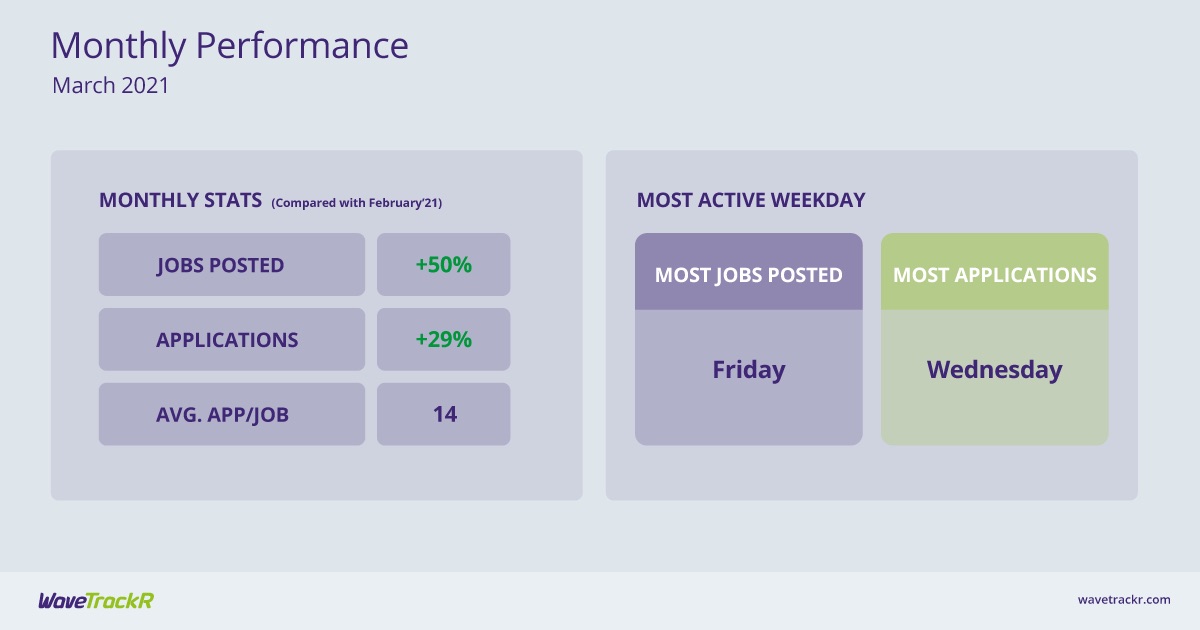

At 179% above the 2020 average, jobs grew by more than 50% from the previous month - a sure sign that business confidence is returning. Applications also climbed, but at a slower rate than jobs, something we haven’t seen since before the pandemic. Other key findings from the report include a continuation of high jobs and applications figures for IT & Internet, a slight decline in the average number of applications per job across all industries, and a rapid increase in applications per job in the Travel, Leisure & Tourism sector.

The surge in jobs we’ve seen in March is the best indicator yet that the government’s roadmap and vaccination rollout are working to return confidence to the jobs market and allow the economy to begin to recover. WaveTrackR’s week by week data findings reveal a steady upwards trajectory in jobs being posted from the second week of February onwards, with the sharpest rise seen in the final week of March when they reached a record 196% above the 2020 average. Applications also grew, to 137% above the 2020 average but had a bumpier journey. They largely climbed from the beginning of February but dropped from +135% to 111% above the 2020 average in the last week of March. What we’re seeing here could be partially explained by the jobs growth. The huge numbers of unemployed workers are gradually finding jobs, reducing the bulging candidate pool - great news for candidates, employers and recruiters alike.

So why the sudden rapid increase in jobs? The reopening of schools, continued efficiency and speed in the UK’s vaccination programme and good signs for the roadmap to progress as planned has clearly encouraged businesses to look forwards towards a very bright light at the end of the tunnel and begin hiring again. With pubs and restaurants opening outside and hairdressers, nail salons, non-essential shops, holiday lets, theme parks and zoos, gyms and leisure centres also all reopening on 12th April, many businesses will have resumed hiring in March to ensure they have adequate staffing in time. Industries that have been shut for months and have yo-yo’d between opening and closing, partially or completely, for a year now are finally being given the green light to begin to reopen - this time hopefully for good - and they want to be fully prepared.

Looking more closely at individual industries, the data shows that Public Sector posted the highest percentage of jobs but applications have fallen since February. Could this be a backlash against, firstly, the announcement in November that, following a decade of cuts, public sector pay would be frozen and then, in March’s Budget, the 1% pay rise for NHS workers announcement? Given Public Sector jobs will be paramount as we emerge from the pandemic, this needs to be closely monitored.

Following the reopening of schools at the beginning of March, Education posted 8% more jobs than in February and received 10% more applications. IT & Internet also continues to boom, with high numbers of jobs and applications. Health & Nursing posted a high number of jobs but received a relatively low number of applications, indicating a skills shortage. Manufacturing and Engineering, still reeling from the pandemic, are experiencing the opposite problem - relatively low jobs but high numbers of applications.

Travel, Leisure & Tourism has experienced a surge of applications, totalling an average of 42 applications per job compared to the overall average of 14. As the industry takes tentative steps to reopen, particularly domestically, it is possible that candidates that had taken a break from the job search are beginning to become active once more. Recruitment Sales isn’t far behind, with an average of 38 applications per job and Finance tops the list, with an average of 61 applications per job. Tallying with overall low applications in Health & Nursing and Public Sector, it is perhaps unsurprising that those sectors also experienced low numbers of applications per job, of 4 and 8 respectively.

Overall, March has been a monumental month for the jobs market. Could this be the turning point that will see the market picking up and have the way for a return to normality? The governor of the Bank of England upgraded the forecast for the UK economy in March, predicting that the economy would return to pre-pandemic levels by the end of the year. As the jobs market is generally a good barometer of economic health, a faster recovery than initially expected might just be the right diagnosis.