- 1.30 million active job adverts in the first week of February, returning to levels last seen in late June 2020

- 132,000 new job adverts posted last week, 44% higher than the last week of June

- The drop in active postings was recorded across every English region as well as Wales and Scotland

- Northern Ireland was the only nation to record an increase in job ads

- Rise in job adverts for dispensing opticians, bricklayers and special educational needs teachers

- Notable falls in postings for conference organisers, fitness instructors and IT professionals

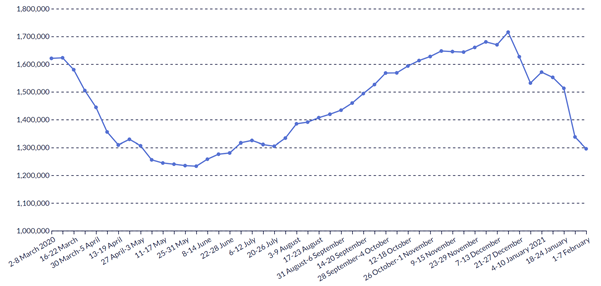

The number of active job adverts in the UK fell to 1.30 million in the first week of February, the lowest total since the last week of June 2020. This was a fall of 3.1% from the last week of January, and 14.4% lower than the week of 18-24 January.

The number of active job adverts has fallen significantly in the past few weeks due to an increase in the number of adverts expiring and being removed from job sites. However, there were 132,000 new job adverts posted in the first week of February, significantly more than the 92,000 posted in the last week of June 2020 – indicating that firms are much more confident about bringing on new staff than they were even after the first wave of the pandemic. The scale of this churn is likely to reflect the changes that are taking place in our economy, as some firms and sectors grow, while others are still struggling.

Neil Carberry, Chief Executive of the REC, said:

“With uncertainty levels high, it is unsurprising to see a note of caution amongst hirers – though new vacancies have not dropped to anywhere near the levels seen last spring. REC surveys suggest this is a pause that is likely to end as restrictions ease, with temporary hiring continuing to deliver opportunities to workers even as permanent roles are less common than before Christmas.

“The vaccine rollout means demand in the health sector remains high, and the construction industry is still hiring strongly as building sites remain open. There is a great deal of underlying confidence that when the lockdown measures are eased, firms will be able to bounce back strongly – and the UK’s vibrant recruitment industry will have a vital role to play in accelerating the recovery.”

East Lothian & Midlothian saw the biggest weekly fall in job postings (-13.6%), followed by North Hampshire (-7.9%) and the Scottish Borders (-7.0). In Scotland overall there was a drop of -3.8% in active postings, while in London the number decreased by 5.3% as the capital’s jobs market continued to struggle.

The only nation which saw a weekly increase in active job adverts was Northern Ireland (+2.4%). This rise was even stronger in Mid Ulster (+4.5%) and Antrim & Newtownabbey (+4.0%), while other local areas of the UK like South Ayrshire (+6.9%) and Powys (+4.3%) also saw increases in postings.

The occupation with the highest increase in active job adverts was dispensing opticians (+15.7%) and there was also an increase for pharmacy and other dispensing assistants (+8.8%) as the vaccine rollout continued.

A number of roles in the construction sector like bricklayers (+14.2%), town planning officers (+8.6%) and plasterers (+7.5%) saw a rise in adverts, while there was also increasing demand for special educational needs teachers, perhaps due to these children requiring more specialised attention with schools remaining shut.

Perhaps unsurprisingly, the biggest falls in active job adverts were for conference and exhibition organisers (-21.7%) and fitness instructors (-20.8%) as no large events can take place and gyms remain closed. There was also a significant decrease in adverts for IT roles such as IT engineers (-14.1%), project and programme managers (-13.4%) and analysts, architects and systems designers (-13.0%).

Matthew Mee, Director, Workforce Intelligence at Emsi said:

“Whilst the headline numbers in recent weeks might raise a few concerns over employer confidence, it is actually encouraging to see new posting volumes remaining resilient. When we dig a little deeper into these numbers we can see demand for key worker occupations remains strong – and there is relative growth in new demand across a number of technology and engineering-based professions. When we look purely at employers that are hiring (as opposed to recruiters), we can also see there seems to be some encouraging early signs of increased new postings activity across London and the South East – which is good to see given our previous commentary on the Covid ‘London Lag’.”