Key findings

- Permanent appointments rise at slowest rate since April 2017...

- ...as the supply of candidates falls sharply...

- ...leading to further marked increases in starting pay

Neil Carberry, Recruitment & Employment Confederation chief executive, said:

“It’s no surprise that growth in new permanent jobs dropped to its lowest level in almost two years last month, because economic uncertainty is now affecting companies’ hiring plans. But the underlying strength of our labour market is still there – vacancies are high and temporary placements rose in the run-up to Christmas. There are opportunities out there for people who want to change job in 2019.”

Summary

The KPMG and REC, UK Report on Jobs is compiled by IHS Markit from responses to questionnaires sent to a panel of around 400 UK recruitment and employment consultancies.

The Report on Jobs is unique in providing the most comprehensive guide to the UK labour market, drawing on original survey data provided by recruitment consultancies and employers to provide the first indication each month of labour market trends.

Candidate availability continues to worsen...

Recruitment agencies signalled a further marked decline in the availability of candidates at the end of the year. The deterioration in permanent labour supply quickened since the previous month, while short-term staff numbers fell at a softer but still marked rate.

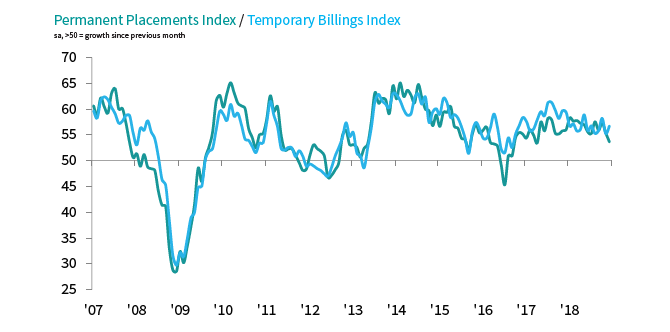

...leading to softer growth in permanent staff appointments

Low candidate supply weighed on permanent staff appointments during December. Though solid, the rate of expansion was the softest seen in 20 months. Temp billings meanwhile rose at a sharper rate, one that picked up from November's joint 25-month low.

Demand for staff remains robust...

Vacancies rose for both permanent and temporary roles across the UK at the end of 2018. Notably, growth of demand for both types of worker was much stronger than seen on average over the survey's 21-year history.

...but shrinking staff supply drives pay rates higher

As demand for workers generally outstripped supply, starting pay continued to increase sharply for both permanent and short-term workers in December. The rate of starting salary inflation was among the quickest seen for over three years, while temp pay growth also remained sharp by historical standards.

Regional variation

The South of England saw by far the sharpest increase in permanent staff appointments, while relatively mild expansions were seen across the remaining three English regions.

All four monitored English regions registered marked increases in temp billings at the end of 2018, led by the South of England.

Sector variation

Vacancies for both private and public sector staff increased further in December.

The steepest increases in demand were seen for temporary and permanent private sector workers. In the public sector, permanent staff vacancies expanded at a quicker pace, while demand for short-term staff rose at a softer but still solid rate.

Accounting & Financial and Engineering were the most in-demand categories for permanent staff at the end of 2018. Nonetheless, marked increases in vacancies were also seen across all other monitored sectors.

Blue Collar remained at the top of the rankings for temporary/contract staff demand during December. Short-term vacancies also rose across all of the other nine monitored categories. The slowest increase was seen for Executive/Professional staff.