- Hiring across Britain is still 31% down, but that’s up from -68% in April

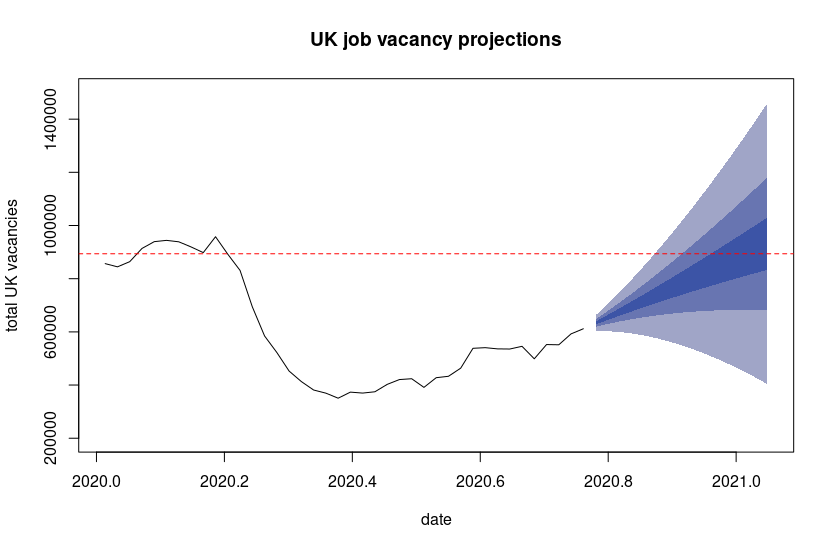

- If the jobs comeback continues at this rate, ‘normal’ levels of recruitment by January 2021

- But job ad resurgence may be offset by doubling of unemployment rate by year end; Bank of England forecasts unemployment to hit 7.5% by end of the year

- London hiring stagnates, while North East, Midlands & South West recover fastest

- Huge sector variation: 10 year recruitment high for Logistics & Warehouse jobs; Manufacturing also strong; but a bleak winter expected for Travel & Graduate jobseekers where hiring is still +50% down

- New restrictions mean Hospitality & Catering vacancies could fall further to 75% below normal levels by late spring and into the summer of 2021

Projection Methodology

The year-to-date UK vacancies for 2020 were processed by an exponential smoothing algorithm, which produced a 15-week forecast. The predicted values are a statistical continuation of the historical data and include confidence bands for the predictions at each point in time. The model does not predict or attempt to account for externalities such as changes to government policy, but instead relies solely on the historic data.

Regional Overview:

U.K hiring activity currently sits at 31% of pre-pandemic levels, so we’re still missing over 250,000 jobs in the U.K. London has seen the slowest rate of recovery (-51%), while the North East (-15%), East Midlands (-16%) and the South West (-17%) have seen sustained hiring growth since May.

|

Jan 2020 Vacancies |

May 2020 Vacancies |

Oct 2020 vacancies |

% Change Jan to Oct |

|

|

UK wide* |

876,983 |

360,183 |

602,455 |

-31% |

|

London |

199,657 |

67,082 |

97,987 |

-51% |

|

South East England |

137,970 |

65,417 |

90,766 |

-34% |

|

North West England |

70,788 |

31,512 |

50,727 |

-28% |

|

South West England |

66,366 |

31,865 |

55,056 |

-17% |

|

Eastern England |

73,166 |

33,529 |

54,782 |

-25% |

|

West Midlands |

60,050 |

24,327 |

43,791 |

-27% |

|

Yorkshire And The Humber |

46,130 |

20,099 |

33,831 |

-27% |

|

Scotland |

33,374 |

15,146 |

25,147 |

-25% |

|

East Midlands |

44,518 |

19,053 |

37,264 |

-16% |

|

Wales |

18,298 |

7,694 |

13,679 |

-25% |

|

North East England |

13,191 |

6,748 |

11,235 |

-15% |

|

Northern Ireland |

6,197 |

2,485 |

4,891 |

-21% |

The table above shows the variance in hiring activity at 3 key points of the 2020 - January (pre-pandemic), May (2020 hiring low point) and October (latest hiring data)

Andrew Hunter, co-founder of Adzuna, comments: “I’m feeling increasingly optimistic that, after a dreadful spring and summer for the U.K job market, we are beginning to see a sustained recovery in hiring. There are definitely tough times ahead - we anticipate unemployment to significantly worsen as we move into winter, the job market will become more competitive and it’s clear that many sectors are keeping a lid on hiring while we battle the second wave of the virus. Confidence is key to getting Britain hiring again, and that will come from keeping the virus at bay, a strengthening economy and continued government support for our businesses big and small.”

