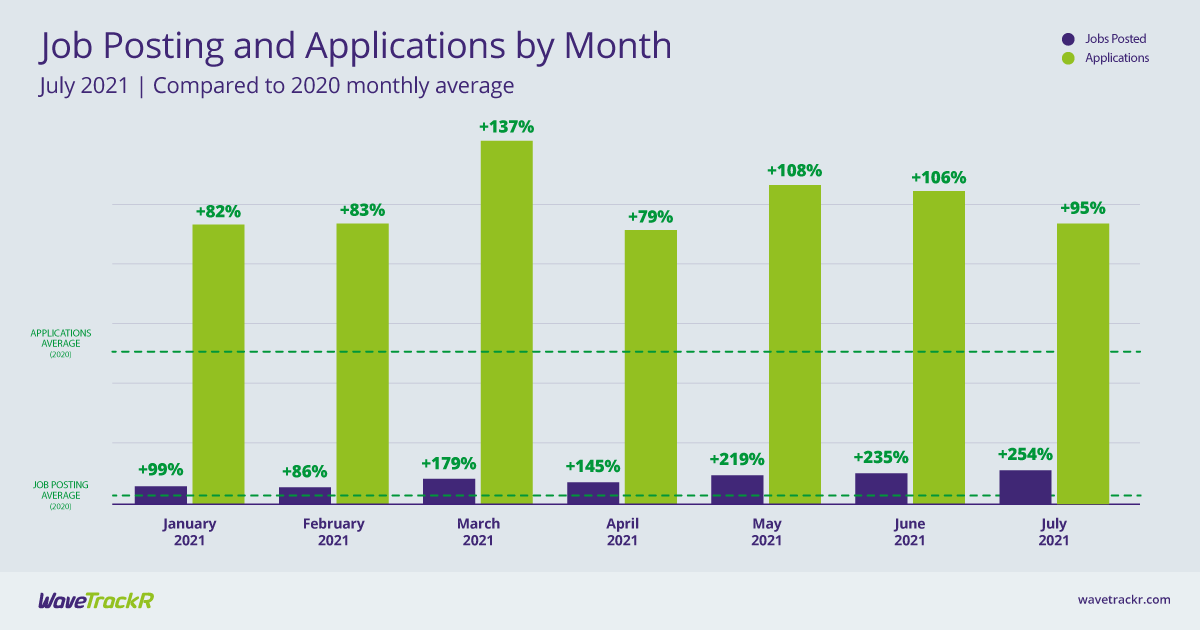

With Freedom Day signalling the end of all restrictions on July 19th and as the number of those receiving either a first or a second vaccination mounts, the WaveTrackR July Report has shown that jobs continue to rise. However, applications fell for the second consecutive month and average applications per job dropped for the sixth month in a row. The labour shortage appears to be continuing to bite.

From an already strong 235% over the 2020 monthly average in June to 254% over that average in July, jobs seem to be on an unstoppable upwards trajectory. As the economy finally fully reopened (bar the remaining international travel restrictions), businesses are understandably keen to open at capacity and begin to recoup the losses felt during the pandemic. However, the potential economic growth this would cause is being hampered by a distinct decline in candidate availability. Applications fell again in July, this time by 6%. Average applications per job also fell, from 10 in June to 9 in July - the sixth consecutive month they have fallen.

Health & Nursing seems to be suffering the most from this disparity between vacancies and applications. It topped the industry charts for the number of jobs posted across the month but received the lowest average number of applications per job - a figure of just 1. Clearly the industry is suffering from a serious skills shortage. The other industries in the top 5 for job posts - Education, Public Sector, IT & Internet and Engineering - also featured in the top 5 for applications, indicating demand is being met. Manufacturing, which suffered a fall in the IHS Markit/Cips purchasing manager’s index in July, rose from receiving the fourth highest numbers of applications to the second highest but doesn’t feature amongst the top five industries for job posts. Stretched supply chains have led to a sharp rise in costs and output and new order growth eased to four-month lows, going some way to explain the discrepancy in jobs vs applications.

For the third consecutive month, financial services industries received the highest average applications per job, with Insurance, Banking and Finance taking the top 3 spots. The stability that a job in financial services offers clearly still carries some sway. However, all of their July averages fell far short of June’s averages. Insurance, for example, received an average of 46 applications per job in July compared to 70 in June. Construction, too, received a relatively high average number of applications per job - 27 compared to the overall average of 9. IHS Markit/Cips figures showed that Construction grew at its fastest rate in 24 years (since the survey began) in June, with total new orders expanding at one of the strongest rates since 2007. With those kind of boom rates and a huge demand for new housing, many are turning towards the sector as a stable and prosperous career choice.

For how much longer will jobs continue to rise and applications fall? It’s hard to tell but weekly data has shown that jobs have risen in the last week of the month, potentially indicating a boom in August. And we may see a rise in candidate activity by the autumn. When the furlough scheme ceases at the end of September, the National Institute of Economic and Social Research believe that unemployment will rise by 150,000. Without the prop of the job retention scheme, more talent will enter the market and candidate availability should rise.