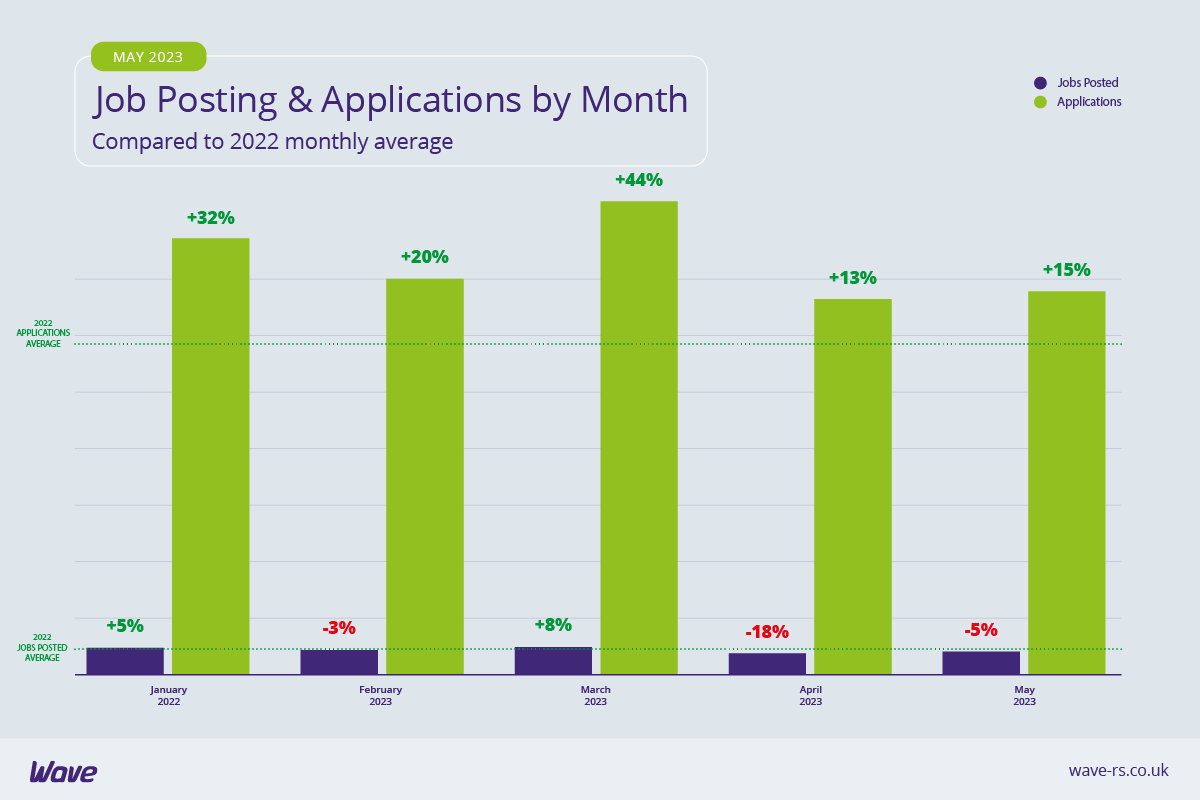

Following plummeting jobs and applications in April, data from the Wave May 2023 Recruitment Trends Report has shown that jobs and applications have risen slightly. This is certainly positive news, although the figures remain low compared to the rest of the year and 2022 averages. As with April, holidays are likely to be partly to blame as May’s bank holiday bonanza and sunny half term will have have affected job activity. However, we may also be seeing a continuation of caution amidst economic uncertainty.

Sluggish figures in a holiday-packed month

Although jobs and applications rose month-on-month, with jobs increasing by 17% from April and applications rising by 2%, they are low compared to the average for 2022 and the rest of the year to date bar April. Jobs were 5% below the 2022 monthly average and applications were only just above April's year-low, reaching 15%. With more bank holidays than usual this May (every Monday bar the 22nd was a holiday), plus a half term with the busiest day at UK airports since before the pandemic, it was a slow month. The average application per job number remains at the year-low of 13 that we also saw in April, likely due to the continuation of relatively low application numbers.

Golden Monday

Wave data consistently shows that candidates are most active at the beginning of the week, with the Wave Recruitment Trends Report for 2023 finding that, throughout the year, Monday to Wednesday were the days that the majority of applications were sent. The most active day in May - Monday 22nd - seemed to prove that the beginning of the week is golden time as it was the most active for both jobs posted and applications received. This isn’t just significant because it was a Monday but because it was the only Monday in May that wasn’t a bank holiday. With a scarcity of working Mondays in May this year, both recruiters and candidates initiated a flurry of activity on the 22nd.

IT & Internet retains most active crown

IT & Internet has regained the top spot for most jobs posted having come second to Health & Nursing in April (the first time the industry hasn’t posted the most jobs since December 2021). It may have fallen second to Secretarial, PAs & Admin this month when it comes to applications but is the most active industry overall. On the flip side, IT & Internet made a surprise appearance in the lowest average applications per job chart, perhaps an indication of the sheer volume of jobs that the industry is posting out.

Secretarial, PAs & Admin jobs in demand by candidates

The Secretarial, PAs & Admin sector is often in the top five for applications but in May took the top spot from IT & Internet, receiving the highest percentage of applications of all industries, proving that jobs continue to be in demand. The sector received the second highest average number of applications per job - a huge 32 compared to the overall average of 13. It’s also a niche job board specialising in Secretarial, PAs & Admin, Secs in the City, that received the highest average number of applications per job of all job boards, including both generalist and niche.

The jobs are there - the Wave Recruitment Trends Report for 2023 found that the industry grew by 42% from 2021 to 2022. It also posted the fifth highest percentage of jobs of all industries in May, indicating a slight closing of the gap between jobs and applications. However, candidate demand seems still to be outstripping supply, possibly due to an increase in automation and some admin jobs being redistributed throughout businesses.

Education jobs boosted in new year recruitment drive

Education posted the third highest number of jobs in May, behind IT & Internet and Health & Nursing, retaining the same position held in April. The difference was in the percentage of jobs they posted in May compared to April - a huge 62.5% more jobs in May, leaping from 8% of all jobs to 13%. This is likely due to the annual recruitment drive to hire teachers and support staff for the new academic year. As teachers need to resign by 31st May (or in many schools by the start of half term) to give the required amount of notice for September, the market becomes far busier in the spring months as schools race to fill positions as they become vacant before the start of the summer holidays.

Niche job boards outperform generalists yet again

Niche job boards again received the two highest average number of applications per job, with Jobserve receiving an average of 30 and Secs in the City leaping from an average of 18 in April to 28 in May. Totaljobs received an average of 20, meaning it received the highest average number of applications per job of all the generalist job boards. With an average of 12, Caterer was third for niche job boards and fourth overall, and Reed and CV-Library were fifth and sixth respectively.

Long-term sickness a growing and real threat to recruitment and the economy

As part of the Wave Recruitment Trends reports we also look at the labour market statistics published by the Office for National Statistics (ONS). In their Labour Market Overview for May, the ONS reported a record high number of economically inactive people due to long-term sickness, which is surely cause for concern. This is closely linked to the low application numbers and high jobs that Wave records in the Health & Nursing industry month after month - this month the industry received an average of just two applications per job, the fewest of any industry.

A critical labour shortage in the industry is a huge contributor to long waiting lists on the NHS, leading to a greater number of people unable to work because of long-term sickness. It seems this is one recruitment area that has turned into a vicious cycle of labour shortages contributing to labour shortages.