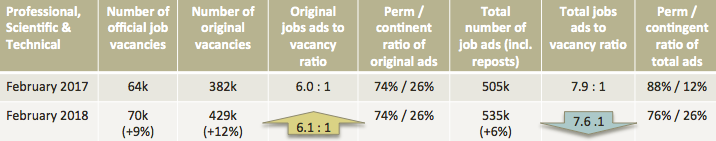

A notable 9% annual increase (in the quarter to February) in the number of official vacancies resulted in a 12% increase in the number of original job ads. Despite one fifth (21%) of total ads originating directly from the employer, the ratio of original ads to vacancies remains the highest within any industry (6.1 ads for every vacancy). This is likely to stem from it also having a high proportion of contingent labour requirements, requiring significant support (from multiple agencies) to fulfill requirements.

Information & communications

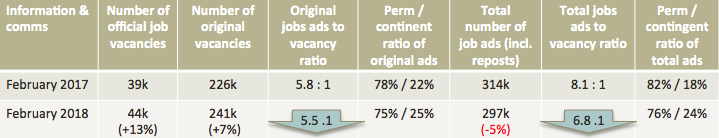

Whilst there was a 13% annual increase in the number of official vacancies, the number of original job ads rose by just 7%, resulting in a fall in the ratio of original job ads to vacancies from 5.8 to 1 last year to 5.5 to 1 in February 2018. Moreover, the number and ratio of total job ads to vacancies also fell YoY, suggesting that more roles were filled through the first ad. Once again, the high proportion of contingent workers operating within the sector makes the challenge of sourcing more complex and in need of support from supply chain intermediaries (as evidenced by just 10% of original ads being posted directly).

Manufacturing

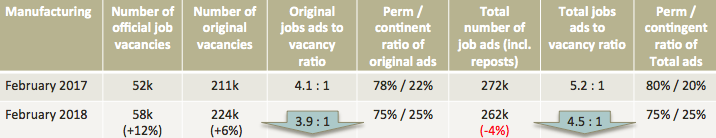

A 12% year-on-year (YoY) increase in manufacturing vacancies translated into just a 6% YoY increase in online job ads, driving a decline in the ratio of job ads to vacancies. Moreover, there was a YoY decline in the ratio of total job ads to vacancies, from 5.2 to 4.5 to 1. This, once again, suggests that the original postings are being more successful and/or employers are deploying other resourcing initiatives than are translating into on-line job ads.

Construction

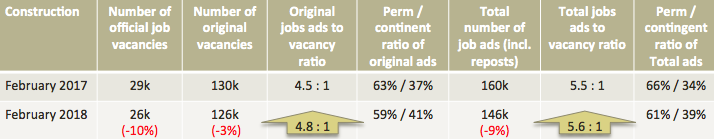

Whilst there was a noteworthy 10% YoY decline in official vacancy numbers within Construction, the lower decline in the number of jobs (-3%) suggests that employers and their intermediaries are having to working even harder to fill vacant posts. As with the aforementioned sectors, the exceptionally high proportion of contingent workers engaged within this industry is exacerbating this situation, with significant support being required from intermediary supply chain partners – as evidenced by the fact that just 8% of original vacancies were posted directly by employers.

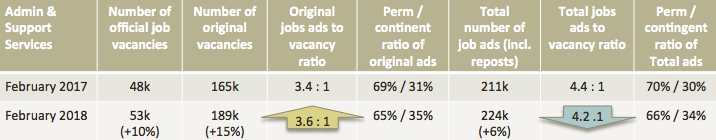

Admin & Support Services

A sector with a 10% YoY increase in vacancies, but with a need to post 15% more original ads and 6% more total ads in an attempt to fill them, clearly has recruitment challenges. With 35% of original ads offering contingent only work (up from 31% in February 2017), this appears to be part of the continuing challenge – notably at a time where interest in more permanency of work is rising in importance (due to a range of economic and political factors).

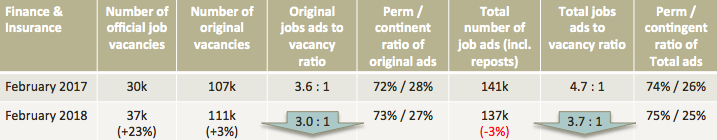

Finance & Insurance

With the loss of some financial services jobs (due to Brexit uncertainty and corporate decision-making) remaining well documented, a 23% YoY rise in the number of vacancies within Finance and Insurance remains somewhat surprising. One contributory factor may be that, with a high proportion of non-UK nationals working across the broad spectrum of roles within the industry, ongoing political and economic uncertainty is resulting in people leaving posts before being potentially asked to do so. Also of significance is the fact that, whilst job vacancies rose sharply, original jobs ads increased by a significantly lower proportion (3%), suggesting that either job advertising is being more successful and/or employers and their intermediaries are deployed other initiatives than on-line advertising to fill vacant posts.

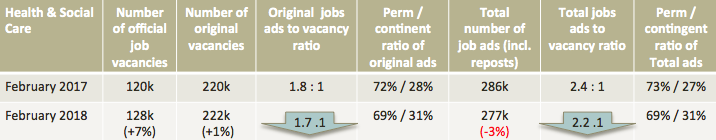

Health & Social Care

Whilst vacancy numbers rose by 7% YoY, the number of original ads rose by just 1%, suggesting – as with other sectors where there is a notably high dependency upon non-UK nationals within the workforce – that either other recruitment initiatives are increasingly having to be deployed over and above on-line advertising and/or advertising is being more successful.

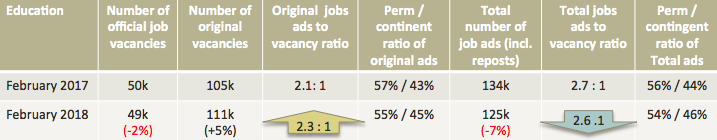

Education

Despite much commentary and data evidence suggesting heightening teacher recruitment challenges, the number of vacancies within the sector declined by 2% YoY. This may well be attributable to the tightening budgets, notably within schools, resulting in the need to find efficiencies. The challenge of filling the available posts is clearly evidenced, however, by the fact that the number of original ads rose, despite the fall in demand.

Accommodation and Food Service

Whilst the number of open vacancies increased by 3% YoY, a 3% decline in the number of original ads – and a noteworthy 13% decline in total ads (including reposts) - suggests that employers and their intermediaries are having to deploy a much wider range of recruitment initiatives to fill posts than just on-line advertising. With the sector being notably historically highly dependent upon non-UK national labour, and the continuing loss of workers well documented, due to ongoing political and economic uncertainty, it would appear that the sector has had to consider alternative recruitment initiatives of significant scope/scale to combat its challenges.

Wholesale, Retail, Transport & Storage

Despite a 4% YoY decline in the number of vacancies within the sector, the volume of original job ads rose, interestingly, by 13% in an attempt to fill this diminishing demand. As with Admin & Support Services, the fact that such a high proportion of original ads (34%) suggest temporary rather than permanent employment – at a time when permanency of work has a much higher currency – may well be contributing to the sector’s challenges.