As the economy continues to re-open and grow, with UK business confidence hitting a four year high according to the Lloyds Bank Business Barometer for August, hiring has been vastly accelerated. Great news for the economy but as candidate availability drops, recruiters are needing to get creative to source talent for the growing number of jobs in the market.

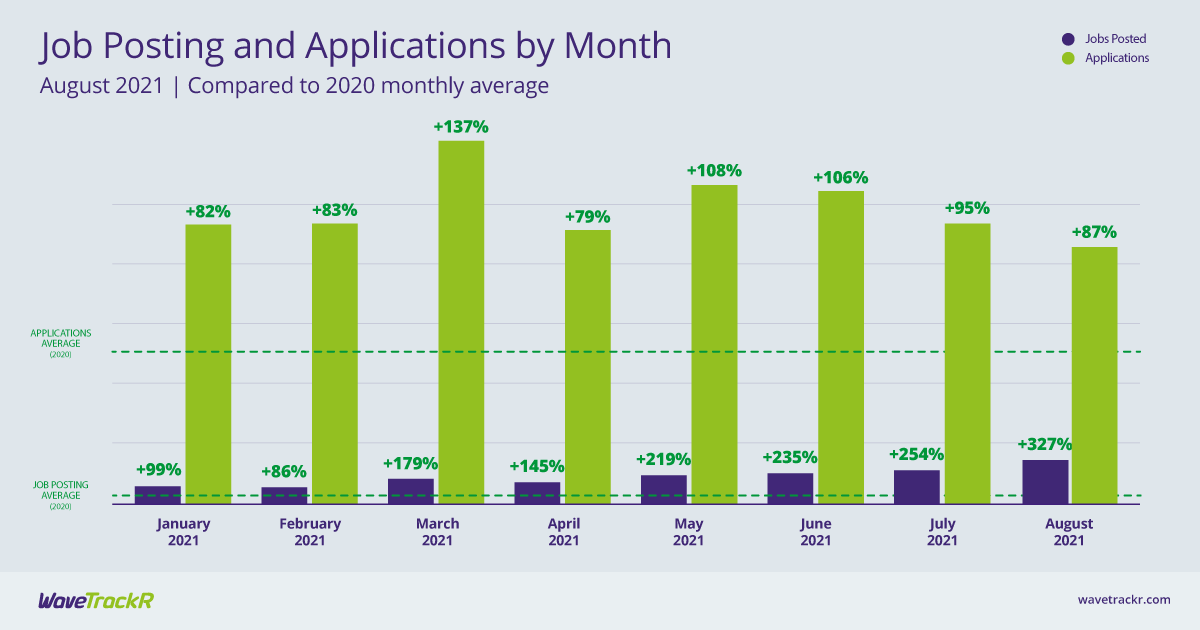

In August, jobs increased by 27% from July - a substantial leap compared to the June to July increase of 6%. In July jobs were an already high 254% above the monthly average but rose to 327% above that average in August. It is a trajectory that keeps shooting skywards. Meanwhile, applications decreased for the third consecutive month, this time by 9%. August applications fell to 87% below the 2020 monthly average, compared to 95% above that average in July. The average application per job fell for the seventh consecutive month, with an average of just 7 applications per job in August. Increased job rises and application falls can only mean one thing - greater labour shortages. The so-called Great Resignation, whereby employees dissatisfied with their job or working conditions leave to pursue the many opportunities now available, should help to increase the talent pool somewhat but the candidate reigns as king.

Public Sector posted the highest percentage of jobs across the month, being responsible for 21% of all jobs posted in August. Health & Nursing also posted a high number of jobs but without receiving a similarly high volume of applications, plus received amongst the lowest average numbers of applications per job - both indications that there remains a skills shortage in the sector. IT & Internet, Education and Engineering all posted high numbers of jobs as well as receiving high numbers of applications, suggesting the application to job ratio is fairly healthy in those industries. Manufacturing yet again received a high volume of applications but without the jobs to support them, perhaps in part due to ongoing supply chain issues hampering production.

Insurance continues to be an over-subscribed industry for candidates, averaging 82 applications per job compared to the all-industry average of just 7. The lure of a seemingly stable career appears to still be incredibly appealing post-pandemic. Oil, Gas & Alternative Energies also experienced a high average number of applications per job, perhaps as a result of the many alternative energy and carbon capture projects stalling whilst awaiting funding or simply due to the cycle of projects finishing and starting. Social Services joins Health & Nursing as an industry receiving an incredibly low average number of applications per job - both industries, suffering from a history of skills shortages intensified by the pandemic and Brexit, received an average of just 2 applications per job in August. Catering & Hospitality, suffering from a huge labour shortage, received an average of 4 applications per job.

For how long will this jobs boom/applications drop continue? Looking at WaveTrackR’s weekly data for August it is clear that jobs spiked at the very beginning of the month and then gradually fell as the month progressed so we may be seeing a plateauing effect when it comes to hiring over the next few months. Positively, the report also found that recruiters were posting the highest percentage of jobs on Tuesdays, the same day that candidates sent the greatest number of applications. Posting jobs when candidates are actively searching is one way to help boost applications in a candidate-short market - and any boost is welcome when labour shortages are rising.