“Though optimism has been rising that the UK economy will avoid recession this year, we continue to see the labour market coming off the boil. Vacancies fell for the ninth consecutive month to 1,105,000, though remain well above pre-pandemic levels.

“Regular wage growth remains high at 6.6% y/y but eased back from 6.7% and, after accounting for high inflation, real wages continued to be squeezed at one of the sharpest rates on record at -2.3% y/y. The gap between private (6.9%) and public (5.3%) sector regular wage growth continued to narrow, with the latter picking up to the strongest since 2005.

“We saw a further 0.4 percentage point drop in inactivity in the latest figures to 21.1%, the biggest drop in nine months, mainly driven by 16-24 year olds as more students returned to the labour force. But inactivity due to long-term sickness continued to increase, hitting a new record high. Overall inactivity remains over 420,000 above pre-pandemic levels. The Chancellor made inactivity a focus in last month’s Budget, though the OBR estimates that his package of reforms may only lower inactivity by about 100,000 and will take several years to take full effect.

“One measure of labour market tightness, the ratio of unemployed people to vacancies, remains close to historic lows at just 1.2. But that may not give the whole picture if employers aren’t as determined to fill those vacancies as they were before.

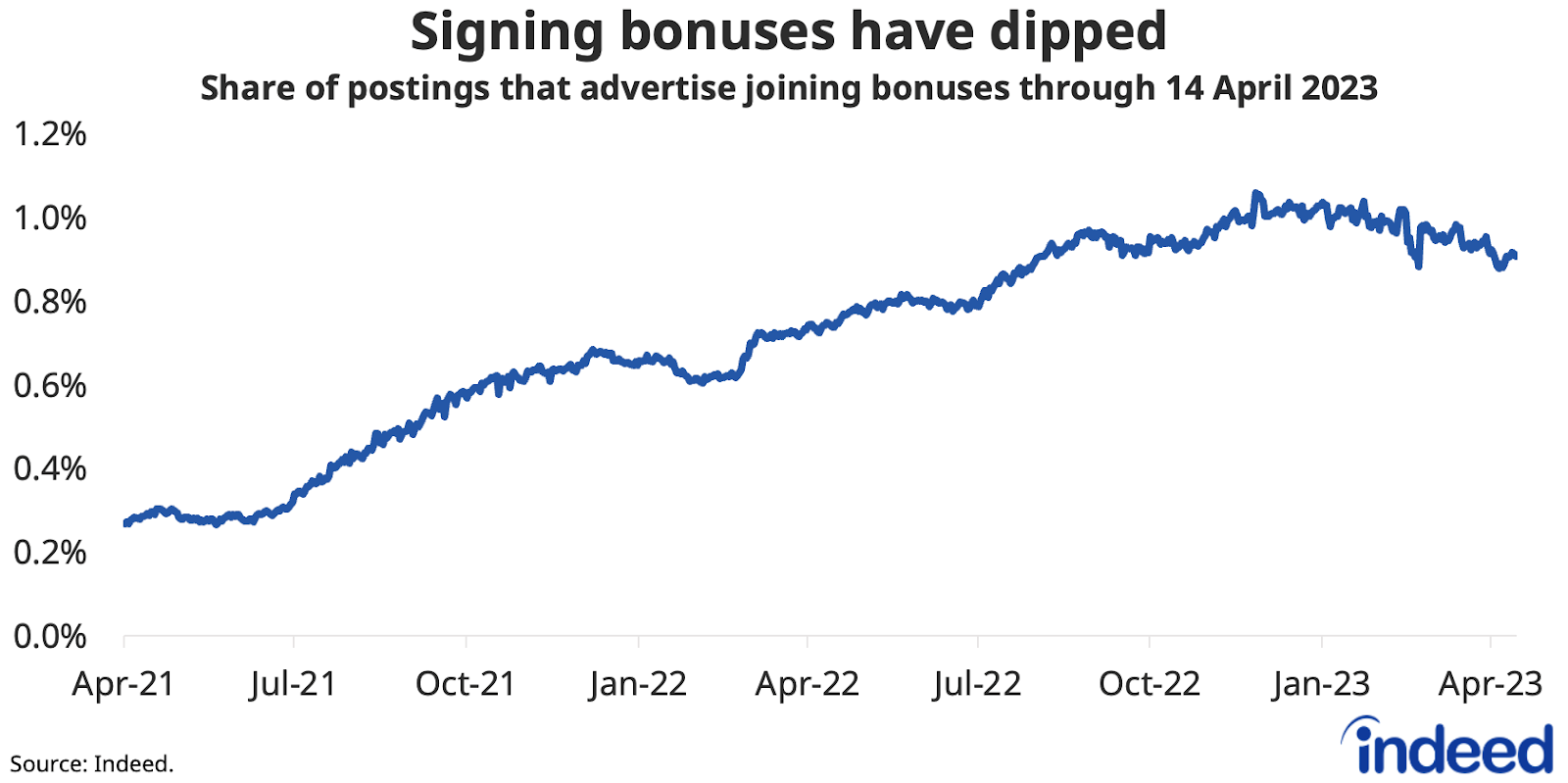

“At Indeed, we’re seeing some signs that employers have started to scale back their recruiting intensity. For example, employers’ use of signing bonuses, which soared during acute worker shortages, has reduced as competition for new hires abates. Today, the share of job postings offering a joining bonus has dipped below 0.9%, from a peak of 1.1% in November.”