Summary

Ongoing political and economic uncertainty continued to weigh on recruitment activity in July, according to the latest KPMG and REC, UK Report on Jobs. Permanent staff appointments declined for the fifth month in a row, albeit marginally, while temp billings expanded at the slowest rate for 75 months.

Subdued confidence not only impacted on hiring decisions, but the availability of workers, which declined further in July. That said, the overall rate of deterioration was the softest seen for two-and-a-half years, helped by only a modest decline in temporary candidate supply. Nonetheless, skill shortages continued to push up rates of starting pay for both permanent and short-term staff.

The report is compiled by IHS Markit from responses to questionnaires sent to a panel of around 400 UK recruitment and employment consultancies.

Hiring trend remains subdued in July

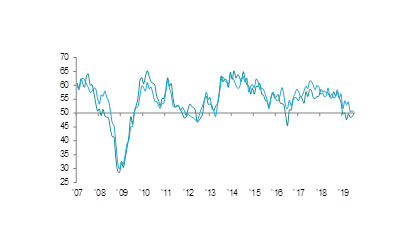

The number of people placed into permanent roles fell for the sixth time in the past seven months in July, albeit marginally. At the same time, temp billings growth weakened to a 75-month low, rising only slightly overall. Panellists linked widely muted recruitment activity to lingering political and economic uncertainty.

Vacancy growth picks up slightly

Overall demand for staff continued to expand in July, with the rate of growth edging up to a four-month high.

Permanent Placements / Temporary Billings

50.0 = no-change

Sources: KPMG, REC, IHS Markit

That said, the increase remained among the weakest since late-2012. While demand for permanent workers picked up slightly, temporary vacancies expanded at the slowest rate for seven years.

Softer deterioration in candidate availability

Recruitment consultancies registered a further decline in candidate availability, which was commonly attributed to a high employment rate and lingering market uncertainty. However, the downturn in total candidate supply was the least marked for two-and-a-half years, with both permanent and temporary staff numbers falling at softer rates.

Starting salary inflation at 27-month low

Starting salaries awarded to newly placed permanent staff rose further amid reports of greater competition for workers. The rate of inflation, though sharp, was the softest seen since April 2017. Temporary pay rates also rose at a weaker pace.

Regional and Sector Variations

Data split by English region indicated that permanent placements declined in London, the South of England and the Midlands. The North of England meanwhile registered an increase for the fifth month in a row. The South of England and London both registered higher temp billings, while falls were seen in the Midlands and the North of England.

Vacancies rose further across the private sector during July, but declined in the public sector. In the private sector, demand strengthened for both permanent and temporary staff, with vacancies growing sharply in each case. However, public sector permanent vacancies declined for the fifth month in a row, while short-term staff demand fell for the first time since January.

The steepest increase in demand for permanent staff was once again seen for IT & Computing. The only sectors to see reduced vacancies were Construction and Retail. That said, trends weakened across all monitored sectors compared to a year ago.

Temporary staff demand rose across seven of the ten monitored job categories in July, led by Hotel & Catering. Retail saw the steepest overall reduction in short-term vacancies, while demand also fell in Executive/Professional and Construction.

Comments

Commenting on the latest survey results, James Stewart, Vice Chair at KPMG, said:

“Businesses continue to take a cautious approach to hiring as Brexit and economic uncertainty linger.

“Permanent staff appointments have fallen for the fifth month in a row, while overall demand remains lacklustre as firms delay recruitment decisions. Uncertainty is also impacting the supply of labour, as people are choosing to sit tight until the outlook is clearer.

“With the UK unemployment rate already at a four-decade low, candidate shortages in the labour market continued to push up rates of starting pay. This will likely cause concern for businesses looking to control their costs and recruit the right people for the long term. Ultimately, businesses will be eager to see a Brexit breakthrough in Westminster to help re-establish market confidence on hiring and investment.”

Neil Carberry, Recruitment & Employment Confederation chief executive, said:

“Our flexible jobs market remains a key strength for the UK as we navigate an uncertain time. While we are seeing a concerning weaker trend in permanent placements bed in, the rate of change is slow, employment rates are high and starting salaries are growing. Businesses will be looking to politicians for a pragmatic way forward to help them turn this around – not just on Brexit, but on domestic policies too.

“The new government should be focused on delivering the negotiated exit from the EU businesses need, but also on avoiding damaging changes that will undermine the strength of our jobs market. An improved approach to immigration, reforms to the apprenticeship levy and avoiding hasty changes to contractor tax rules should be top of the list.

“In difficult times such as these, recruitment specialists are an invaluable source of local and industry expertise to businesses looking to hire new staff. The REC is helping its members to do this with our new, local workforce intelligence data, so that they can continue to provide employers with the right people to grow their business.”