Sector Overview:

Logistics & Warehouse, Manufacturing & Cleaning jobs are now in positive territory - hiring rates in these sectors are now above pre-pandemic levels. There are now over 60,000 live logistics & warehouse jobs being advertised across Britain, the most we’ve seen in a single month since we started collecting job market data 10 years ago. The autumn looks bleak for travel & hospitality jobseekers (-63%), Graduates (-59%) and Consultants/Freelancers (-57%).

|

Sector |

Job vacancies Jan 20' vs Oct 20’ |

|

Hospitality, Travel & Catering Jobs |

-63% |

|

Graduate Jobs |

-59% |

|

Consultancy Jobs |

-57% |

|

PR |

-57% |

|

HR & Recruitment Jobs |

-56% |

|

Admin Jobs |

-55% |

|

Charity & Voluntary Jobs |

-53% |

|

Sales Jobs |

-52% |

|

Energy |

-50% |

|

Accounting & Finance Jobs |

-50% |

|

Legal Jobs |

-45% |

|

Engineering Jobs |

-41% |

|

Retail Jobs |

-39% |

|

IT Jobs |

-38% |

|

Customer Services Jobs |

-30% |

|

Creative & Design Jobs |

-30% |

|

Teaching Jobs |

-24% |

|

Scientific & QA Jobs |

-22% |

|

Maintenance Jobs |

-21% |

|

Property Jobs |

-19% |

|

Healthcare & Nursing Jobs |

-18% |

|

Trade & Construction Jobs |

-16% |

|

Social work Jobs |

-11% |

|

Cleaning Jobs |

14% |

|

Manufacturing Jobs |

19% |

|

Logistics & Warehouse Jobs |

77% |

The table above shows the % of job vacancies advertised in the U.K October 2020 vs. the pre-pandemic levels of January 2020

Andrew Hunter, co-founder of Adzuna, comments: “Hiring activity could be back to normal as early as January 2021, but make no mistake, we will see a very different jobs market emerge into the post-pandemic world. The recovery has been led by the handful of sectors boosted by the pandemic. Logistics & Warehouse jobs are up 77% since the start of the year, Manufacturing jobs have grown by a fifth, and key worker roles like Healthcare & Nursing and Social Care are continually hiring. But these growth areas sit in stark contrast to sectors like Hospitality & Catering, where the recovery has ground to a halt over recent months and hiring activity is stuck around 60% below normal. The wave of new UK restrictions, including the curfew, could cause these sectors to backtrack further and we expect Hospitality & Catering hiring activity to decline to 75% below normal levels by late spring and into the summer of 2021. Similarly, Travel looks stuck in the mud with no signs of imminent recovery. There will be a knock-on effect on workers in these areas and we expect to see huge movement between jobs as workers look to migrate from fading sectors to flourishing sectors.”

UK Salary overview:

|

Month |

Average advertised salary -- UK |

|

September 2020 |

£36,436 |

|

August 2020 |

£36,201 |

|

July 2020 |

£36,604 |

|

June 2020 |

£36,964 |

|

May 2020 |

£36,727 |

|

April 2020 |

£35,645 |

|

March 2020 |

£35,278 |

|

February 2020 |

£35,264 |

|

January 2020 |

£35,094 |

|

December 2019 |

£34,887 |

|

November 2019 |

£34,680 |

|

October 2019 |

£34,550 |

|

September 2019 |

£34,664 |

Advertised salary performance in key sectors:

|

Sector |

Average advertised salary, October |

Average advertised salary, May |

Average advertised salary, January |

% change from Jan |

|

Retail |

£24,931 |

£30,746 |

£27,090 |

-8% |

|

Manufacturing |

£22,823 |

£25,262 |

£24,488 |

-7% |

|

IT |

£53,147 |

£53,331 |

£51,307 |

+4% |

|

Logistics & Warehouse |

£23,973 |

£24,167 |

£24,025 |

0% |

|

Healthcare & Nursing |

£39,752 |

£39,432 |

£38,450 |

+3% |

|

Trade & Construction |

£40,062 |

£42,313 |

£42,667 |

-6% |