- A new report by Lowell reveals the UK’s attitudes towards talking about debt

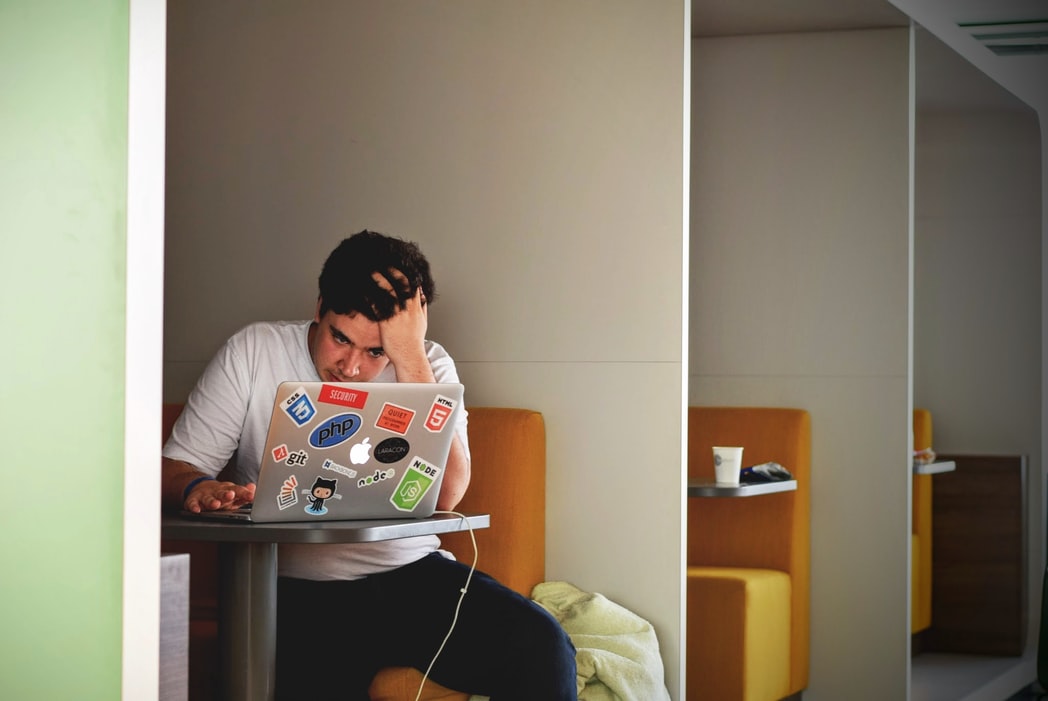

- 73% of the UK say their finances cause them to feel stressed

- For those that have opened up to others regarding their own debt, 42% said it made them feel that they had a clearer path to sorting money worries

Brits are typically known for not talking about taboo subjects. A new report today from Lowell shows that we would rather talk about other sensitive topics such as sex, relationships and politics, than open up to those around us about debt.

With household financial debt increasing in the UK1, Lowell’s report shows it is more important than ever to open up the conversation and challenge the stigma surrounding debt.

The report of 1000 UK respondents2 revealed that a staggering 31% of the UK worry about their finances every day, whilst 35% worry every week.

What will people talk about?

The respondents were asked to rank several topics that are considered ‘taboo’, and the report showed that on average, people were most comfortable talking about politics and health, followed by sex and relationships. On average, debt was firmly in last place.

Why people choose to keep debt quiet

The report asked those who had debt why they would feel uncomfortable talking about their situation.

The top reasons those in debt choose to stay quiet have been revealed as:

Reason |

% of those in debt |

|

It makes me feel uncomfortable |

41% |

|

It makes me worried |

35% |

|

It makes me feel ashamed |

36% |

|

It makes me feel embarrassed |

34% |

Who are people most likely to talk to?

The report showed that we are most likely to open up to those closest to us, with 65% of respondents saying they would be comfortable talking about their finances with their spouse or romantic partner. Surprisingly, that’s still over a third of people who won’t talk about their financial situation with their other half!

The report also found 60% of respondents would feel comfortable talking about finances with family, and 45% would be happy to broach this subject with a friend. Perhaps most unsurprisingly, only 18% of the UK would speak about their finances with their work colleagues.

The benefits opening up about your financial situation can have on your wellbeing

Suffering in silence is never the answer when it comes to debt, however it may be easier said than done to open up about what is considered such a taboo subject. The constant worrying can have a huge impact on people’s mental health, which in turn, can make the situation feel so much worse.

Talking to someone about debt can really help. The report revealed that those who open up about their financial situation saw a positive impact such as:

Benefit of talking about their debt had on the respondent |

% of those in debt |

|

It made them feel that they had a clearer path to sorting money worries |

41% |

|

It made them feel comforted |

32% |

|

It made them feel relieved |

29% |

John Pears, UK Managing Director at Lowell commented:

“At Lowell, we understand that everyone’s personal circumstances are different, however, talking about debt can help you feel less stressed and more positive about addressing the situation.

During these unprecedented and uncertain times, we understand that many people may be struggling. We encourage anyone who is struggling financially to open up to someone who they feel comfortable with, be that family, friends or support organisations.

As our report shows, by talking about debt you may feel a weight lifted from your shoulders and get the support you need to become debt free.

A number of organisations who can help you can be seen at https://www.lowell.co.uk/help-and-support/independent-support/”