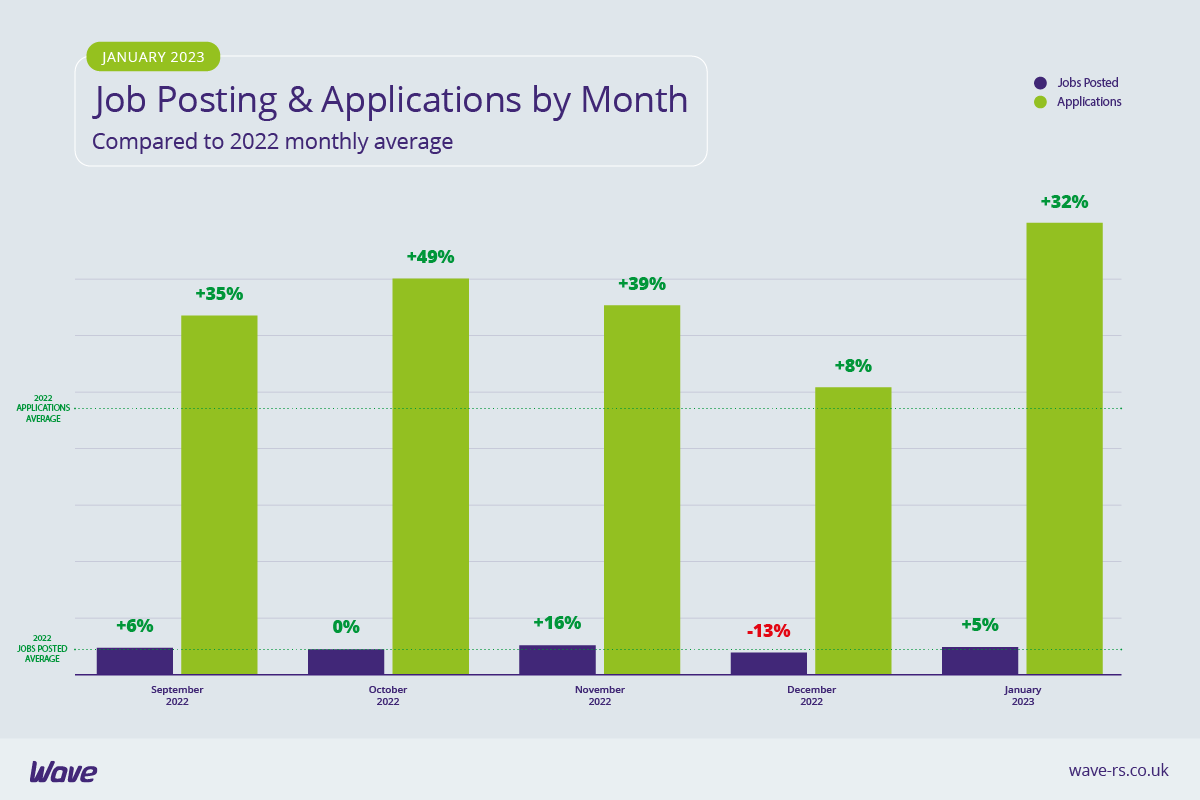

The Wave January 2023 Recruitment Trends Report has revealed a huge rise in applications in January, with levels higher than in any month in 2022. Following two years of candidate shortages, this is welcome news. Jobs also rose but not by the same extent, indicating that the gap between jobs and applications may finally be beginning to close.

A swell of candidates boosting applications

Following a month that saw significant falls in both jobs and applications, January has boomed, especially when it comes to candidate activity. The new year, new job trend has truly kicked in, with applications 57% up month on month and 32% over the 2022 average, higher than in any month in 2022. An increase in job activity is a seasonal trend as people kickstart the new year searching for a fresh start but these numbers indicate a surge of candidates entering the market, likely as a result of a number of factors but especially economic pressures. The cost of living crisis has prompted people to look for better compensation in other jobs as well as force people out of economic inactivity and back into the market. The Office for National Statistics reported a decrease in the economic inactivity rate towards the end of the year, driven by those aged 50 to 64 - largely those returning to the job market from retirement to meet increased living costs.

Jobs rise month on month but rate is dropping

Jobs have increased too, by a decent 25%, but not in the same league as application rises. In fact, they were only 5% over the 2022 monthly average - lower than any month in the first half of 2022 bar April. The general jobs figures for the latter half of 2022 and January 2023 point to a slow-down in jobs as the economic situation worsened in the UK and talk of recession began. This mirrors findings from the ONS that vacancies have been falling for several consecutive quarters. It certainly seems like we are now seeing caution in the market ahead of what is forecast to be a challenging year economically.

