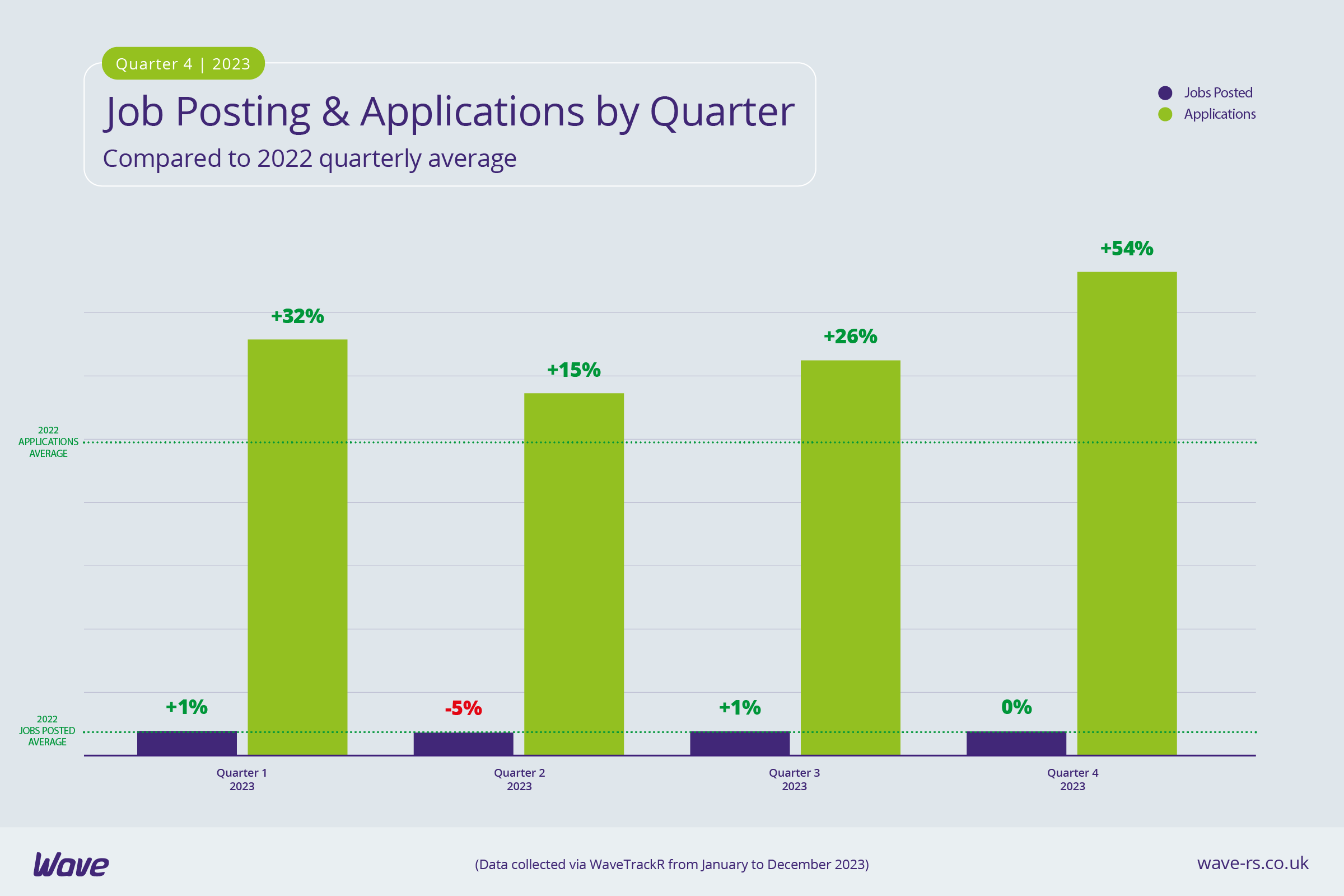

The Wave Q4 2023 Recruitment Trends Report revealed that applications were the highest of any quarter in 2023 and jobs equalled the 2022 quarterly average. What Q4’s job figures didn’t equal was the pace of growth in 2022 – an indication that as 2023 ended, the market was re-setting, shifting the balance from candidate-led to a more even keel between candidate and employer.

