- Further sharp rise in staff placements registered in August

- Record drop in permanent candidate availability

- Glasgow continues to see fastest pay growth

Scotland’s labour market continued to go from strength to strength in August, with the latest Bank of Scotland Report on Jobs indicating further marked gains in placements during the month, as well as strong pay growth amid rising demand for staff. Latest data meanwhile showed the most marked deterioration in permanent candidate availability in the survey’s history, a further sign of increasing tightness in the jobs market.

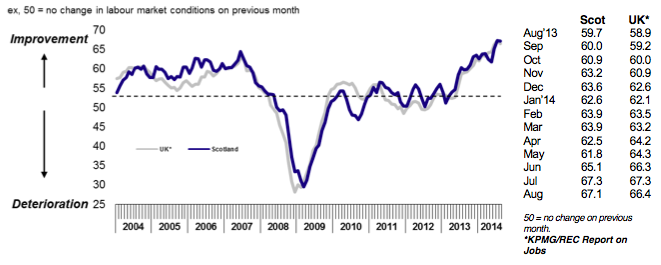

Highlighting a marked improvement in Scottish labour market conditions, the Bank of Scotland Labour Market Barometer registered 67.1 in August, well above the critical 50.0 threshold. The barometer was down slightly from July’s survey-record high of 67.3, but nevertheless above the equivalent UK index.

Bank of Scotland Labour Market Barometer

Donald MacRae, Chief Economist at Bank of Scotland, commented:

“August’s Barometer returned a strong reading showing a rising number of people appointed to both permanent and temporary jobs. There was a record drop in people available for jobs and growing evidence of strong growth in pay confirming the tightening of the jobs market. The economic recovery continues with business confidence remaining high.”

Regional analysis

- Aberdeen-based consultancies posted the sharpest rates of growth in both permanent appointments and billings received from the employment of temporary staff in August, while Edinburgh saw the least marked increases on both fronts.

- Permanent candidate availability deteriorated to the greatest extent in Glasgow, while temp candidate supply fell fastest in Dundee.

- Glasgow led broad-based growth in both permanent starting salaries and hourly pay rates for temporary staff.

Wages and salaries

- Permanent salary inflation in Scotland eased from July’s survey-record high in August, but nevertheless remained sharp and in excess of the UK-wide average for the second straight month.

- Recruitment consultancies also recorded another robust increase in average hourly pay rates for temporary/contract staff in August, with the pace of growth remaining comfortably above the long-run series average.

Employment

- The ongoing upturn in permanent placements north of the border extended to an eighteenth successive month in August, with the rate of growth remaining strong.

- The rate at which temp billings increased was the fastest since January 2011, having quickened for the fourth month in succession.

Vacancies

- Latest data showed a further strong increase in the demand for permanent staff among Scottish businesses.

- August also saw a further rise in temporary job vacancies in Scotland, with the rate of growth slightly weaker than July’s seven-year high but still strong in the context of historical survey data.

Availability

- The availability of candidates for permanent vacancies in Scotland deteriorated to the greatest extent in the series history during August.

- Temp candidate supply also deteriorated rapidly, albeit to a slightly lesser extent than in July.

Sectors

- Sector data north of the border showed that the fastest growth in permanent job vacancies was in Nursing/Medical/Care, followed closely by IT & Computing.

- The sector which saw the most marked increase in temporary job openings was Engineering & Construction, thereby ending Nursing/Medical/Care’s 21-month run as the growth leader. Executive & Professional again registered the slowest increase in demand for temp staff.

Permanent Staff |

Temporary/Contract Staff |

| Nursing/Medical/Care | Engineering & Construction |

| IT & Computing | Nursing/Medical/Care |

| Accounts & Financial | IT & Computing |

| Engineering & Construction | Hotel & Catering |

| Blue Collar | Blue Collar |

| Executive & Professional | Secretarial & Clerical |

| Hotel & Catering | Accounts & Financial |

| Secretarial & Clerical | Executive & Professional |

(Ranked by strength of demand in Scotland in August 2014)

The Bank of Scotland Labour Market Barometer

A key tool in the Monthly Labour Market Report is the Bank of Scotland Labour Market Barometer. The Barometer is a composite indicator devised from four key measures: demand for staff; employment; availability for work (inverted); and pay in the permanent and temporary markets.

The Bank of Scotland Labour Market Barometer remained close to July’s survey-record high of 67.3 in August, registering 67.1 – its second-highest reading since the survey’s inception in January 2003. This was consistent with another sharp improvement in the overall health of Scotland’s labour market.

The equivalent jobs barometer for the UK as a whole slipped from its own record high in July, posting 66.4 in August (from 67.3).

Strong growth in staff placements, pay and vacancies, as well as a rapid deterioration in candidate availability, meant that the Bank of Scotland Labour Market Barometer remained well above the 50.0 no-change mark in August. However, the only factor that placed greater upward pressure on the barometer than in July was a faster contraction in candidate supply, with growth in placements, pay and vacancies having eased.