- April saw more vacancies than jobseekers in 32 of the top 50 UK cities, as competition for jobs falls to post-recession low of 0.77 jobseekers per advertised vacancy

- Number of jobseekers falls under 800,000 for first time since recession

- Advertised vacancies grow by a quarter over year to April, hitting 1,033,435

- Salford leads the way – almost fourteen times easier to find employment than a year ago in what was the most competitive location for jobseekers

- Workers may not feel better off despite deflation as salaries plateau, dropping 0.5% over last six months

April saw more vacancies than jobseekers in 32 of the top 50 UK cities, suggesting that large numbers of UK workers don’t have the skills to fill the positions required in the modern workforce, according to the latest UK Job Market Report from Adzuna.co.uk.

The number of jobseekers has fallen under 800,000 for the first time since the recession, to stand at just 795,967 in April, compared to 1,142,340 a year ago.

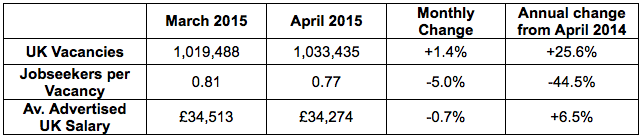

However, at the same time, the number of advertised vacancies in the UK has soared past the million-mark to reach a new post-recession record of 1,033,435 available positions in April. This is a 25.6% year-on-year increase on the 823,081 vacancies advertised in the same month last year and a 2.7% increase on the 1,019,488 vacancies recorded in March.

The simultaneous fall in jobseekers and rise in vacancies has translated into a new record low in competition for jobs, with just 0.77 jobseekers per advertised vacancy in April, down from 0.81 in March and almost half of the 1.39 recorded in April 2014.

This falling ratio of jobseekers to advertised vacancies held true across 32 of the top 50 UK cities, suggesting that three in five cities are struggling to fill positions – most likely due to a skill shortage.

Table 1:

Andrew Hunter, co-founder of Adzuna, comments: “The number of jobseekers is falling while advertised vacancies are ballooning. This could be a warning sign that our workforce lacks the skills necessary to fill up many of the new jobs appearing. The recovery certainly has the capacity to progress further and faster – but at the moment there’s a disconnect between our abilities and our economic climate. It’s like standing outside your recently fixed up car, tuned up and ready to go, only to realise you’ve lost the keys.

“If we’re going to get behind the wheel of this recovery, we need to unlock the potential of our workforce, with more emphasis on the diversity of available jobs if only people are aware of them and willing to train themselves. This change could be led by the government, but part of it is a culture-shift. We have the recovery we deserve – now we need to build a workforce capable of taking advantage of it.”

Booming vacancies in skilled professions

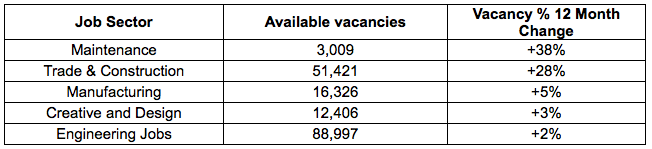

Job vacancies are on the rise in skilled work in April as positions are created more quickly than the workforce is able to fill them. The increase is particularly apparent in the Maintenance sector, with a 38% increase in advertised vacancies. In absolute terms, the 28% increase in Trade & Construction positions translates to over 11,000 more vacancies advertised in the sector than in April 2014.

Table 2: Vacancies in Skilled Professions

Andrew Hunter continues: “Our position in the EU is clearly vital to help fill these key roles and keep the economy moving. We have a lot to learn about the movement of labour from the current setup. The referendum isn’t the only legislation on the horizon: George Osborne’s plans to devolve power to Northern cities could see a major boost to infrastructure in key job areas. Not only would this provide skilled trade jobs in the short-term, it would also make it easier for our skilled workforce to move around the UK, making it to the areas where they’re most needed. But even in the best possible outcome, ease of access to the ‘Northern powerhouse’ isn’t going to make up for the skilled labour lost by a possible break with the EU.”

Salford shoots down the rankings as job competition shrinks

The skills shortage is beginning to bite in all areas of the country, even those with typically higher levels of jobseeker competition.

Salford was in the top ten worst cities to find a job in April 2015, but only just. With 2.19 jobseekers per available vacancy, Salford has come a long way from last year when it was the most competitive city in the UK for employment. In April 2014, there were 30.42 jobseekers per vacancy in Salford – meaning that, just a year on, it is almost fourteen times easier to find a job in the Northern city.

The worst places to find a job in February were Sunderland (5.33) Hull (4.88) and Bradford (4.36). By contrast, the lowest jobseeker to vacancy ratios were found in Cambridge (0.11), Guildford (0.15) and Reading (0.19).

Andrew Hunter, co-founder of Adzuna, explains: “The Queen’s Speech saw the first full airing of the city devolution bill. The concentration of jobs in the North suggests a deep-rooted skills shortage in the northern workforce. More power over local infrastructure may increase employees’ mobility, but this only addresses the symptom.

“We need to see the cross-party commitment to apprenticeships – so prevalent in the manifesto-war – put into action. This isn’t a quick fix. It will take some time for these young men and women to make their way into the workforce. Nevertheless, it’s an investment for the future that is sure to pay massive dividends in the North when it finally comes to fruition.”

Stagnant salaries give the lie to ‘good deflation’

Despite deflation making salaries stretch further, lacklustre salary growth means that UK workers might not be feeling much better off. The average UK salary was £34,274 in April. Despite being 6.5% above the £32,185 average seen in April 2014, salaries were 0.7% lower than the £34,513 seen in March, and 1.1% below the £34,670 seen six months ago in October 2014.

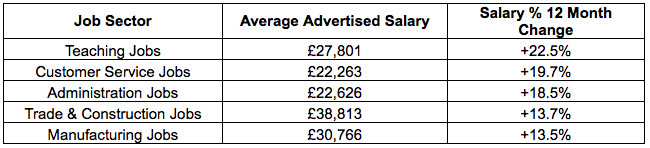

Looking at salary growth by sector, average advertised pay for Customer Services roles has seen a 19.7% year-on-year increase to £22,263, while salaries in the Administration sector have improved by 18.5% compared to April last year, bringing them up to £22,626. At the other end of the scale, Creative and Design jobs have seen salaries slip 1.1% compared to last year, reducing them to £30,110.

Table 3: Biggest improvers – job sectors by average salary

Andrew Hunter concludes: “Salaried creative and design positions are one of the first to be cut back when times are tough. No one doubts the impact these positions can have – even in the depths of the recession, the creative industries were adding over £70bn a year to the economy. Nevertheless, when cuts have to be made, it’s understandable that a company might try to coast on their existing creative content to ride out the storm.

“The return of pay growth to advertised customer service and administration positions should be like sunlight breaking through the clouds for our beleaguered creatives. Now that the core business roles are making a comeback, employers are likely to think about the elements of their companies that go beyond their bottom lines. It’s like the dove returning with an olive branch – not safe harbour in itself, but a promise of things to come.”

Salary growth slowdown in the North West

Yorkshire and The Humber fights for its position at the top of the salary growth table with a 12.2% improvement in advertised wages compared to April last year. North East England (9.4%) has come in close second, followed by the East Midlands (8.8%). Eastern England is now tied with the West Midlands for third place (11.2%). Salary growth in Northern Ireland lies well behind the pack (3.9%), while Scotland still hasn’t found its feet despite showing overwhelming political unity. Though not in quite as bad a shape as the other two regions at the bottom of the pecking order, London’s year-on-year salary growth (4.9%) is still well below the 6.9% UK average.

Table 4: Biggest improvers – UK regions by average salary