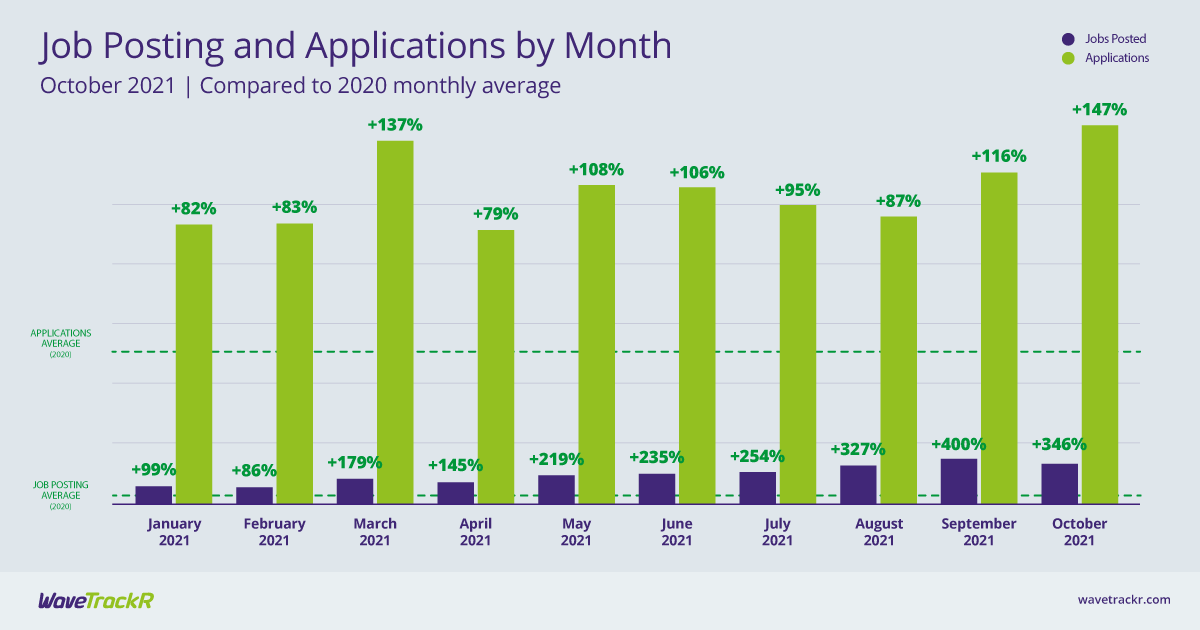

WaveTrackR’s Recruitment Trends: October 2021 Report saw jobs drop for the first time since April but also saw applications rise, narrowing what had been a widening gap between jobs and available candidates. Are we looking at the beginning of the end of the candidate short market?

Following a summer characterised by candidate shortages, an increase in applications and slight dip in jobs will be something of a relief to recruiters seeking top talent for their clients. Applications have increased for the second consecutive month, this time by 14% from September to a figure of 147% above the monthly average - the highest they’ve been all year. Meanwhile, jobs have decreased for the first time in six months, following a peak of 400% over the 2020 monthly average in September. At 346% above that average, October’s figures couldn’t be described as low but are becoming more manageable given the level of applications. This has led to the average application per job to rise by 2.4 from September’s figures to 9.4 in October.

Many of the industries posting high numbers of jobs and/or receiving high levels of applications remain unchanged from September. IT & Internet and Education continue to post jobs and receive applications at similar rates, indicating stable markets with demand on both sides largely being met. Health & Nursing and Public Sector, however, are posting high numbers of jobs but not receiving the volume of applications needed to successfully fill all roles. Perhaps unsurprisingly, therefore, they also received the two lowest numbers of applications per job at just 2 each. Historic talent shortages in these sectors have been exacerbated by both the pandemic and Brexit, leading to what some are calling a talent crisis. Catering & Hospitality continues to face a severe candidate shortage for similar reasons. Once highly in demand, the industry has been hit hard by a combination of EU workers leaving and others not returning since jobs have picked up again following the pandemic. Our report has shown that it is now experiencing low numbers of average applications per job - just 4 compared to the all-industry average of 9.4 this month.

Engineering received the highest percentage of applications of all industries but without the corresponding level of jobs to place that number of candidates in. Indeed, at 21, it received amongst the highest numbers of average applications per job. Manufacturing, too, continues to receive large numbers of applications but doesn’t make it into the top 5 for jobs. Secretarial, PAs & Admin, meanwhile, appears to be more buoyant this month. After appearing in the applications top 5 in September, it finds itself there again in October but this time with a boost to jobs, closing the gap between jobs and applications.

Financial services industries prove popular amongst candidates again this month, with Finance, Banking and Insurance all receiving high numbers of applications per job; the former two receiving the highest figures. Electronics also received a far higher than average number of applications per job, perhaps as a result of the supply chain issues hitting the industry on a global scale.

As always, numbers fluctuate between industries but the overall figures speak of a calming situation. Could a dip in jobs and a rise in applications be the market stabilising after a torrid spring/summer which saw jobs soar and applications decline?