This correlates with a slight decrease in total gross gambling yield (GGY) across the sector. However, the good news is that the online component of the industry is making great strides, indicative of trends in other sectors and perhaps offering fresh employment opportunities.

The Growth of Online Employment

employee_design by Brand Expression (CC BY 2.0)

Remote gambling, represented primarily by online casino sites, now forms the largest part of the gambling sector’s gross yield. These sites account for 38% of GGY, with the next largest component being the betting industry, which forms 22.1%. What this means to the job market is that there is a clear shift towards online roles, with remote-based opportunities becoming the custom rather than a perk for employees. The remote-working opportunities are more accessible with the growth of iGaming in new markets or regions. For example, the number of markets that can access leovegas mobile is quite good, with the site available in nine different languages. This growth has heightened the need for iGaming companies to employ staff in multiple countries.

New roles are opening up in content management, web design, information technology, community management, technical support and related fields. There is also a shift towards creativity in gambling, with the skills of game designers and developers being required to keep up with the public’s thirst for new and better online games. Traditional roles associated with the gambling industry, such as a legal counsel, marketing and management, will still be in demand, but are shifting in the direction of an online focus.

A Steady Sector

Overall, the gambling industry in Great Britain remains not only steady but profitable despite its slight yield drop. These findings were made public by the UK Gambling Commission which published its bi-annual report in May 2019. This publication is for those who have an involvement or interest in the gambling industry, such as governmental policy makers, the media, licensed operators, trade bodies, financial organisations, gambling enthusiasts, researchers, consumers and employees.

Overall, GGY was £14.5 billion from October 2017 to September 2018, which represents a decrease of 0.4% when held up against the previous official figures. This slight downtick can be attributed in part to the difficulties faced by high streets across the country, as shoppers go online, with the total number of betting premises declining for the fifth consecutive period of reporting.

Results in Detail

billion_design by Brand Expression (CC BY 2.0)

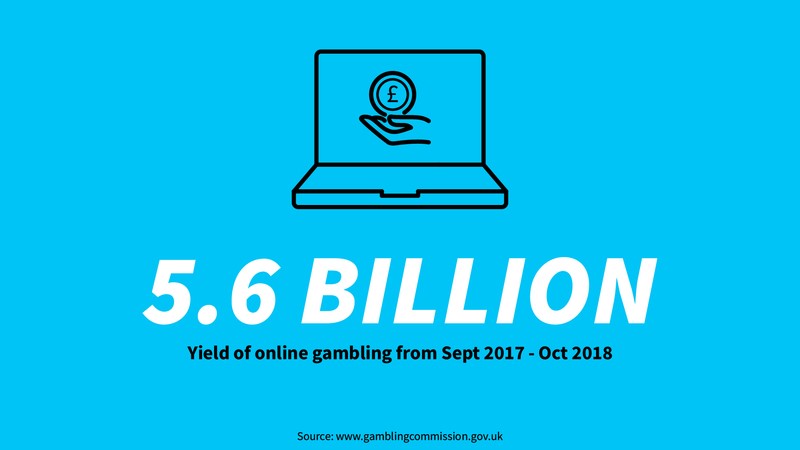

Non-remote gambling, which includes everything from sports betting to slot machines, is still a large sector, representing a yield of £3.2 billion over the reporting period. But it is far surpassed by remote gambling, which claimed a yield of £5.6 billion. Casino games are the largest earners in the sector, generating £3 billion, and the largest sub-sector is slots games, which managed to gain a yield of some £2 billion. Remote betting has also proved to be popular, totalling £2.5 billion. The most popular sports within this sub-sector are horse racing and football.

Gambling Employee Profile

Over the reporting period, there were 106,670 people employed by operators licensed by the Gambling Commission. Almost 50% of these were involved with betting. So, while the outlook for non-remote betting shops looks to be following the rest of the high street, there is still opportunity in an area which requires a large workforce. Jobs in the betting industry include everything the expected roles such as traders, bookmakers and accountants to customer service executives, PR officers and specialised analysts. In such a large industry there is also plenty of room for progression, with many companies having a multinational profile.

Remote betting and bingo employees accounted for 9.6% of the workforce, meaning that there is a shift towards those working in a purely online capacity. With the rise of online gaming there is plenty of room for home workers.

Other members of the UK gambling workforce include non-remote casino employees, at 13.3%, non-remote bingo employees, at 11.6%, and technical gaming machine staff, at 6.4%. This last figure suggests that among the roles to be found in the gambling industry there is also space for those with technical training.

Entering the Industry

As the variety of roles in the gambling industry is so vast, it’s impossible for potential workers to identify just one route to employment. In the non-remote portion of the sector there is scope for apprenticeships, combining practical training with study, allowing those wishing to enter the industry to embark on rewarding careers. On the remote side of the industry there are training options and courses depending on the role a candidate wishes to pursue. As the UK Gambling Commission figures show, this is a large industry with plenty of options for those who wish to take part in it.

Outlook for Recruiters

It’s clear that the UK gambling industry is large enough to require specialist recruiters. But the good news for non-specialists is that because the range of roles is so vast, experience in recruitment of other industries can be useful. The gambling industry has recruitment needs that include flexibility and adaptability as it, and the rest of the world, progresses towards an online model.