Highlights

- Advertised UK salaries have fallen 4.1% to an average of £32,323 in the twelve months to December, a drop of £2,136 in real terms

- Wales was the only UK region to show year-on-year salary growth with the average advertised salary rising 4.1% to £28,121 in December 2013

- But demand for seasonal workers fuels a services boom as the Hospitality and Catering sector bucks the salary trend, with a 1% monthly increase

- Proposals to increase the minimum wage would affect over 1 million British workers – yet still fail to address the cost-of-living crisis for the squeezed middle

- Competition for jobs falls by almost a third (30%) year-on-year, with just 1.61 jobseekers per vacancy in December

- Despite job market positivity, advertised vacancies have been slow to pick up, with employers hiring below November 2013 levels

The average advertised salary across the UK has fallen to a sixteen month low, according to the latest UK Job Market Report from Adzuna.co.uk.

The average advertised salary has fallen by 4.1% in the past twelve months, to just £32,323 in December 2013. This equals a drop in wages of £2,136 in real terms, and marks the third consecutive month in which advertised salaries have fallen.

Andrew Hunter, co-founder of Adzuna, explains: “The recovery in the jobs market is far from over. The great news is unemployment has fallen at record levels, but wages are still stuck in a post-recession hangover – while the backlog of employees waiting for the right time to change jobs is clearing, salary levels are yet to catch up. Compared with this time last year, there are fewer people fighting it out for each position, but the chances of securing a decent salary have become slimmer.”

Table 1

|

|

November 2013 |

December 2013 |

Month Change |

Annual change |

UK Vacancies |

768,289 |

744,665 |

-3.1% |

+11.9% |

Jobseekers per Vacancy |

1.59 |

1.61 |

+1.3% |

-30.0% |

Av. Advertised UK Salary |

£32,651 |

£32,323 |

-1.0% |

-4.1% |

Salaries across the nation

The salary slide has been felt throughout the country, with annual advertised pay declining in every region aside from Wales during the twelve months to December. The East of England and the West Midlands have borne the brunt of the fall, with the average salary dropping 8.4% and 6.9% respectively in these regions. But Wales has bucked the trend. Salaries in Wales have risen 4.1% over the twelve months to December, reaching an average of £28,121. Salaries in Wales are now at their highest point since August 2012.

Andrew Hunter comments: “The salary picture looks gloomy throughout the country. But some areas are weathering the storm better than others, with Wales leading the way. Initiatives such as Jobs Growth Wales, which has created over 10,000 jobs for young people, are helping to kick-start the regional labour market.[1] As demand for good employees has increased, so has advertised salaries. Wales is further along the curve in this respect than England, Scotland and Northern Ireland.”

Festive season fuels services boom

A few sectors have managed to navigate the salary slump, and witnessed an increase in advertised salary in December.

Salaries in the Hospitality and Catering sector increased 6.6% to £19,234 in the year to December 2013 – the largest increase of any UK sector. The industry also saw a rare monthly increase of 1% from November to December. This follows recent statistics showing that revenues in bars and restaurants increased 5% and 38% respectively over the Christmas period, largely fuelled by corporate hospitality as a result of increased business confidence.[2]

Other sectors to record salary increases in December included Engineering (+5.1%) and the Energy, Oil and Gas sector (+1.5%). In both skilled sectors, a brain drought has led to fewer skilled workers vying for each role and employers have increased salaries as a means to attract talent.[3]

At the opposite end of the spectrum, some of the sectors that have suffered most severely from the salary slump include Healthcare (-3.4%) and Teaching (-1.8%). Public sector cuts have taken a toll on budgets, and salaries have been squeezed as a result.

Andrew Hunter comments: “After years of corporate belt-tightening, the Christmas party season clearly brought some festive cheer to the hospitality sector. Our waistlines may have just about recovered, but the long-term effect on salaries is still being felt.”

Impact of proposed changes to the minimum wage

Adzuna analysis reveals that well over 1 million British employees would be affected if the Government proposals to increase the minimum wage to £7 per hour were to come into effect. Even this move, however, will still leave many Britons well below the living wage across the country.

In addition, recent research estimated that almost two-thirds of hospitality employees earn the national minimum wage,[4] meaning that a significant number in the industry could be in line for a pay rise if the proposed changes were implemented.

Andrew Hunter, co-founder of Adzuna, explains: “For the 1m+ workers affected by this change, the proposed jump in their hourly rate would have a significant impact. But for the remaining majority of our workforce, any improvements are likely to be more gradual. Osborne’s proposals would do nothing to help the squeezed middle, who are still struggling from a cost-of-living crisis caused by inflation.”

