As jobs continued their seemingly unstoppable upwards trend in June, climbing a further 5% from May, applications dropped. It may only have been a 1% drop but that becomes more significant with the finding that average applications per job dropped for the fifth consecutive month. Against a backdrop of rising jobs, this dip in applications reveals a slowly yawning gap between available jobs and available (and willing) candidates.

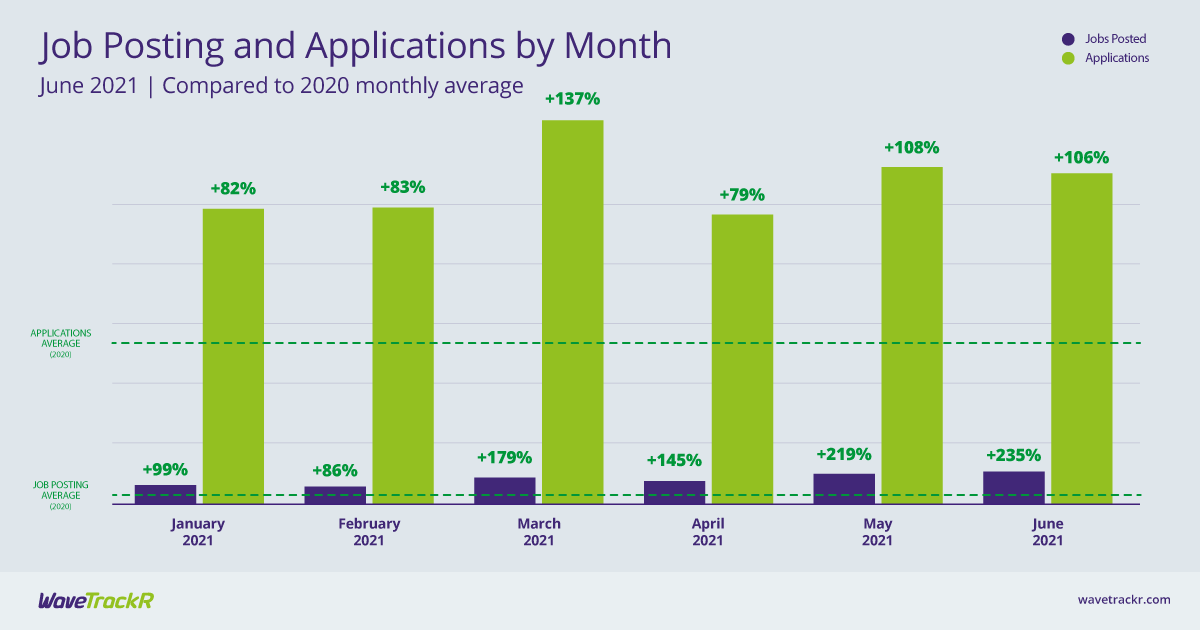

Job postings increased from May’s figures of an already strong 219% above the 2020 monthly average to 235% above that average in June. As industries continued to re-open, albeit not as quickly as hoped with the delay to the exit of lockdown, and the vaccination programme ramped up to cover all adults, the market has picked up across most industries. Admittedly, the delay to the June 21st lockdown exit caused a drop in both jobs and applications - from 275% above the 2020 monthly average to 198% above that average for jobs the week that restrictions were supposed to end. However, the jobs and applications figures for the final week of June are still higher than the first two weeks of the month. Hiring remains on the increase but, overall, applications are now decreasing. There were no heady peaks in applications of the likes seen in April and May.

June’s average monthly percentage may only have dipped from 108% to 106% above the 2020 monthly average but following a period of time in which the majority of recruiters were being inundated by an influx of applications, this has certainly not gone unnoted. The reasons are likely wide-ranging, including candidate hesitancy amongst continued uncertainty, the furlough scheme holding back the market, a lack of EU workers, and skills shortages, amongst other factors. Clearly, a strong candidate attraction and engagement strategy has never been more crucial.

Of course, experiences differ for each industry. Education continues to be in demand both in terms of jobs and applications, taking the top spot for highest number of jobs posted and receiving the second highest number of applications. Public Sector, IT & Internet, Health & Nursing, and Engineering all posted high numbers of jobs too, with all bar Health & Nursing receiving healthy numbers of applications. Yet again Health & Nursing is struggling to attract the number of candidates needed to successfully fill the high number of jobs it posts. At just 2, it receives the lowest average number of applications per job across all industries. Manufacturing, too, continues to receive a high level of applications but doesn’t make it onto the top five for job posts. Social Services received the second lowest number of average applications per job. An industry with difficult to fill positions at the best of times, the need for social care services has risen during the pandemic whilst supply has dropped.

Financial services industries received the highest average applications per job for the second consecutive month, with Insurance (an industry not even in the top 5 in May) claiming the highest at 70. It seems the combination of the lure of a stable career choice during continued global uncertainty, combined with jobs lost to the EU as financial institutions relocate, may still be at play. With a relatively high number of average applications per job in Secretarial, PAs and Admin, is an increase in automation leading to a decrease in demand for such services within businesses? Electronics, too, is new to the top 5, perhaps caused by both a historic skills shortage and supply chain issues (in particular a global shortage of semiconductors, which are in just about everything we use) affecting the market.

Further increased job activity is an incredibly positive sign that the economy is recovering more quickly than originally forecast, leading many economists to predict that we will be at pre-pandemic levels by the end of 2021 - a full year earlier than expected. After spending the majority of 2020 faced with a hiring freeze and a dearth of jobs, coupled with an explosion in applications from a talent pool greatly increased by high unemployment, we now seem to be seeing a reversal. Jobs are steadily increasing but candidate activity is down. Now is the time to ensure your talent attraction strategy is robust and your candidate experience is smooth. For those with access to the right candidates, the jobs are plentiful.