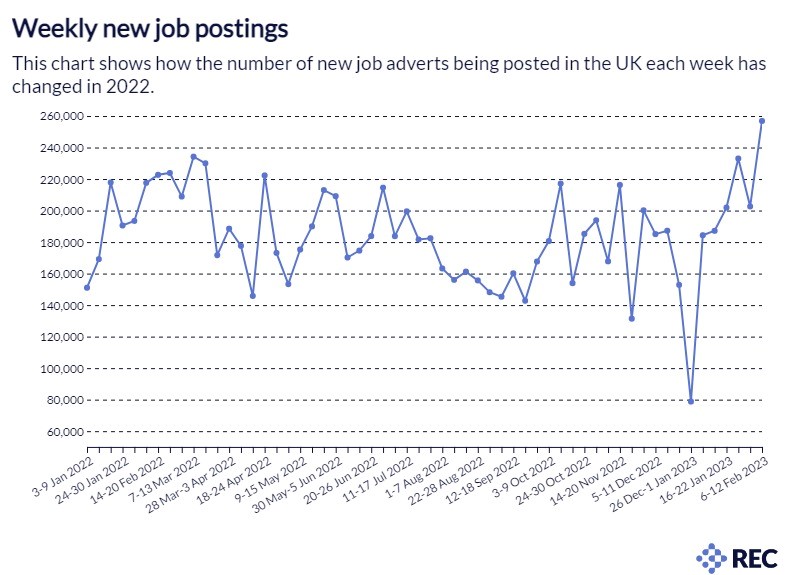

- There were 256,855 new job postings in the week of 6-12 Feb 2023 – the highest recorded since data collection started in Jan 2022. It is also 26.8% higher compared to the week before (30 Jan-5 Feb 2023) and 22.4% higher compared to the same period in the previous year (7-13 Feb 2022).

- The number of active postings in the week of 6-12 Feb was 1,323,315 – a 6.6% increase compared to the previous week (30 Jan-5 Feb), but an 8.5% decrease compared to the same period last year (7-13 Feb 2022).

- Notable increases in adverts for construction trades floorers and wall tilers (+ 52.7%), painters and decorators (+43.1%), construction operatives (+23.5%), and carpenters and joiners (+22.8%).

- Three out of the UK’s top ten hiring hotspots in the week of 6-12 Feb were in Scotland: Falkirk, East Dunbartonshire, South Lanarkshire.

- Three out of the UK’s bottom ten hiring hotspots were in Wales: South West Wales, Gwynedd, Powys.

There was a boom in the number of new job adverts (256,855) in the week of 6-12 Feb 2023, according to the Recruitment & Employment Confederation (REC) and Lightcast’s latest Labour Market Tracker.

There has been a 6.6% increase in the number of active postings in the week of 6-12 Feb compared to the previous week, with 1,323,315 active job adverts. The previous week saw a drop in demand with 1,241,200 active postings - perhaps due to school half term when many people are on-leave from work – suggesting that the overall demand, while volatile, continues to remain at a high level.

Neil Carberry, Chief Executive of the REC, said:

“Employers are still looking to hire, even in a slower economy. In part, that is driven by shortages – but it is also likely to be a reaction to a stronger-than-expected start to the year. It is still a good time to be looking for a new job, to open up opportunities and boost pay. But for businesses it is more challenging than ever – that is where working with the right professional recruiter comes in.

“Construction is perhaps the most reactive sector to changes in economic weather, so the sector bouncing back now is a sign of renewed hope, as well as new projects getting underway in the spring.

“The entrenched labour shortages that are driving this buoyant labour market are not sustainable for our economy and likely to damage economic growth. The economy stands to lose up to £39 billion in GDP every year from 2024 unless business and governments act on labour shortages. We hope the Chancellor will put people issues first in his Budget next month by addressing key issues, such as childcare, skills and infrastructure.”

Occupations with notable increases in job adverts include floorers and wall tilers (+52.7), painters and decorators (+43.1%), telephonists (+23.9%), construction operatives (+23.5%), and carpenters and joiners (+22.8%).

In contrast, driving instructors (-23.4%), weighers, graders and sorters (-22.3%), veterinarians (-21.3%), packers, bottlers, canners and fillers (-17.3%), and veterinary nurses (-16.6%) saw the biggest weekly decline in job adverts.

Falkirk (+16.3%) saw a bigger growth in job adverts in the week of 6-12 Feb 2023, followed by Tower Hamlets (+15.5%), Walsall (+15.4%), and Solihull (+14.6%).

Medway (-3.2%) saw the largest decline in job adverts, followed by Herefordshire (-2.6%), Bromley (-1.7%), and Dumfries and Galloway (-1.3%).

Elena Magrini, Head of Global Research at Lightcast, said:

“Despite the recent news that the Office for Budgetary Responsibility (OBR) has revised its forecasts for economic growth down by between 0.2% and 0.5%, when we look at the labour market we are still seeing strong demand, with nearly 257,000 new online job advertisements being posted in the week beginning 6th February – about 15% above the same period in 2022. This may be reflective of continued confidence amongst some employers, but may also perhaps be indicative of the labour shortages identified by the OBR as one of the reasons for its more pessimistic forecast.

“One of the most interesting subsets of the data is the growth in demand for construction jobs. At a time when organisations such as the Construction Products Association (CPA) are forecasting a fall in construction output of 4.7% in 2023, we might have expected to see a slowdown in demand for these jobs. However, it seems that for the time-being at least, employers in the construction industry are still seeking large numbers of new workers, suggesting that the predicted downturn has not yet been reflected in a slowdown in recruitment activity.”