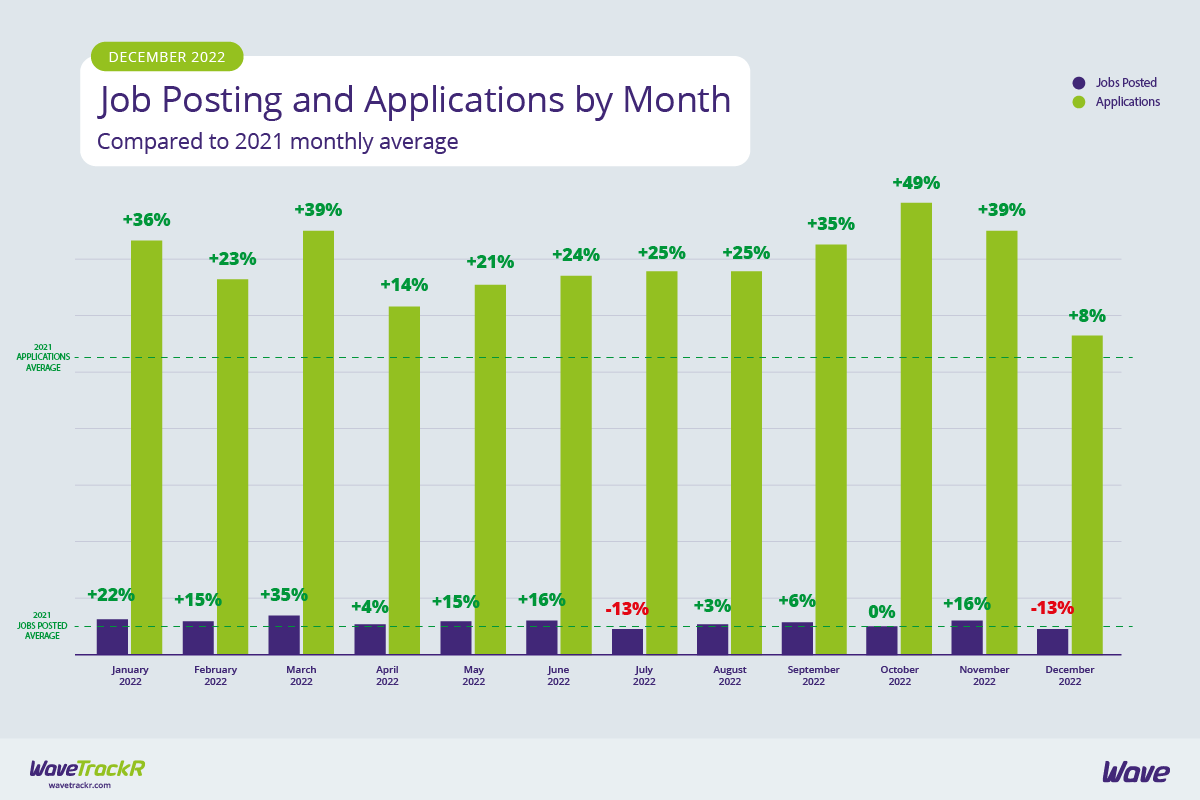

The WaveTrackR December 2022 Recruitment Trends Report has found that both jobs and applications dipped considerably in December compared to November, with jobs falling by 25% and applications by 22%. A drop in activity is usual in the final month of the year as businesses, employees and candidates wind down for the Christmas break but continued economic uncertainty could also be playing its part. We dig into the data, look at the facts behind the numbers and try to unpick the jobs market as 2022 drew to a close.

Economic uncertainty could play into falling jobs and application figures

Jobs fell to the joint lowest they have been for the entirety of 2022, matching July’s shock low figures of 13% below the 2021 average. Applications were also incredibly low - at 8% above the 2021 average, application numbers were the lowest experienced in 2022. Whilst a fall in job activity is a seasonal trend arising from an annual slow-down as we approach the end of the year, the rate by which the figures fell does give cause to consider other factors at play.

The Office for National Statistics recorded a fall in quarterly vacancy growth for the fifth consecutive period between September to November 2022 and the single month vacancy estimates showed a large monthly fall in November, taking them to their lowest level since July 2021. WaveTrackR data has also seen jobs at lower levels in the latter half of the year than the former. This likely reflects the continued uncertainty across the majority of industries, with feedback from ONS respondents that economic pressures are a major factor in a scaling back of recruitment.

IT & Internet continues to dominate job activity figures

IT & Internet posted the largest numbers of jobs and received the highest percentage of applications for an incredible 8th consecutive month. The industry posted 21% of all jobs and received 23% of all applications - a far bigger percentage share than even the industries posting and receiving the next highest numbers of jobs and applications (Education posted 13% of all jobs and Manufacturing received 13% of all applications). The industry may have been shaken by sweeping job cuts in major Big Tech companies in the latter part of 2022 but those lay-offs are certainly not representative of the strength of the tech industry as a whole.

Health & Nursing and Public Sector facing severe candidate shortages

Historically underfunded and under-resourced, both Health & Nursing and Public Sector have struggled to fill vacancies for many years. With the nurses strike in December making very public the need for better pay and working conditions, the average number of applications per job in the industry fell to just 2 (the average across all industries in December was 13). Public Sector received an average of just 4 applications per job in December and both industries were amongst the top five for the number of jobs posted but not in the top five for applications received. It is clear something needs to be done to aid recruitment in these areas - and much of that needs to come from the government before we face a crisis of epic proportions.

Financial services industries receive high average numbers of applications per job

In uncertain times, it is human nature to search for stability in all areas of life, not least your career. In a recent Talent Matters podcast episode, LinkedIn Sales Director Cara O’Leary revealed that in the UK, job security is the fourth highest priority for candidates when searching for a job on the platform. Financial services industries have a reputation for being relatively secure - we saw many sectors receiving high average numbers of applications per job during the pandemic and in these economically uncertain times, we are seeing it again. The two industries receiving the highest average number of applications per job - Finance at 24 and Accountancy at 20 - are financial services sectors.

Niche job boards top 3 for average application per job

Niche job boards consistently rank highly when it comes to average application per job numbers and in December the top 3 job boards were all niche. Receiving an average of 20 applications per job, IT specialist job board Jobserve received the highest average number of applications per job for the second consecutive month. Secretarial, PAs & Admin-focused board Secs in the City followed with an average of 17 and catering specialist Caterer.com received an average of 16 applications per job. At 13, Totaljobs received the highest average number of applications per job of the generalist job boards, followed at some distance by Reed.co.uk and CV Library, both receiving an average of 5.

The busiest day of the week in December was Thursday

The most active weekday in December was Thursday - the day that the highest percentage of jobs were posted and the day that most applications were received. This marks a change as the beginning of the week is usually favoured by candidates.

As we enter a new year, we would usually expect to see both job and application figures rise - whether that happens or not will be a good indicator of how much the economic situation is affecting the jobs market. WaveTrackR’s January Recruitment Trends Report will make for very interesting reading.