- Growth in staff remuneration continues to outpace UK average

- Permanent placements rise sharply amid strong growth in demand for staff

- Edinburgh sees fastest rises permanent and temporary placements

Latest data from the Bank of Scotland Report on Jobs signalled a record increase in permanent starting salaries as a surge in demand for staff continued. A further contraction in candidate numbers was another factor behind the improvement in remuneration. The temporary jobs market also remained healthy, with billings, vacancies and hourly pay rates all rising on the month, according to February’s survey of recruitment consultancies.

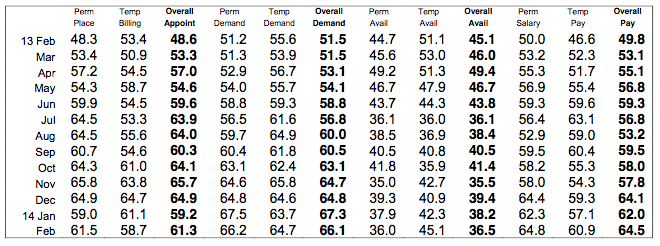

At 63.9 in February, the Bank of Scotland Labour Market Barometer – a composite indicator designed to provide a single figure snapshot of labour market conditions – was the second- highest in the series history; just below June 2007’s survey record. This signalled a marked improvement in overall Scottish labour market conditions. The Barometer was also above the UK equivalent, as has been the case throughout the past year.

Bank of Scotland Labour Market Barometer

Donald MacRae, Chief Economist at Bank of Scotland, commented: “February’s Barometer reached 63.9 – the second highest in eleven years of the survey amid a continued surge in demand for staff. The number of people appointed to both permanent and temporary jobs rose sharply accompanied by a record increase in permanent job starting salaries. Business confidence is clearly increasing among Scottish firms. These results show the recovery in the Scottish economy continuing into 2014 and becoming more established with every month.”

Bank of Scotland plc is registered in Scotland no. SC327000. Registered office: The Mound, Edinburgh EH1 1YZ. Authorised and regulated by the Financial Services Authority.

Regional analysis

The fastest rises in permanent placements and temporary billings were again both recorded in Edinburgh, in line with the trends in each of the past three months.

February’s deterioration in permanent candidate supply was broad based by region and led by Aberdeen, where the most acute fall in temp candidate numbers was also recorded.

Permanent salaries continued to rise fastest in Glasgow, while temp wage growth was strongest in Edinburgh.

Wages and salaries

Permanent salary inflation picked up since January, reaching the fastest in the 11-year series history.

Temporary/contract hourly pay rates also increased at an accelerated pace, the fastest since last July.

Employment

Growth in permanent placements in Scotland was strong, and also slightly quicker than in the preceding month.

Although still robust, the latest expansion in billings received from the employment of temporary staff was the least marked since last September.

Vacancies

February saw another sharp rise in the number of permanent job vacancies, with growth only fractionally weaker than last month’s multi-year high.

Demand for temporary staff meanwhile rose to the greatest extent for three months.

Availability

The availability of permanent job seekers deteriorated at a faster rate in February – the most marked since November.

The supply of candidates for temporary positions also decreased, but the rate of decline was the slowest in nine months.

Sectors

Consultancies in Scotland highlighted Accounts & Financial as the leading sector for growth in demand for permanent staff, as was the case in the opening month of the year. The second- best performer on this front was Engineering & Construction.

Demand for temporary staff rose fastest in Nursing/Medical/Care, followed by Hotel & Catering and then Accounts & Financial. Blue Collar recorded the slowest increase in temp vacancies, though one that was still marked overall.

Permanent Staff

- 1 Accounts & Financial

- 2 Engineering & Construction

- 3 IT & Computing

- 4 Hotel & Catering

- 5 Nursing/Medical/Care

- 6 Secretarial & Clerical

- 7 Executive & Professional

- 8 Blue Collar

Temporary/Contract Staff

- 1 Nursing/Medical/Care

- 2 Hotel & Catering

- 3 Accounts & Financial

- 4 IT & Computing

- 5 Engineering & Construction

- 6 Secretarial & Clerical

- 7 Executive & Professional

- 8 Blue Collar

(Ranked by strength of demand in Scotland in February 2014)

The Bank of Scotland Labour Market Barometer

A key tool in the Monthly Labour Market Report is the Bank of Scotland Labour Market Barometer. The Barometer is a composite indicator devised from four key measures: demand for staff; employment; availability for work (inverted); and pay in the permanent and temporary markets.

After falling in January for the first time in five months, the Bank of Scotland Labour Market Barometer rebounded to a near-survey high of 63.9 in February (up from 62.6).

As a consequence, the Barometer remained above its UK-wide equivalent which also increased on the month from 62.1 to 63.5.

Boosting the Bank of Scotland Labour Market Barometer were a faster increase in employee placements, stronger pay inflation and a more marked drop in candidate numbers. Although demand for staff again rose sharply, the slower rate of growth had a negative directional influence on the Barometer.