January 2015

London Employment Monitor December 2014 highlights:

- Year-on-year figures show professionals seeking new roles increase by 51%

- Month-on-month figures show a decrease both in professional opportunities (down 37%) and in professionals seeking to move (down 23%)

- Those securing new positions in December increased salaries by an average 18%

- The average salary change over the course of 2014 was 18%

December is traditionally quiet

"We saw tired executives taking Christmas breaks earlier than in previous years," says Hakan Enver, Operations Director, Morgan McKinley Financial Services. "Whilst the seasonal dip hit a little earlier, hiring activity also slowed due to wider concerns about a fragile UK recovery."

However, for those who did change roles, the rewards continue to be significant at an average 18%. "We are seeing increased numbers of professional job seekers, up 51% on December 2013, when the recovery really began to take root. While there is some caution in the market, we believe the overall growth trajectory of the last 12 months will continue into 2015."

Muted economic data dent City confidence

Eurozone woes continue to dampen economic confidence as December's Composite Purchasing Managers' Index (PMI) fell to 51.4 for the month against an expected 51.7. Neither France nor Italy showed any growth in the month and even Germany (with a score of 52) is showing weakening growth. These figures increase the pressure on the European Central Bank to launch a programme of quantitative easing.

The monthly Markit/CIPS shows a loss of the storming momentum built up in previous months in the UK, with business activity registered at 55.8, down from November's figure of 58.6 and the slowest rate of increase for 20 months. However, UK economic growth continues uninterrupted for two years, even at more muted levels.

The disappointing growth rate, coupled with a potential exit by Greece from the Eurozone and dramatically falling oil prices, both of which are also resulting in slight market nerves are likely to "fuel worries that the upturn is too fragile to withstand higher interest rates".

The Markit survey reports "insufficient staff numbers" as an underpinning cause of backlog growth as UK employment in general nevertheless continues to rise for the 24th month in a row. Market volatility was reflected in early January FTSE falls as reported by Reuters. In addition to the difficulties facing the energy sector in the light of plummeting prices, the poor PMI figures, particularly within the UK dominant services sector that showed the steepest decline in three years, are again contributing to market nerves.

Compliance, compliance

HM Treasury published its review of Fair and Effective Markets on 31 December 2014, following investigations into LIBOR and FX trading malpractice. The review recommends the inclusion of seven new benchmarks into legislation governing financial conduct. While broadly welcomed, the inclusion of new benchmarks places yet more regulatory burdens on financial institutions on top of EU regulation in the pipeline.

"This year has been the year for compliance professionals," says Hakan Enver, Operations Director, Morgan McKinley Financial Services. "While we continue to also see demand outstripping supply for skilled IT executives, regulatory demands and enhanced reporting needs are pushing compliance to the top of hiring agendas in the City. This is a trend we see continuing well into 2015."

Election uncertainty

"Election uncertainty is never good for economic confidence," notes Enver, "but the May UK election is particularly influential." Not only is there unprecedented uncertainty as to its outcome, with minority parties potentially gaining important seats, but also "the EU referendum if the Conservatives retain power may trigger a possible exit or partial exit from the Eurozone. Most City employers are against an EU exit, while generally in favour of Conservative policies."

Furthermore, he says, "moves to stem immigration can only increase the pressure on the supply of skilled professionals in the capital, as urgent needs remain unfulfilled."

The crystal ball for 2015

The FT's annual New Year economists' survey for 2015 shows most economic pundits united in a just-growth story. Polled economists gave forecasts ranging from a muted 0.8 per cent (Markit, Commerzbank, Francesco Papadia) to a slightly more optimistic range of 1-1.2 per cent forecast by Crédit Agricole, Bank of America, Berenberg and RBC Capital Markets.

"There are a number of contrary currents moving to affect the performance of the economy," explains Enver. "We see continuing growth for London's financial sector, but at more cautious rates than might have been predicted a year ago. The highly-qualified professional, ideally with technical know-how and international experience, will continue to be a sought-after commodity in the City and we believe London's pre-eminence as the world's most important financial centre will continue into 2015."

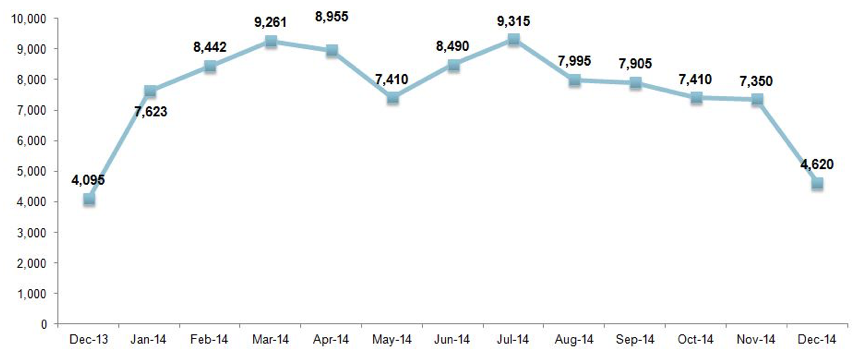

Chart 1: Financial services jobs new to the market December ‘14

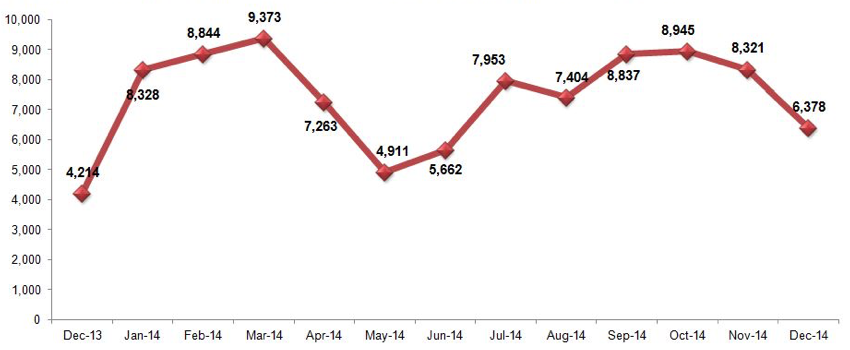

Chart 2: Professionals seeking new roles, both in and out of employment December ‘14

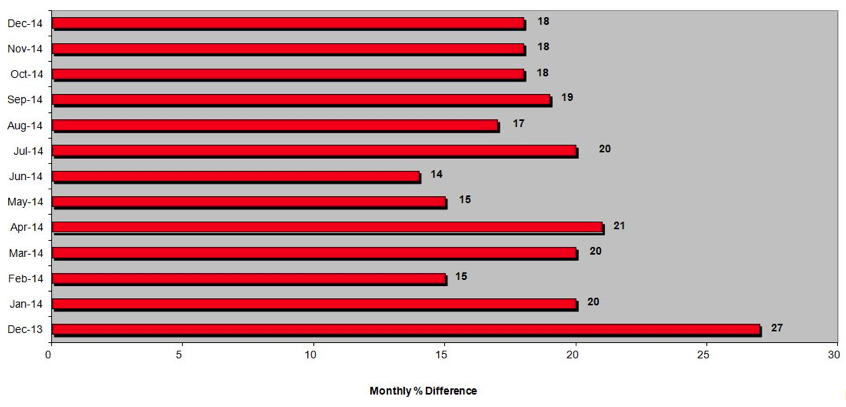

Chart 3: Average change in salary each month – December ’14