Vacancies and competition for jobs

The number of vacancies in December was 11.9% higher than a year ago, with 744,665 positions on offer. This was despite a slight monthly decrease from November, typical of a seasonal slowdown.

Compared to the previous year, competition for jobs fell by almost a third (30%) in December. But compared to the previous month, a slight monthly fall in advertised vacancies meant that competition for jobs increased by 1.3% in December, to 1.61 jobseekers for each advertised vacancy.

Employers have been slower than anticipated to boost workforces in January, demonstrating a delayed recovery from the seasonal recruitment slump. Adzuna data showed that advertised vacancies in late January fell almost 20,000 vacancies short of the record levels seen in November.

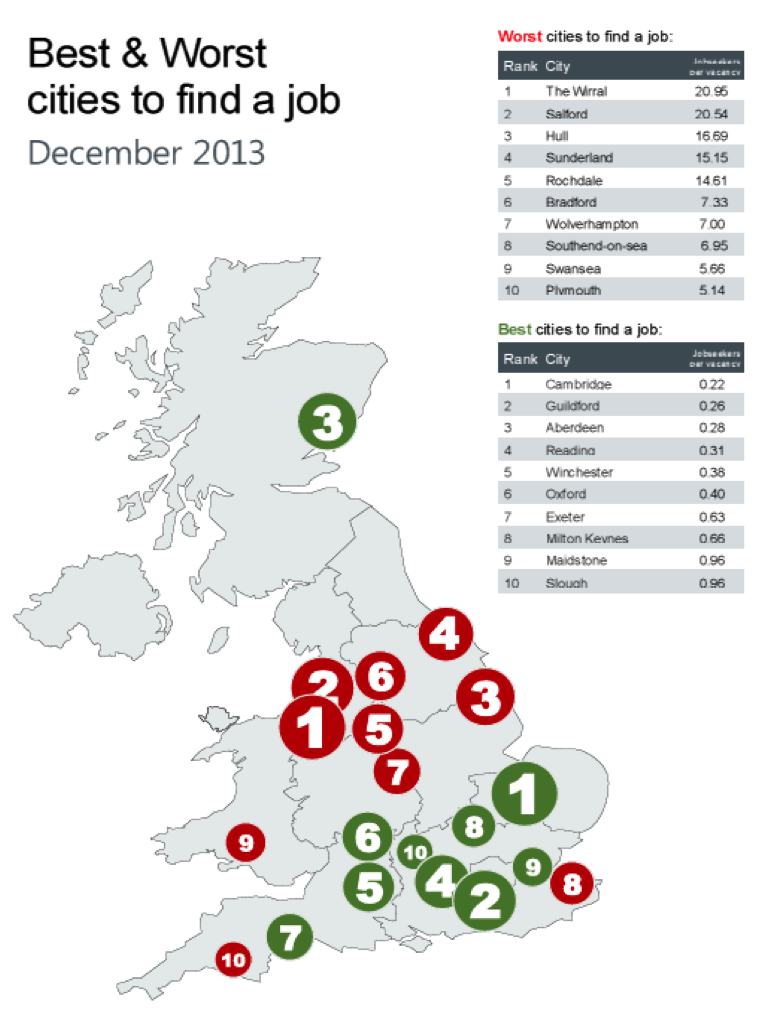

A strong North-South divide… but signs of improvement

A prominent North-South divide persists in the labour market. Nine of the top ten cities to find a job were in the South of the UK, and seven of the worst ten cities to find a job still based in the North. Cambridge was the best city in the UK to find a job in December, with just 0.22 jobseekers per vacancy. It was almost 100 times more difficult to get a job in Salford, the second most difficult city in the UK to find a job (with 20.54 jobseekers per vacancy), compared to Cambridge, the easiest place in the UK to find a job (with 0.22 jobseekers per vacancy).

There are, however, a few signs that the situation is improving for some industrial pockets in the North. Wolverhampton may be the seventh worst city in the UK to find a job, but competition for vacancies in the city is falling rapidly, and has dropped 38% over the last six months, bolstered by a strong service sector, and growing manufacturing and engineering industries.

Likewise, in Sunderland – the fourth worst city to find a job in the UK, and home to the UK’s vehicle production industry – competition for jobs has halved since July 2013.

Andrew Hunter comments: “Several local industry hubs are fighting back. Competition for jobs in both Sunderland and Wolverhampton has eased dramatically since July, as more vacancies have opened up. Wolverhampton has the added bonus of having growing manufacturing and engineering industries, where business confidence is encouraging investment and boosting salaries.”

[1] Welsh government scheme which started in April 2012

[2] D&D/Living Ventures trading statement, December 2013

[3] Professor John Perkins’ Review of Engineering Skills, November 2013

[4] Resolution Foundation study