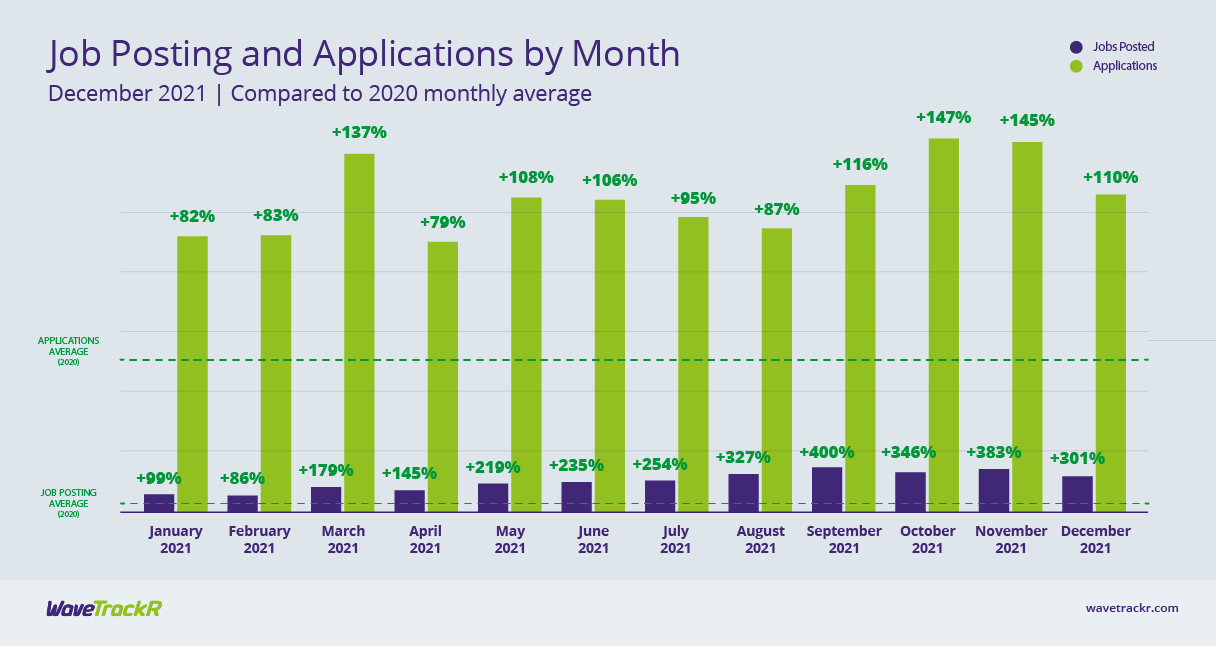

Data from Data from WaveTrackR’s December report has shown that both jobs and applications fell in December, the first time they have simultaneously fallen since April. However, the final month of the year is notoriously slow as businesses start to wind down activity and candidates take a break, ready to begin the search again in the new year. A reduction in both jobs and applications was expected. Whether they pick up again in January will be the real test as to the state of the job market as we enter 2022.

At 301% over the 2020 monthly average, jobs reached their lowest level since July. Cause for concern? Unlikely. This is a seasonal trend as businesses put a pause on recruitment efforts as the year wraps up and employees take holiday. Applications also dropped, to 110% over the 2020 monthly average from 145% over that average in November. This is likely to be both as a result of fewer jobs on the market and as candidates, too, take a break and time to reflect before resuming their job search in January.

For further confirmation that the dip in job activity is thanks to the annual end of year slow-down of business and recruitment, WaveTrackR’s week-by-week jobs and applications graph highlights the period in which activity plummets. In the week between Christmas and New Year, the final month of the year, when businesses slow right down or shut altogether over the holiday season, jobs drop to just 3% above the 2020 weekly average. Given just 2 weeks before they had soared to the highest levels of the year (488% above the 2020 weekly average), that is quite a fall. Application numbers weren’t quite so dramatic but the trajectory across the month was similar. This certainly suggests that the dip in both monthly job and application figures for December is wholly down to the relative inactivity over the holiday period.

The industries posting the highest numbers of jobs and those receiving the largest percentages of applications remains unchanged from November, with only the order changing slightly. Education increased its job posting percentage from 12% of the jobs across all industries in November to 18% in December, taking the lead from Public Sector which posted the second highest numbers of jobs (15%). Education, alongside IT & Internet and Secretarial, PAs & Admin, also received amongst the highest numbers of applications, suggesting that demand is being met in each of those sectors. Public Sector and Health & Nursing are again missing from the industries receiving the highest amount of applications but place amongst those posting the highest numbers of jobs.

With each receiving 12% of all applications sent in December, Manufacturing and Engineering received the highest numbers of applications (alongside Education, also at 12%) but aren’t posting a similar volume of jobs, an indication that there still aren’t the jobs to meet the demands of candidate numbers in those industries. This has been a problem for Manufacturing and Engineering for a number of months now. It is perhaps unsurprising, therefore, that Manufacturing and Engineering jointly received the second highest average applications per job in December.

Far more surprising is Transport & Logistics taking the top spot - at an average of 29 applications per job, it received the highest average number of applications per job of any industry in December. We reported on the growing numbers of applications in the Transport & Logistics industry back in September but this surge is noteworthy. Has the recent, much publicised recruitment drive in the industry succeeded in narrowing the skills gap? Is the backlog of driver training, tests and the issuing of licenses starting to clear leading to a drip-feed of new candidates entering the market? Did the provision of a number of short term visas for overseas drivers to work in the UK in the three months leading up to Christmas make a difference to application numbers? Or have the wage increases many haulage companies have been forced to give out of desperation for workers meant that drivers are simply bouncing from job to job? Whether this surge in candidate numbers is sustainable is perhaps another question entirely.

On the other end of the scale, Health & Nursing and Public Sector continue to receive low numbers of applications per job, tallying with the high jobs and low applications recorded. Travel, Leisure & Tourism makes a new entry onto the board, receiving an average of just 4 applications per job. The question that must be asked is how many in the Travel sector permanently switched careers in the face of continued uncertainty in the industry?

Other interesting data uncovered by the report suggests that in December recruiters and candidates were finally on the same page - both at their most active on a Wednesday. If that means that recruiters are posting jobs first thing and candidates are applying for those jobs later in the day, this is the ideal situation. We will be looking more at time-to-apply data in our upcoming annual report so look out for its release soon.

December is always a slow month in the world of recruitment as businesses wind down at the end of the year and candidates take a break from the job search over Christmas. The fact that neither jobs nor applications crashed and that it is clear from the weekly data that the majority of the fall occurred over the Christmas and New Year period is encouraging. We now await to see if job posting activity returns in the first month of the year and if applications rise with the ‘new year, new job’ trend that we often witness in January.