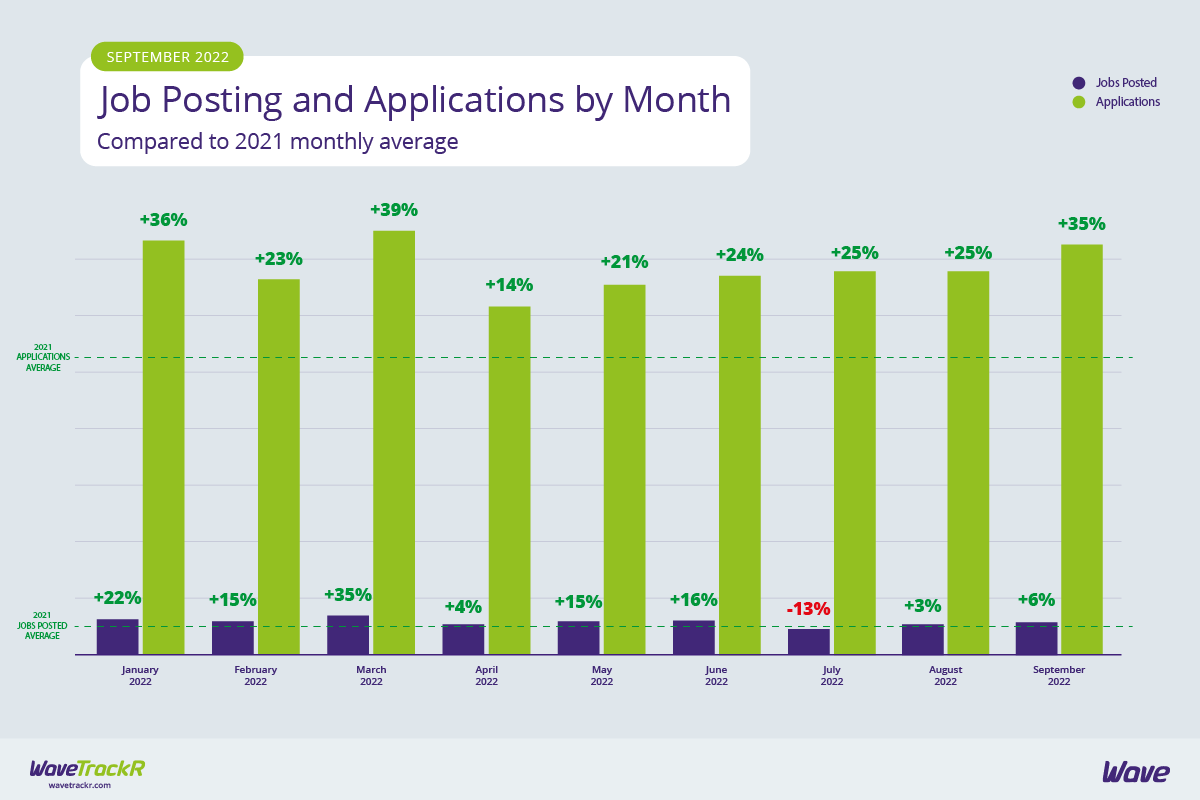

An 8% rise from August takes applications to 35% above the 2021 monthly average. Jobs continued to increase, only by 3% compared to August but in a market where businesses are treading carefully due to hikes in a multitude of costs, any rise is positive.

Increased activity in both jobs and applications

Jobs in September were 6% above the 2021 monthly average. It’s the third month in a row they have risen following plummeting numbers in July, when many feared businesses were beginning to pause hiring due to market uncertainty and soaring costs. September’s rise may only equate to a 3% increase from August (following August’s 18% increase on July) but consistent increases are just what is needed. Applications rose more significantly. At 35% above the 2021 monthly average and following two months of plateauing figures, applications are on the up again. The past few months have been fairly slow for many industries so heightened candidate activity is extremely positive.

IT & Internet continues to dominate the market, Education and Manufacturing on the up

IT & Internet dominates activity yet again. For the fifth consecutive month, the industry posted the highest percentage of jobs and received the largest number of applications - proof that it continues to thrive. Education increased its share of jobs posted - from 11% in August to 18% in September - and also features in the top 5 industries for applications. Education has long faced a skills shortage and schools across the UK are struggling to recruit enough teaching and support staff. Applications were boosted during the pandemic but that seemed to dissipate the further we moved out of the worst of the crisis so an increase in application numbers is extremely positive. Having said that, Education received an average of just 5 applications per job - 8 less than the average across all industries. Manufacturing increased its job posting in September, more closely matching its jobs to its share of applications. Supply chain issues, increased costs and strikes at ports have hampered Manufacturing production recently so a rise in jobs is a good sign.

Health & Nursing and Public Sector skills shortages remain

Health & Nursing and Public Sector continue to post a high percentage of jobs but without the application numbers to fill those vacancies. Both face historic skills shortages that show no signs of easing in the near future. A pay rise this year was designed to try and increase both retainment and recruitment but even those receiving the largest rises will see a real time pay cut because of soaring inflation.

Secretarial, PAs & Admin faces high demand, low jobs challenge

Secretarial, PAs & Admin experienced the opposite challenge, receiving a high number of applications but not making it into the top 5 for jobs. Are secretarial, PA and admin positions declining due to a rise in automation or are companies trying to save money due to increased costs, delegating administrative tasks to other employees? This is definitely an industry to keep an eye on as the demand from candidates is certainly there. It is amongst the 5 industries to receive the highest number of applications per job - 19 compared to the average of 13. Niche job board Secs in the City, specialising in secretarial, PA & admin jobs, consistently ranks top for providing recruiters with the highest average number of applications per job. In September the number was 20, far more than all other jobs boards.

Retail & Wholesale jobs fall

At an average of 39 applications per job, Retail & Wholesale was inundated with applications compared to the general average of 13. This is perhaps a three-pronged result - partly due to the rise in online shopping, partly due to declining retail footfall because of the cost of living crisis and the sudden fall in the value of the pound, and partly due to retailers’ own increased operating costs. Various reports have suggested that consumers are already spending less and research by Retail Economics with retail technology firm Metapack has found that 60% of shoppers are expected to cut back on non-food items in the three months leading up to Christmas - usually the ‘golden quarter’ for retailers.

Industries on either end of the scale

Other industries receiving a high average number of applications per job include two financial service industries (Finance and Insurance), which often receive relatively high numbers of applications per job, and Customer Services, which led the board in August. Four of the five industries on the other end of the scale are unchanged from August - Health & Nursing, Not for Profit & Charities, Public Sector and Education all received an average of less than 6 applications per job. Catering & Hospitality, which has faced severe skills shortages since the pandemic, received an average of 7 applications per job - 6 under the average for all industries.

A niche job board comes out on top again

As mentioned earlier, Secs in the City provided by far the highest number of applications per job for their clients with a huge 20. With an average of 15 applications per job, Totaljobs jumped to second position, placing it in the top spot amongst the generic job boards. IT specialist CW Jobs took just 1 fewer, at 14, and new entry on our board is JobServe, providing recruiters with an average of 12 applications per job. Caterer and Reed took the other top spots.

Thursday is the golden day

And if you want to know when to post your jobs, Thursday was the magic day when most jobs and applications activity took place. In a move away from the usual beginning of the week high activity, in September Thursday was the day most jobs were posted as well as being the day the majority of applications were received.