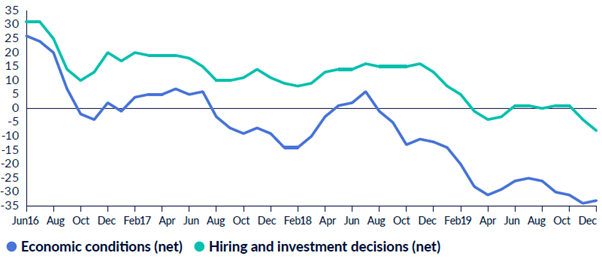

The REC’s JobsOutlook report also showed that business confidence in the UK economy stayed low this quarter, at net: -33. With the election now complete and firms having greater clarity for 2020, the new government must move quickly and deliver on a business environment for stability, investment and growth.

Neil Carberry, Chief Executive of the REC, said:

“Many employers have been sitting on their hands for the past few months, putting off hiring until the outlook was clearer. Now that some of the fog has lifted, both business and the new government can put their plans into action. What we need to see from the government are policies that will help make great work happen – the first priority will be to secure our managed exit from the EU. This is also not a time to be making sweeping and incomplete changes to how we treat flexible workers – the government should bring forward the review of IR35 it promised on the campaign trail, and delay implementation.

“Skills and labour shortages remain a huge concern for employers. Three quarters of firms are working at or near full capacity, and more than half are worried about finding enough candidates to fill permanent roles. These concerns cross a wide range of sectors including construction, engineering, education and healthcare. We need reforms to skills systems across the UK – including to the failing apprenticeship levy – but we also need an immigration system that is based on the needs of the economy at all levels.”

Employer confidence:

Other key points from the latest JobsOutlook, covering September-November 2019, include:

- Short-term demand for temporary agency workers fell by 16 percentage points from the previous quarter (June-August 2019) to net: 0. Medium-term demand also fell to net: -1.

- In contrast, demand for permanent staff remained at a similar level to the previous quarter, both in the short term (net: +21) and medium term (net: +24).

- Three in four (75%) employers had little or no surplus capacity in their workforce this quarter. This increased to 84% in the public sector.

- More than half (52%) of employers of permanent staff said they were worried about the availability of workers for permanent roles. Construction was the skills area causing most concern (57%).

- There was a notable year-on-year rise in the proportion of public sector bodies that had increased staffing levels in the previous year, from 42% to 69%.