London Employment Monitor April 2017 highlights:

- 16% decrease in jobs available, month-on-month

- 15% decrease in jobs available, year-on-year

- 29% decrease in professionals seeking jobs, month-on-month

- 49% decrease in professionals seeking jobs, year-on-year

Robust Q1 gives way to wobbly Q2

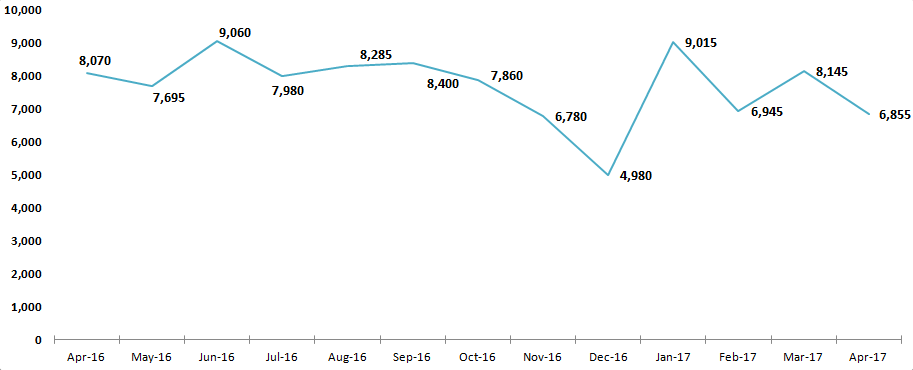

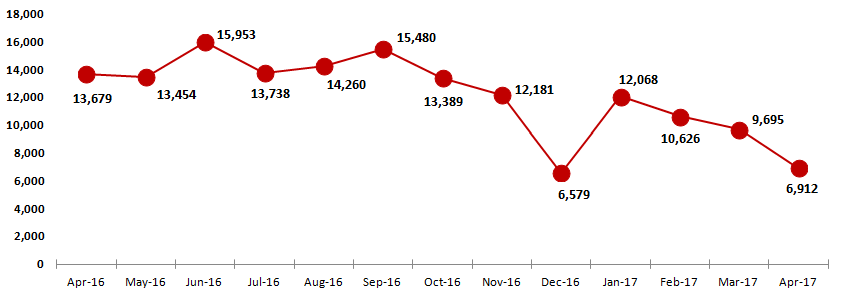

The second quarter of 2017 got off to a sinking start with a 16% decrease in jobs available, month-on-month, and 15% decrease year-on-year. Job seekers were down by a sharp 29%, month-on-month, and halved, year-on-year. Easter heralded two bank holidays around which many professionals took extended leave, a significant contributor to the downward shift. Nevertheless, the annual holiday season fails to fully account for the significant drop in both jobs and jobseekers.

Financial services jobs new to the market April 2017

“We’ve seen an even sharper drop in applications from EU citizens for positions across the UK, and businesses are pressing the pause button on hiring until after the June general election,” said Hakan Enver, Operations Director, Morgan McKinley Financial Services. “In the months leading up to the EU referendum, hiring and job seeking came to all but a standstill, only to shoot back up again after the vote. We may be seeing a similar trend emerge now,” continued Enver.

The June 8 snap election is intended to test the public’s appetite for the hard Brexit championed by Downing Street. London Mayor Sadiq Khan as well as members of the minority in the House of Commons are calling for a soft Brexit that would maintain many existing benefits of EU membership. It remains unclear if the public will vote based on their preferred Brexit outcome, or who they trust to do a better job of navigating the complex international divorce proceedings.

Professionals seeking new roles, both in and out of employment April 2017

Ten months after Brexit referendum, confusion takes further toll on jobs

EY’s latest Global Capital Confidence Barometer (CCB16) found that though the investment climate in the UK is strong and remains highly attractive to global investors, certain indicators are resoundingly in the red. It concluded that the biggest risks faced by companies in the UK in the coming year include the free movement of labour and trade flows as well as currency instability, all issues that stand to be heavily influenced by the tenor and outcome of the Brexit negotiations.

Fearing further fallout, Bank of England Governor Mark Carney called upon financial institutions to devise Brexit contingency plans. The majority had long since done so, with a number already well into the implementation phase. “Keeping businesses in London is proving a challenge for the government, but it’s nothing compared to what it’ll take to lure them back if they leave,” said Enver. “Political leaders failed to assure businesses that they would fight to keep jobs in the UK. Instead, it’s been ten months of promising a hard Brexit, with radio silence on details. Guesswork makes for poor business planning, so everyone is prepared for a worst case scenario and the impact on jobs is undeniable,” concluded Enver.

Job seekers are hearing the same message of a hard Brexit and many are expecting their positions to be moved or even eliminated. “When businesses are forced to focus on contingency planning, their growth and hiring efforts invariably stall,” said Enver. “Consequently, applicants seeking opportunities in London now expect a short term stint. They are coming to earn money, gain valuable professional experience, then take both elsewhere.”

Average change in salary each month April 2017

A chorus of business leaders is urging the government to preserve the free movement of labour between the UK and Europe as fears mount that the city is haemorrhaging talent. “The UK trains excellent professionals for the jobs of the future, but the rate of demand for skilled financial services professionals, especially engineers and IT experts, is soaring. To keep up with demand, businesses need to recruit beyond the British born,” said Enver.

Though more questions than answers about Brexit negotiations remain, one thing appears certain: the European Banking Authority (EBA), currently based in London, will be relocated. The agency, which conducts stress tests on European banks seeks to ensure that institutions across the EU adhere to the same regulatory framework. The EBA has not yet identified a new location for its operations, and though Prime Minister May hopes to keep EBA offices in London, the EU Commission has made clear that its location is not a part of Brexit negotiations, and as an intra-EU regulatory body is necessarily located within the geographic boundaries of the Union. The fraught schism is becoming increasingly the norm as both sides bicker over issues with significant consequences for all involved. “It takes two to tango. No one benefits from this digging of heels we’re seeing on both sides of the Channel,” said Enver.

New President boosts French efforts to beat London at its own game

Since the Brexit referendum, France has been on a wooing spree of London businesses. Though French employment laws and the country’s high taxes traditionally make it an unlikely contender for financial services supremacy, the government has at every turn sought to sweeten the deal for an industry with the power to fundamentally change the underperforming French economy.

Paired with generous tax incentives, the election of Emmanuel Macron to serve as France’s next President has made the previously long-shot notion of poaching financial services jobs from London seem less absurd. Macron is a former investment banker with a keen understanding of the industry, a devout Europhile, and has set the goal of reinvigorating the French economy by recruiting top professionals in a broad range of fields. His election also assuaged fears of further regional instability were French voters to have handed the keys to the presidential palace to Marine Le Pen, a staunch opponent of the EU.

Frankfurt and Dublin’s concurrent efforts to vie for London’s jobs is painting a picture of a fragmented Europe-wide banking system, leaving many unconvinced of a major reorganisation of the industry. “Everyone’s scrambling for whatever they can get from the financial services industry in London. But much of its success lies in its sophisticated infrastructure. When you take pieces of that infrastructure and spread them out across the continent, you quickly wind up with a Frankenstein,” concluded Enver.