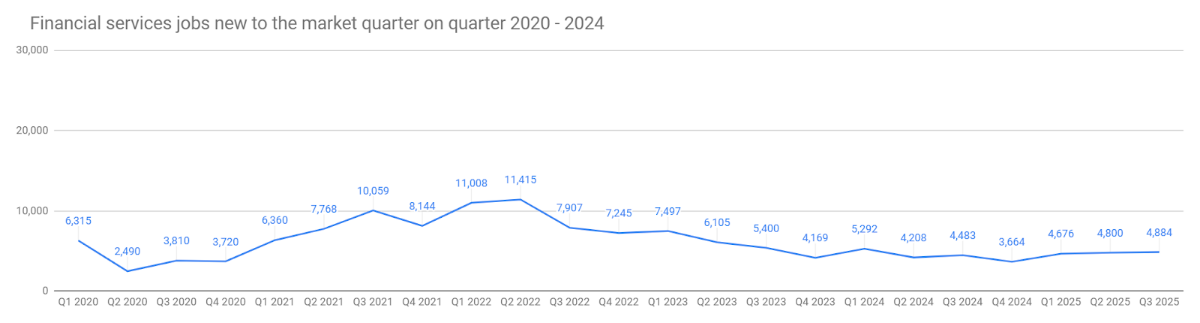

Key stats from Morgan McKinley’s 2025 London Employment Monitor:

- 2% increase in jobs available quarter-on-quarter (Q3 2025 vs Q2 2025)

- 9% increase in jobs available year-on-year (Q3 2025 vs Q3 2024)

The latest employment figures from Morgan McKinley show that job openings across London’s financial services sector rose by 2% in Q3 2025 compared to the previous quarter and 9% in the same period last year, signalling a market that remains resilient despite seasonal and economic headwinds.

Mark Astbury, Director, Morgan McKinley commented: “Our latest London Employment Monitor shows vacancies rose by 2% in Q3 2025 compared with the previous quarter. While the quarterly rise is modest, the more striking figure is the 9% year-on-year growth, clear evidence that London’s jobs market remains on an upward trajectory despite the ongoing impact of AI.”

“The quarterly increase follows a sharp dip in Q2, when uncertainty around potential US tariffs caused many firms to pause hiring. Typically, recruitment slows over the summer months, but this year’s rebound reflects a catch-up effect as employers resumed previously delayed hiring plans. With the upcoming UK Budget in November, many firms are still cautious, assessing whether new fiscal measures could affect workforce planning. In most cases, decisions are being delayed rather than withdrawn.”

”Structural changes continue to reshape the employment landscape. Junior roles are increasingly being near-shored to hubs such as Belfast and Glasgow, while automation is reducing reliance for administrative staff in industries such as insurance. This has slowed graduate hiring, as many entry-level tasks are now automated or centralised. London continues to command the lion’s share of senior and strategic roles, particularly in technology leadership, corporate finance and AI strategy. We are seeing demand towards higher-value positions in audit, tax and IT management: functions that are critical as firms adapt to regulatory and digital change.”

“Sector data underscores the shift. FinTech is booming, with 6,425 roles posted year-to-date, surpassing last year’s total underpinned by the five-year funding cycle and the race to commercialise AI platforms. Banking and consumer finance firms continue to consolidate with vacancies trending down as cost pressures mount. Yet even here, operations hiring is up, reflecting the need to shore up back-office capacity in response to complexity around tariffs, automation and compliance.”

“Looking more broadly, major US investment through the £150 billion US–UK Tech Prosperity Deal will inject momentum into the digital economy. London stands to benefit most as the UK’s financial and innovation hub, funnelling capital, talent and expertise into the wider economy.”

Astbury concluded: “In short, the UK hiring market is showing growth, not retreating. Firms may be pausing to take stock, but the trajectory remains upward, with London firmly at the centre of Britain’s next phase of digital and financial growth. Much now depends on the Autumn Budget and whether it reassures employers or adds further cost pressures that will set the tone for hiring into early 2026.”