IT & Internet continues to dominate the jobs market

IT & Internet continues its domination of both jobs and applications. The industry posted 24% of all jobs in January, 8 percentage points higher than the industry posting the second highest levels of jobs, Health & Nursing. It received 17% of all applications, giving it the greatest share but dropping by 6 percentage points from December. Both Education and Manufacturing feature on the charts for high jobs and applications, suggesting they also continue to be busy for all the right reasons.

Health & Nursing and Public Sector

Health & Nursing increased its percentage share of jobs in January but received a low percentage of applications, indicating that the industry’s skills shortage could be deepening. Its average application per job figures are proof of this - Health & Nursing received an average of just 2 applications per job - a stark reminder of the critical skills shortages that continue to challenge the industry. Public Sector also posted a relatively high percentage of jobs but without receiving a similar share of applications. The strikes that began in 2022 and are continuing into 2023 are reflective of the feeling amongst public sector workers and are only likely to intensify the issue of shortages.

The industries with a high application to jobs ratio

Secretarial, PAs & Admin received a high percentage of applications again in January, increasing its share by 4 percentage points from December, but didn’t post a high percentage of jobs. This is the same challenge faced by Engineering - a relatively low percentage of jobs but a high percentage of applications, also 4 percentage points higher than December.

Financial services popular in turbulent times

In times of uncertainty and turbulence, the appeal of financial services industries often grows due to their perceived stability and we might be seeing that in WaveTrackR’s average application per job figures for January. Accountancy received a huge average of 58 applications per job in January - 23 more than the next highest (Retail & Wholesale) and 38 more than the industry received in December. Finance is also in the top 5 for highest average numbers of applications per job. Job security has become one of the highest priorities for jobseekers, with LinkedIn finding that it was amongst the top four priorities for candidates searching for new jobs in the latter half of 2022.

Cost of living possible reason for increased Retail applications

Retail & Wholesale received an average of 35 applications per job in January, the second highest of all industries and a substantial increase from December. This could be connected to an increase in those talking on second jobs to help with soaring costs of living - a report published by insurer Royal London in September 2022 found that 5.2 million UK workers had taken on a second job, with a further 10 million considering doing so if costs continue to rise. Jobs in Retail & Wholesale can often involve shift and evening work and so make good second jobs. They also offer a way back into the market from retirement for retirees who need a little more money to meet rising costs.

Construction faces ongoing skills shortage

Of the industries recording low average numbers of applications per job in January, the majority at least increased those numbers from December. Construction is the exception (along with Health & Nursing which faces chronic labour shortages). The industry has faced a persistent skills gap for many years and a recent survey found that 75% of contractors currently have issues recruiting skilled operatives.

The pandemic-era Property boom is over

Property was in the top 5 for lowest average numbers of applications per job for the fourth consecutive month, possibly because it is quickly being seen as a less secure industry in which to work. Following a boom fuelled by low interest rates and strong demand from buyers looking for a lifestyle change during the pandemic, house prices plateaued in mid-2022 and started to fall at the end of the year. Rising interest rates were pushing up mortgages and the increased cost of living has made it impossible for many to be able to afford to buy. In January, house prices had officially fallen for the fifth consecutive month and in December the number of home loan approvals dropped for 4th consecutive month.

New year, new job, positive changes

Tuesday was the most active day of the week for both jobs and for applications - it was the day the majority of jobs were posted and the day most applications were received. In terms of the most active day of the month, the greatest percentage of jobs were posted on 4th January, one day after most agencies returned following the bank holiday. The highest numbers of applications were received on 17th January, two weeks later, once schools had been back a full week and people had started to settle into the new year - it was also the day after ‘Blue Monday’, perhaps prompting many to make positive changes.

Niche boards for niche skills

Niche job boards account for three of the four job boards that received the highest average numbers of applications per job in January. Caterer received the most, with a high average of 32 applications per job. Secs in the City was second with 23 and JobServe was fourth with 16. The only generic job board in the top four was Totaljobs with 22. The job boards receiving the fifth and sixth highest average numbers of applications per job were Reed and CV-Library, both receiving 8 - half the number of the board that came in fourth. The data suggests that those industries with niche skills are well served by niche job boards.

With a greater rise in applications than in jobs, the average application per job has risen by 3, from 13 in December to 16 in January, which equals the highest seen in 2022. It is certainly looking like we will see greater candidate numbers and lower jobs in 2023 as the UK works its way through the downturn.