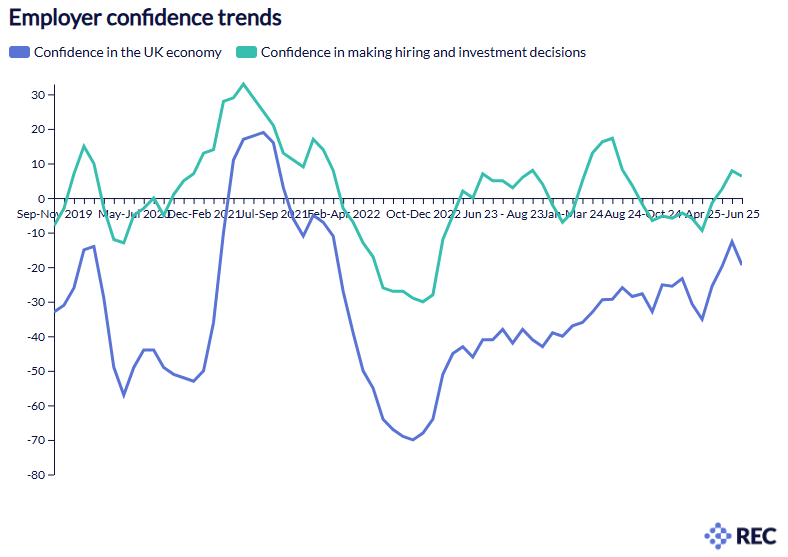

Employers’ confidence in making investment and hiring decisions rose again in the three months to August. It was up by four points between April - June 2025 and June - August 2025, ending the quarter on net: +7.

The survey of 704 employers put their confidence in the UK economy in the measured three-month period (June - August 2025), at -19 – compared to -20 in the three months to June 2025. This is where there is concern. Firms are less gloomy than they have been – but the number is still in negative territory.

While not exactly buoyant, employer confidence is clearly firming as we head into the final quarter of 2025 – and the survey’s direct questions on hiring intentions reflect that. It will likely take time for this intent to filter through to activity this autumn, however.

REC Chief Executive Neil Carberry said:

“The story of the last year has been businesses getting more confident in themselves, but holding off on investment and hiring because of wider economic, policy and technology concerns. That may be starting to change as last year’s Budget fades from view, some sectors like construction bounce back and interest rates are stable. But it just serves to triple underline that the impact on businesses of this autumn’s Budget decisions needs to be the opposite of last year – only business confidence can drive growth, so the Budget must underpin it.

“The last Budget unsettled employers, with higher National Insurance combining with a 25% rise in the minimum wage in the past three years. On top of that, firms are worried about red tape in the Employment Rights Bill, including the risk of being tied up in tribunal cases for years after dismissing someone early in their tenure.

“Today’s report shows the potential rewards if government makes it easier for firms to invest and create jobs. And growth, which creates better tax receipts, is also the only way out of the fiscal straitjacket the Treasury finds itself in.”

In further encouraging findings for the job market, today’s JobsOutlook shows:

- The short-term permanent hiring outlook continued to grow this quarter, up by six percentage points to net +18% across June-August 2025 compared to April-June 2025.

- Medium-term permanent hiring intent also rallied this quarter, up by six percentage points to +20% compared to April-June 2025.

- Following the 12 percentage-point surge in the last quarter (April-June), the barometer of forecast short-term temporary hiring needs rose by a further two percentage points across June-August (to net: +14%).

- Despite just a two percentage-point rise in medium-term temporary/contract hiring intent, forecast demand improved significantly across the quarter – from net: +13% in June to net: +21% in August.

- Employers in London forecast the highest demand for permanent staff and temporary staff compared to the rest of the UK.

- And greater forecast demand is coming from private sector companies, rather than the public sector.