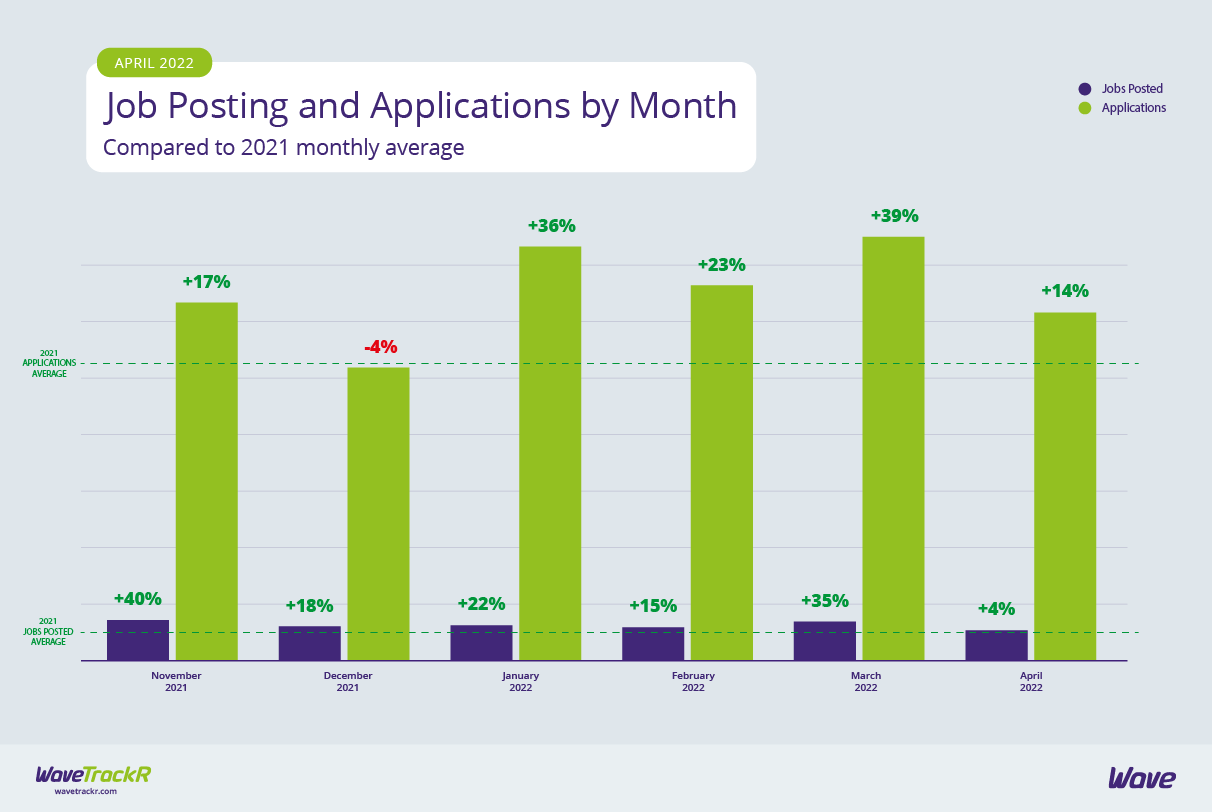

Following March’s boosted jobs and applications figures, April’s drops - revealed in WaveTrackR’s April 2022 Recruitment Trends Report - were somewhat unexpected. Could continuing price hikes across a number of areas and a general feeling of uncertainty resulting form the war in Ukraine be starting to impact the jobs market as businesses begin to act with caution?

Jobs dropped by 22% from March numbers and applications fell by 18%. At just 4% above the 2021 monthly average, jobs are the lowest they’ve been since July 2021 and applications, too, have dropped. At 14% above the 2021 monthly average they are at the lowest levels seen in 2022 to date and, bar a phenomenal drop in the traditionally slow month of December, haven’t been lower since September 2021. So what’s happened? The rapidly rising cost of everything from materials, to fuel, to energy, to fertiliser, to food, and much more, are quickly beginning to affect businesses - not to pandemic levels but enough for many to put on the brakes, be cautious and scale back hiring. Add to that further supply chain issues resulting from both the war in Ukraine and the multiple city-wide lockdowns in China, plus the general uncertainty that surrounds any war, and it is understandable that organisations may be taking a ‘wait and see’ approach.

Of course, not every industry is impacted in the same way. IT & Internet goes from strength to strength, yet again posting the highest number of jobs and receiving amongst the largest levels of applications. Given the supply chain issues that are hampering production in many industries, it is encouraging to see Manufacturing posting relatively high numbers of jobs and receiving the largest number of applications. There is still an imbalance though, illustrated by the fact that the industry received a high average number of applications per job.

Public Sector and Health & Nursing are yet again posting high levels of jobs but receiving low numbers of applications and the reverse is again true for Secretarial, PAs & Admin and Engineering & Utilities. Secretarial, PAs & Admin candidates are experiencing an extremely competitive market, with the sector again receiving the highest average number of applications per job, though that number has dropped from 23 in March to 19 in April. Still, far higher than the overall average of 12. The continuing high levels of applications being received in the Secretarial, PAs & Admin sector is reflected in Secs in the City yet again being the job board with the highest average application per job figures (and the only job board to receive a higher average than the overall average of 12) - and also a reminder that niche boards can work spectacularly well for some industries.

There is little change to the industries posting the most jobs and those receiving the most applications. The top 5 in each are the same as in March, only with different percentage shares. Transport & Logistics received amongst the highest number of applications per job in April, a great sign that the industry is recovering from months of candidate shortages. At the other end of the scale, Health & Nursing is still receiving extremely low average numbers of applications per job - just 2. Travel, Leisure & Tourism jobs are also struggling to attract the applications needed, possibly due to many leaving the sector when it was effectively closed and then not returning. Human Resources is a new entry, receiving an average of just 3 applications per job - the same as Travel, Leisure & Tourism.

The April report also found that most jobs were posted on a Tuesday for the second consecutive month, with the majority of applications also made on a Tuesday - proof that candidates respond within a day to job ads if they are actively searching. Posting your jobs at the beginning of the week is therefore a smart move in order to grab the attention of talented candidates when they are looking.

Whether this fall in job and application levels is a temporary glitch or the beginning of a more cautious approach to hiring in yet another unsettled time remains to be seen. What is certain is that we will be looking at May’s data with eager eyes.