- Loss of legacy knowledge (43%) is the biggest worry for finance chiefs

- 96% of senior finance professionals find interim management an attractive career option

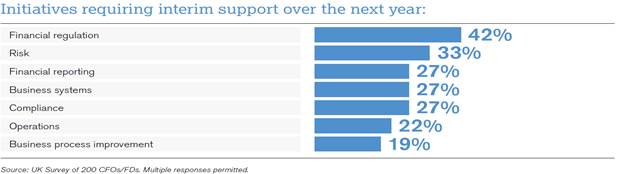

- Greatest demand (42%) for interims is within financial regulation

More than two thirds (69%) of employers said they are worried about the baby boomer generation – employees born between 1946 and 1964 – leaving their workforce in the next two years, according to a new report1 released today by Robert Half Management Resources. Some 22% of employers across UK businesses said they are ‘very concerned’ about experienced professionals leaving the workforce, while 47% are ‘somewhat concerned’.

The loss of legacy knowledge (43%) is the biggest worry for employers, ahead of leadership abilities (20%), functional skills (18%), non-technical attributes (13%) and external contacts (5%) that these professionals bring to the workforce. Finding a way to retain these business leaders and manage succession planning strategies will be a chief priority in the coming years.

Interim management and consulting may prove to be the solution to keep these professionals on board, according to findings within the report. Nearly all (96%) of CFOs surveyed would consider interim management and consulting an attractive career choice as they approach retirement, with 42% citing it as ‘very attractive’. The flexibility offered by interim management roles represents a major draw for more experienced finance professionals, cited by 61% of respondents in the study. The often lucrative compensation is also important, with 53% of those surveyed excited by potential pay awards. With employers eager to tap into the knowledge and expertise of finance specialists, many are willing to pay a premium for the best people.

Nearly four in 10 (37%) respondents said that they are lured by the exposure to different companies and sectors and the opportunity to apply their skills in different contexts. This is followed by the chance to keep working, while reducing their weekly hours cited by 17% of senior finance professionals.

Julian McLaren, a Vice President with Robert Half Management Resources said, “Most of those professionals we work with who are considering a career in interim management are looking to apply the skills and experience they’ve gleaned throughout their careers to progressive, forward looking organisations. Companies hoping to capitalise on growth initiatives are well advised to leverage the deep expertise that these professionals offer, often providing the legacy of knowledge transfer and upskilling to permanent employees long after the engagement has ended.”

According to the report, the greatest demand for interims across the financial space is within financial regulation (42%), risk (33%), financial reporting (27%), business systems (27%) and compliance (27%). Employers also expect to hire on a non-permanent basis in operations (22%), business process improvement (19%), audit (16%), project management (13%), change management (5%) and financial crime (4%).

Julian McLaren concludes: “Finance leaders benefit from the cost-effective access to skills offered by interims. By continuing to capitalise on the readily available and highly trained interim market, businesses can adjust more easily and quickly to workload variations. They can scale their workforce up and down according to demand, plug short-term gaps in the senior management team where applicable and ensure they have the right people leading key projects.”