- Sharpest drop in permanent candidate numbers in survey history

- Faster increase in placements as demand for staff surges

- Glasgow leads broad-based rise in permanent salaries

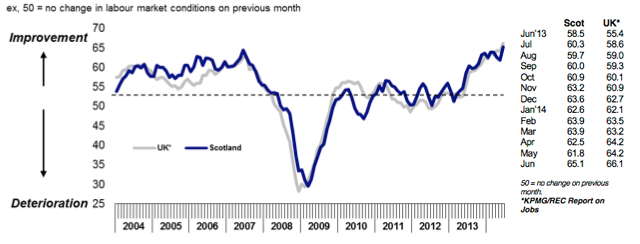

June’s Bank of Scotland Report on Jobs showed a further tightening of conditions in Scotland’s labour market, with salary inflation pushed to the highest in the survey’s history on the back of stronger demand for staff and a record drop in permanent candidate availability. Increased vacancies also helped drive an upturn in staff placements, with appointments of permanent employees and temp billings both rising at faster rates.

Highlighting growing pressure in Scotland’s labour market, the Bank of Scotland Labour Market Barometer – a composite indicator designed to provide a single figure snapshot of labour market conditions – rebounded to a survey-record high of 65.1 in June, up from 61.8 in May. The increase in the barometer was the first since February, and mirrored a similar upturn at the UK level.

Bank of Scotland Labour Market Barometer

Donald MacRae, Chief Economist at Bank of Scotland, commented: “June’s Barometer reached a record high in the eleven and a half years of the survey. The number of people appointed to jobs increased while vacancies grew at a robust rate. The number of candidates available for both permanent and temporary jobs fell accompanied by a record rise in starting salaries. The recovery in the Scottish economy looks set to continue.”

Regional analysis

- Edinburgh led growth in permanent placements for a second consecutive month ahead of Glasgow, with Aberdeen and Dundee seeing further declines.

- Growth in temp billings on the other hand was broad-based, with the most marked increase seen in Aberdeen.

- All four regions posted drops in both permanent and temporary candidate numbers, with permanent candidate supply falling fastest in Dundee and temp availability down to the greatest extent in Aberdeen.

- Glasgow saw the sharpest increase in permanent salaries followed by Dundee and Edinburgh, while Aberdeen registered the most marked rise in temp hourly pay rates.

Wages and salaries

- Permanent salary inflation accelerated sharply in June was the fastest seen in the history of the survey which began at the start of 2003.

- Temp pay rose solidly on the month, and at a slightly faster rate than in the preceding survey period.

Employment

- June saw the rate of growth in permanent placements north of the border accelerate for the second month running, reaching the fastest in the year-to-date.

- Similarly, growth in the temporary jobs space gained momentum as billings received by Scottish consultancies rose to the greatest extent since January.

Vacancies

- The number of permanent job openings rose at sharp and slightly accelerated rate in June. Demand for temporary staff also strengthened, with vacancies rising to the greatest extent since February.

Availability

- June data showed a survey-record contraction in the number of candidates seeking permanent employment in Scotland.

- Having accelerated for the second month in a row, the rate of decline in temporary candidate numbers was sharp and the most marked in eight months.

Sectors

The Accounts & Financial sector led growth in demand for permanent staff in Scotland, ahead of IT & Computing and Nursing/Medical/Care respectively. Secretarial & Clerical and Blue Collar saw the joint-slowest rises in permanent job vacancies.

The Nursing/Medical/Care sector saw the most marked rise in temporary job vacancies in Scotland, followed by IT & Computing. The slowest rise in temporary staff demand was in the Executive & Professional sector.

Permanent Staff

1 Accounts & Financial

2 IT & Computing

3 Nursing/Medical/Care

4 Executive & Professional

5 Engineering & Construction

6 Hotel & Catering

=7 Blue Collar

=7 Secretarial & Clerical

Temporary/Contract Staff

1. Nursing/Medical/Care

2. IT & Computing

3. Engineering & Construction

4. Blue Collar

5. Accounts & Financial

6. Hotel & Catering

7. Secretarial & Clerical

8. Executive & Professional

(Ranked by strength of demand in Scotland in June 2014)

The Bank of Scotland Labour Market Barometer

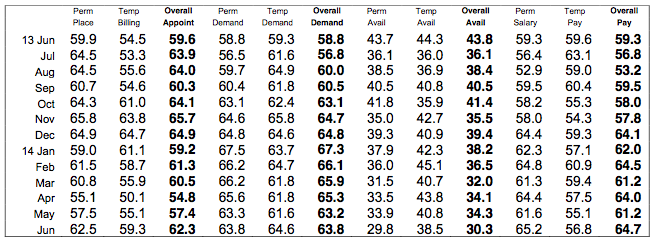

A key tool in the Monthly Labour Market Report is the Bank of Scotland Labour Market Barometer. The Barometer is a composite indicator devised from four key measures: demand for staff; employment; availability for work (inverted); and pay in the permanent and temporary markets.

At 65.1 in June, up from May’s seven-month low of 61.8, the Bank of Scotland Labour Market Barometer was the highest in the history of the survey which began in January 2003.

An equivalent barometer for the UK also rose to a fresh record high in June and, at 66.1, was above Scotland’s for the third straight month.

All four components of the Bank of Scotland Labour Market Barometer had a positive influence on its direction in June. Overall staff placements increased to the greatest degree in 2014 so far, partly reflecting a strengthening of demand for staff. Candidate numbers fell at a sharp and accelerated rate that was fastest in the survey’s history, while staff pay increased at a record pace.