Candidate activity peaks in Q4 as increasing numbers enter the market

Following a lacklustre Q3 in terms of applications, Q4 was a busy quarter for candidates. In October, the highest percentage of applications all year was recorded, hitting 66% over the 2022 monthly average. November’s numbers dipped slightly but still equalled the second highest of the year.

As the year came to an end - a time we’d usually expect all recruitment activity to plummet - applications only dropped to 38% over the 2022 monthly average, which puts the figures in the top half for the year. In Q4, applications soared above all other quarters in the year, reaching 54% over the 2022 quarterly average - the next highest was Q1, at 32% over the 2022 quarterly average.

We saw higher numbers of candidates entering the market in Q4, some as they took on second jobs to help with the cost of living, others coming out of retirement for similar reasons. As part of its Q4 2023 Recruitment Trends Report: The impact of flexible working on recruitment, Wave recorded an increase in hybrid jobs on the market in 2023, which may have helped a range of candidates (such as carers, parents, those with neurodivergencies or disabilities) that would struggle to work a full time office job to enter or re-enter the market.

Job pace plateaus as the market begins to reset

As applications continued their upward trajectory, jobs plateaued, equalling the 2022 quarterly average. Looked at on a monthly level, they dipped in October, rose again in November and then dropped by quite a margin in December. A fall in jobs in December is a seasonal trend but one that makes the consistently high application numbers all the more noteworthy. What we’re likely seeing is the market resetting after the crazy hiring rush of 2021/2022.

Importantly, jobs aren’t plummeting in the way that much of the the press is reporting it - the pace has slowed but numbers are staying at a fairly stable level. As applications increase, the hope is that labour shortages may start to ease, though that only works if the applications are from qualified candidates in the industries struggling with skills shortages.

Uptick in Education jobs as it leads job post figures

Education has stormed into the top spot for volume of jobs posted in Q4, taking the lead from IT & Internet. From posting 15% of all jobs in Q3 to 26% in Q4 (8 percentage points ahead of IT & Internet), Q4 was a busy period for the Education industry. Given its busiest period tends to be Q2, when schools are lining up staff for the start of the new academic year in September, this is significant.

The industry is also joint highest for applications, indicating that supply is likely meeting demand. However, receiving an average of just 9 applications per job compared to the general average of 17 would also suggest that it’s a delicate situation.

Continued skills shortages in Health & Nursing and Public Sector & Services

Both Health & Nursing and Public Sector & Services were amongst the five industries posting the highest numbers of jobs, yet didn’t record similarly high levels of applications. Both industries also appeared on the list of industries with the lowest average application per job figures, with Health & Nursing averaging just one application per job in Q4.

The historic skills shortages the industry shares with Public Sector & Services has meant consistently low application numbers for a number of years and that looks set to continue for quite some time yet.

Second job seekers push up applications for industries with seasonal jobs and shift work

As the cost of living forces many to find second jobs, especially in the expensive run-up to Christmas, Retail & Wholesale and Customer Services found themselves inundated with applications in Q4, racking up an average of 109 applications per job in Q4.

Retail & Wholesale advertise a high number of short-term, seasonal roles in Q4 to cope with an increase in buying demand and goods from Black Friday and Christmas shopping. This suits candidates looking for second jobs to help ease the effects of the cost of living crisis, as does the relatively high proportion of evening and weekend work. This is a trait Retail shares with Customer Service, which received the second highest average number of applications per job in Q4 (73).

Niche job boards receiving record numbers of applications

Niche job boards continued to prove their strengths in attracting candidates by netting high average numbers of applications per job. Indeed, the top 3 job boards bringing in the highest numbers were all niche. Jobserve supplied an average of 97 applications per job, over three times the number received by the generalist job board with the highest average number of applications (Totaljobs at 31).

Caterer received the next highest and more than doubled its average application per job figures from Q3, leaping from 41 in Q3 to 83 in Q4, likely due to an increase in demand in the lead-up to the festive period. Secs in the City came in 3rd, with an average of 44 applications per job – 4 over the industry's Q3 figures.

A shifting market for 2024

As we head into 2024, Wave’s jobs and applications data indicates the market is shifting. No longer are we in a candidate-driven market with high jobs and low applications. Many are calling it a reset, with jobs returning to the numbers we might have seen without the pandemic (they remain above pre-pandemic figures). Meanwhile, unemployment figures are slowly starting to tick up, meaning there are more active candidates in the market. This presents huge opportunities for those recruiters who are smart with their candidate attraction strategies.