- In the week 12-18 July, there was a total of 1.57 million active job adverts in the UK

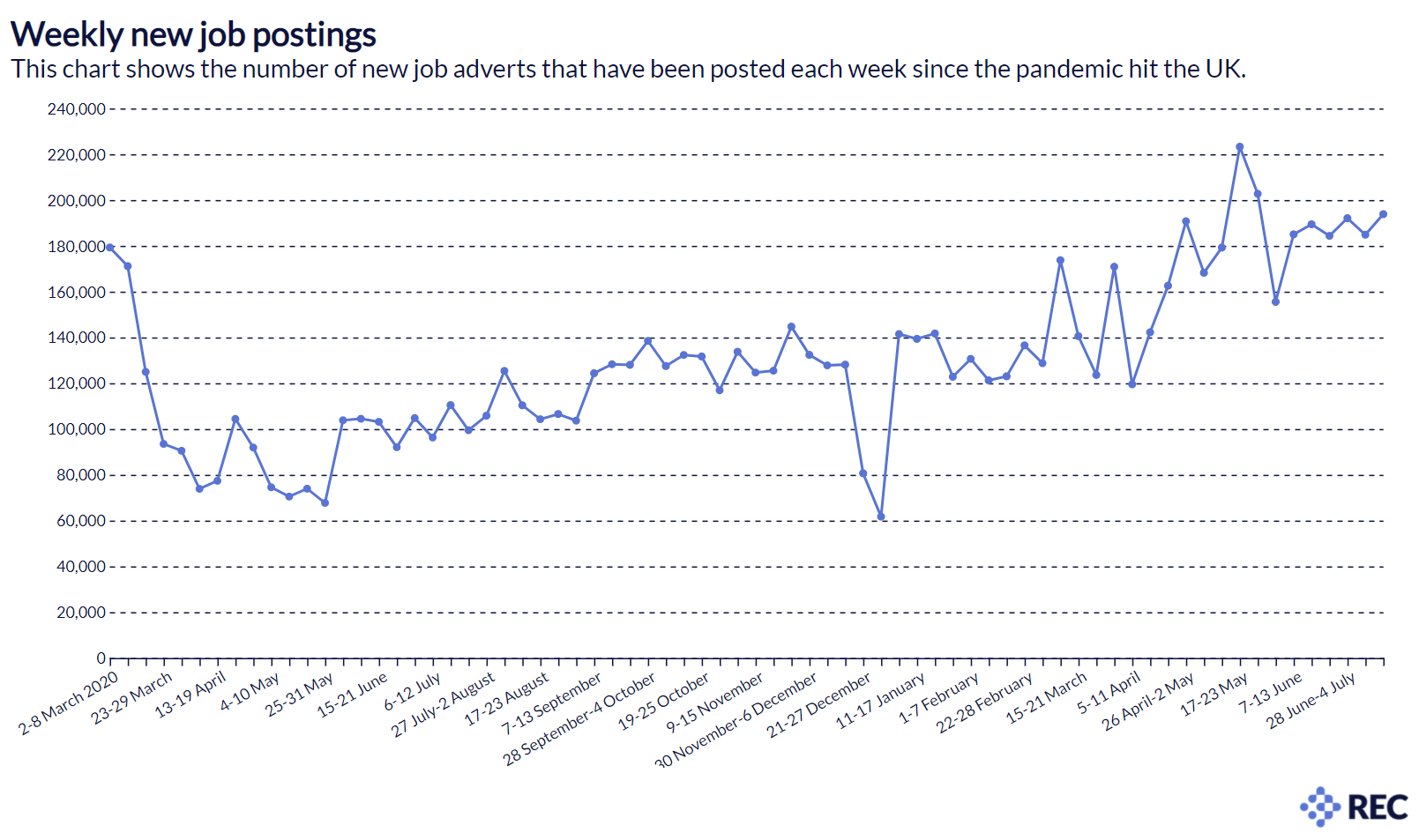

- There were around 194,000 new job adverts posted between 12-18 July, slightly higher than in previous weeks

- New job postings numbers have remained stable since early June

- Six out of the UK’s top ten hiring hotspots were in London last week as the capital jobs market kicks back into action

- Higher demand for childminders and falling demand for teachers as summer holidays approach

- Sunderland recorded the biggest weekly fall in active job postings, followed by West Dunbartonshire

- Four out of the bottom ten local areas for growth in active job postings came from Northern Ireland.

According to the Recruitment & Employment Confederation (REC)’s latest Jobs Recovery Tracker, there were 194,000 new job adverts posted in the week of 12-18 July, which gives a total of 1.57 million active job postings in the UK last week. The number of job adverts in the UK has remained high and stable since early June, as employers sought to bring on new staff before the final COVID restrictions were lifted.

On a regional level, London boroughs are seeing a steady increase in active job postings after a long period of decline, as people start to return to office jobs in cities. Six out of the top ten areas for growth last week were London boroughs, including Brent (+3.7%), Kensington & Chelsea and Hammersmith & Fulham (+3.7%), and Wandsworth (+3.2%).

Kate Shoesmith, Deputy CEO of the REC, said:

“Employer confidence has continued to grow over the past few weeks, and demand for staff remained high in anticipation of the final COVID restrictions being lifted. We have also started to see London’s jobs market kicking back into gear as the hospitality and retail sectors open up and more people return to offices in the capital.

“But with demand so high, many businesses are really struggling to find the staff to fill vacancies. Employers need to consider their offer to candidates at times like these, and we are already starting to see wages rising in some sectors. But businesses and individuals will also be concerned by government plans to raise National Insurance, the nation’s biggest jobs tax, at a time when many are still struggling. Raising NI would disproportionately affect temporary and low-paid workers, who can afford it the least. The social care system is in desperate need of funding, but government must think carefully about whether this is the best way to do that.”

However, not all areas saw an uplift in job adverts last week. Sunderland (-14.0%) saw the steepest fall in active job postings, followed by West Dunbartonshire (-11.2%). Four out of the bottom ten local areas for growth in active job postings were in Northern Ireland, including the Causeway Coast and Glens (-10.1%).

With more people starting to go back to work ahead of the final stage of unlocking, 12-18 July saw the highest increase in active jobs postings for childminders since data collection began (+43.6%).

This rise in demand for childcare will also have been affected by schools breaking up for summer holidays. Teaching and other educational professionals saw the biggest decline in job adverts (-48.9%) as the sector goes into a cooling off period over the summer, as well as support roles like school secretaries (-10.3%).

Previous data has shown huge demand for jobs in the hospitality sector as restrictions eased. However, growth in demand seems to have stabilised, with bar staff (+3.3%), waiters and waitresses (+2.2%) and chefs (+1.1%) only seeing marginal increases in active job postings.

Matthew Mee, Director, Workforce Intelligence at Emsi, said:

“Yet again we’re seeing continued recovery in job demand nationally and with the easing of lockdown measures across different nations, key sectors most significantly impacted by the pandemic are continuing in hiring mode. Looking at some broader data sets beyond demand we’re also seeing confidence levels returning – in particular noting last week’s HR1 submissions (potential redundancy notifications) down to just 10% of the levels we witnessed in June 2020. It seems then that a tight labour market is perhaps upon us once again across key sectors, locations and occupations – and with UK employment levels estimated to have contracted by some 825,000 workers from the year previously reported (Jan-Mar 2020 to Jan-Mar 2021) we can anticipate upwards pressure on wages and for increased government support to tackle key talent shortages.”