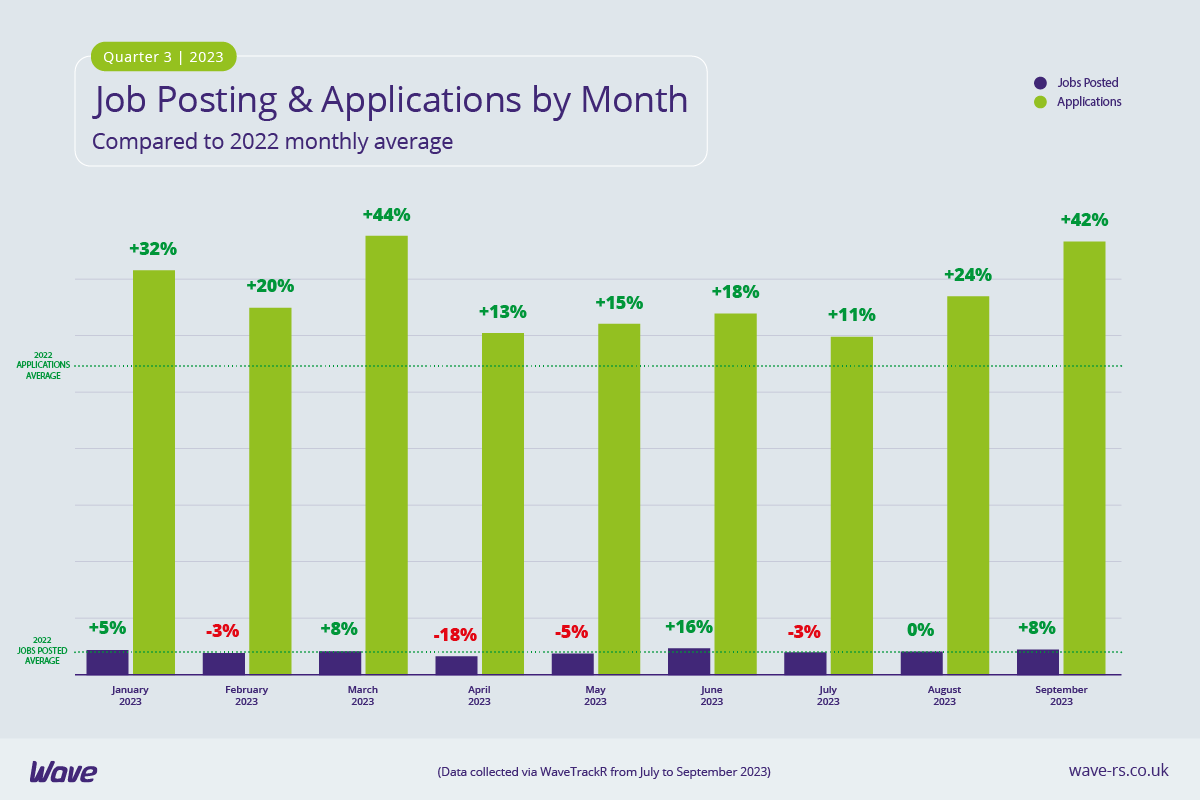

In data revealed in Wave’s Q3 2023 Recruitment Trends Report: The importance of time and job scheduling when posting job adverts, we see an uplift in jobs and applications, with a particular boost in activity in September.

September activity leads to uplifts in jobs and applications

Following a lull in activity in Q2, activity stepped up in Q3, with rises in both jobs and applications. Jobs were up 7% compared to Q2 and applications up 9% on the quarter. This is largely thanks to an incredibly productive September, with huge uplifts in both candidate and recruiter activity, proving that the trend for a busy September in the world of recruitment continues, even in uncertain economic times. Only June was more active for jobs across the entirety of 2023 to date and applications are up there with March in terms of strength of candidate activity across the year. This may in part be down to the cost of living - and in more ways than one. TotalJobs data revealed at Wave’s recent Talent Matters London event has found that a third of workers are looking to change jobs for higher pay to combat the rise in the cost of living but it’s also found that two thirds of workers are open to relocating to another city for a more affordable lifestyle and a better work-life balance.

After the summer, there’s also a real ‘school’s back in session’ feeling to September, which spills into both candidate and recruiter activity. A break over the summer can give candidates a chance to reassess their careers and consider a move, plus parents have more time to think about a job hunt once the children are back at school. Recruitment activity tends to be slower over the school holidays when consultants are off at various points so that ramps up when the majority of people are back at work. No-one really knew if this September would buck the trend, with a general slow-down of jobs (though ONS statistics show that the numbers remain above pre-pandemic figures), but it appears that the annual September boost has continued in 2023. Q3 figures are also proof that the market is performing better than expected, despite continued inflationary pressures and a raft of doom and gloom news reports.

IT & Internet dominate recruitment activity, Health & Nursing’s skills shortages continue

IT & Internet once again proved its dominance in the market, posting the highest percentage of jobs and receiving the most applications in Q3, even if in both cases its percentage share dropped on the quarter. Health & Nursing posted nearly the same percentage of jobs as IT & Internet but received a tiny percentage of overall applications, illustrating the struggle that the industry continues to have with skills shortages - their difficulty in finding qualified candidates to fill the huge number of vacant roles is well documented. This is underscored by the fact that the industry received an average of just two applications per job, the lowest of any quarter this year bar their average of one in Q1.

Retail amongst industries receiving highest average applications per job

Retail & Wholesale received an average of 30 applications per job in Q3, 16 over the general average for the quarter. This is perhaps a reflection of the challenges the British high street has been facing since the pandemic. Most recently, Wilko’s collapse has resulted in a total of nearly 11,000 redundancies (with more likely) and sent shockwaves through the high street, which has undoubtedly made retail businesses wary of hiring as well as flood the job market with those made redundant.

Other industries receiving high average numbers of applications per job include Banking and Insurance. Banking received a huge average of 155 applications per job in Q3 - well over double the number they received in Q2. Insurance netted just under that number but it equated to a seismic seven times rise from Q2. Recruitment Sales received an average of 41 applications per job - a sluggish market in Q2 likely resulted in many recruitment businesses pausing hiring.

Niche job boards net highest average applications per job

The job boards receiving the three highest average numbers of applications per job in Q3 were all niche, something that we see a lot in our recruitment data, indicating that niche job boards provide immense value. IT-focused JobServe received an huge average of 96 applications per job in Q3 - far more than any other job board in any other quarter of 2023, whether generalist or niche. Catering & Hospitality-focused Caterer received the next highest with an average of 41 applications per job and Secretarial, Admin & PA- based Secs in the City came in third with 40. Just under Caterer was the first generalist job board to chart - TotalJobs with an average of 26 application per job. CV-Library and Reed.co.uk received a third of TotalJobs’ average, at 9 each.

Forecasters seem unable to accurately predict what the economy might do next but it seems likely that the market will continue to cool but not plunge into anything like the mass redundancies we were seeing over the pandemic. It is still righting itself after the jobs surge that occurred in 2021/2022 and jobs remain above pre-pandemic levels. If anything, hiring difficulties are easing as more candidates join the market and jobs reduce to a manageable level. What we can control is how we strategise candidate attraction - craft a first-class job ad, get your jobs out at the right time and post them to the right place.